Rolfe family’s Maffra North hits market with $8.5 million-plus price guide

In this week’s property round-up with Kylie Dulhunty: the Rolfe family lists Maffra North with an $8.5 million-plus guide, US-backed 40 South...

5 min read

Kylie Dulhunty

:

Dec 4, 2025

Kylie Dulhunty

:

Dec 4, 2025

Centuria Capital Group has taken another major step in its push into alternative real estate. Pic: Supplied

Each week, we take the pulse of rural property - from sales data to who’s making headlines. Check out this week's report from Kylie Dulhunty.

Size: 22 property portfolio

Location: Various states

Sale price: $444 million

Centuria Capital Group has taken another major step in its push into alternative real estate, acquiring Arrow Funds Management and the management rights to the unlisted Arrow Primary Infrastructure Fund (APIF).

The off-market deal lifts Centuria’s agricultural assets under management to $1.3 billion, which is an 85 per cent increase since the start of the 2025-26 financial year and brings an additional $444 million in AUM into the business.

The transaction is structured at a 5.5-times EBIT multiple post-synergies and includes both APIF and its stapled operating vehicle, Arrow Operations Trust.

APIF holds a portfolio of 22 assets valued at $444 million as at 30 June 2025, with a 12.7-year WALE and leases to some of Australia’s largest primary production operators such as Baiada Poultry Group, Select Harvests, Nutrano Group, Pace Farms and SunPork Group.

The diversified portfolio spans poultry farms, a pork fattening facility, almond and macadamia orchards, mango orchards, dried-fruit vineyards and an organic glasshouse, with assets located across NSW, Victoria, South Australia and the Northern Territory.

Most properties are under annual CPI-linked rental escalations.

Centuria Joint Chief Executive Officer John McBain said the acquisition strengthens the company’s long-term strategy to scale high-conviction alternative real estate.

“This acquisition adds further scale and operational expertise to Centuria’s agriculture division,” he said.

“Centuria’s growth in agricultural real estate has been part of a deliberate strategy to diversify into high conviction alternative real estate sectors, which we commenced in the post-COVID period and have subsequently scaled beyond $1 billion of AUM.

“Centuria has an established record for successfully integrating complementary funds management businesses and we look forward to offering APIF’s private clients the same high level of service they have enjoyed in the past.”

The sale comes just days after Centuria announced it had bought Australia’s largest glasshouse for $168 million.

Fellow Joint CEO John McBain said Centuria’s growth had been a deliberate strategy.

“This acquisition adds further scale and operational expertise to Centuria’s agriculture division,” he said.

“Centuria’s growth in agricultural real estate has been part of a deliberate strategy to diversify into high conviction alternative real estate sectors, which we commenced in the post-COVID period and have subsequently scaled beyond $1 billion of AUM.

“Centuria has an established record for successfully integrating complementary funds management businesses and we look forward to offering APIF’s private clients the same high level of service they have enjoyed in the past.

“Centuria has a mature private client investor base, which has supported its funds management platform for more than 30 years and we are experienced in understanding and responding to the specific needs of private investors.”

The acquisition will be funded through existing cash and undrawn debt, with the entire Arrow management team moving across to Centuria.

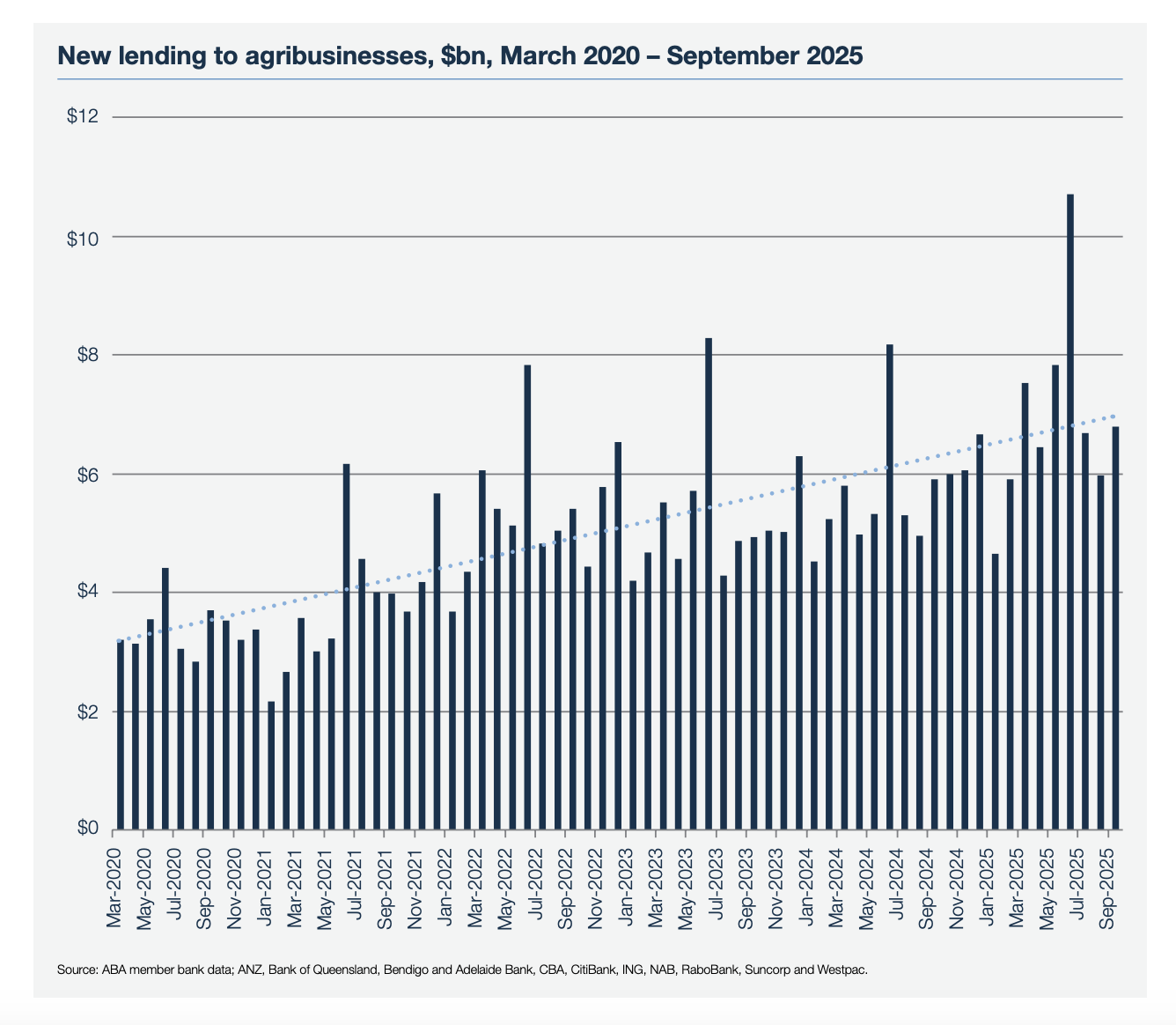

Lending to Aussie farmers has surged 80 per cent since 2019, with banks now holding more than $140 billion in loans according to new data.

The Australian Banking Association’s 2025 Banking in Agribusiness report reveals that outstanding credit to Australia’s 170,890 agribusinesses has reached $140.3 billion, which is up from roughly $78 billion in mid-2019 and driven by sustained investment in productivity, land, equipment and technology.

ABA CEO Simon Birmingham said the figures highlighted the industry’s strategic importance and the deep reliance farmers have on access to capital.

“Australia’s farmers are among the most innovative and productive in the world, and banks understand their importance to the Australian economy,” Mr Birmingham said.

“Access to finance supports investment in innovation, new machinery and equipment as well as more sustainable farming practices.”

Banks remain the dominant financiers across rural Australia, providing 93 per cent of all rural business lending, well ahead of pastoral financiers and government programs.

Monthly lending has also accelerated sharply.

In the year to September 2025, ABA member banks provided an average of $6.8 billion in new lending per month, almost double the $3.6 billion recorded four years earlier.

More than 44,000 individual loans were issued to agribusinesses during the year.

The report shows that farmers’ balance sheets have strengthened significantly over the past three decades.

Average farm debt has grown from $304,776 in 1996 to $1.2 million in 2024, but capital values have risen at an even faster pace, from $2.4 million to $14 million, pushing the average farm equity ratio above 90 per cent.

Sheep and beef operations have some of the highest equity ratios, at 95.4 per cent and 94.2 per cent, respectively.

The ABA notes this financial capability underpins a sector that now produces more than $100 billion in agricultural output annually, with about 80 per cent exported.

Mr Birmingham said banks also recognised the volatility farmers face.

“When trouble strikes and farmers are exposed to natural disasters, banks are highly experienced in helping customers navigate difficult circumstances,” he said.

“Banks can quickly put in place hardship arrangements, including restructuring loans, waiving fees and charges, and repayment deferrals, giving customers breathing room to get back on their feet.

“Australian banks will continue to stand side-by-side with our farmers and continue to back their innovation and success.”

Size: 1,524ha

Location: Pilliga, NSW

Sale method: Online auction with AuctionsPlus at 11am on December 9.

Price guide: N/A

A well-balanced mixed farming holding in the tightly held Come By Chance district of north-west NSW is heading to online auction with AuctionsPlus, offering scale, soils and reliable water on the Namoi River.

‘Dunmore’ spans 1,524ha (3,765 acres) south of the river between Pilliga and Walgett, with 411ha (1,015 acres) developed for cultivation and the balance under grazing.

The mainly grey-black self-mulching soils provide excellent water-holding capacity and strong agricultural potential, supported by a long-term average annual rainfall of about 485mm.

The property has 4.3km of frontage to the Namoi River and additional water security from on-farm dams.

It is subdivided into seven main paddocks with sound fencing, providing flexibility for cropping rotations, backgrounding or breeding enterprises.

Structural improvements include a three-bedroom country home, a grain shed and basic sheep yards, giving buyers a functional base from which to operate and scope to further develop the asset in line with their production goals.

Agents describe ‘Dunmor’ as a versatile mixed farm in a proven district, combining fertile alluvial soils, relatively flat topography and secure water to underpin both cropping and livestock options.

Dunmore will be offered for sale by online auction through AuctionsPlus at 11am on December 9. Rural Property NSW’s Michael Guest is handling the sale.

Size: 1,385ha

Location: Castle Creek, QLD

Sale method: Private treaty

Price guide: $6.85 million

A productive mixed landholding with scale, secure water and a registered soil carbon project has been listed for sale in Central Queensland’s renowned Banana district, with ‘Green Yards’ offered by private treaty for $6.85 million.

The 1,385ha (3,422-acre) holding at Castle Creek presents a rare combination of grazing productivity and natural capital income, underpinned by an estimated carrying capacity of 500 Adult Equivalent cattle.

Located 29km north-east of Theodore and within reach of Rockhampton and Bundaberg, the property sits across two freehold titles in one of the region’s most reliable grazing zones.

‘Green Yards’ comprises a mix of favourable land classes long prized by northern graziers: 350ha of developed brigalow and softwood scrub, 835ha of downs and shaded forest, and 200ha of harder forest ridges.

Soils include productive black self-mulching and deep brown cracking clays, while pastures feature dense buffel, Queensland blue grass, green panic and seasonal herbages and legumes.

A standout feature is the registered soil carbon sequestration project, which has the potential to generate up to 4,091 Australian Carbon Credit Units (ACCUs) annually.

Two completed projects have already produced 9,000 ACCUs, supported by years of capital investment in land class development, pasture improvement and carbon-focused management.

Water security is strong, with four bores equipped with solar-powered submersible pumps feeding 13 storage tanks and 14 troughs.

The property also offers 4km of dual frontage to Lonesome Creek, along with three catchment dams.

Infrastructure includes high-standard fencing with steel and timber posts, an extensive laneway system, and 500-head cattle yards fitted with a vet crush, race, drafting pound, loading ramp, calf cradle and undercover work area.

‘Green Yards’ is for sale by private treaty through LAWD, with Darren Collins and Alex Horan handling the sale.

Kylie Dulhunty is a journalist with more than 20 years experience covering everything from court to health. Today, Kylie loves nothing more than turning market trends, industry insights and epic property sales - residential, rural and commercial into captivating stories.

Posts By Tag

.png)

In this week’s property round-up with Kylie Dulhunty: the Rolfe family lists Maffra North with an $8.5 million-plus guide, US-backed 40 South...

In this week’s property round-up with Kylie Dulhunty: A diverse line-up of significant rural listings and sales, spanning a landmark Balmullin...

In this week’s property round-up with Kylie Dulhunty: Wattle Range Portfolio offers institutional-scale opportunity in South Australia’s...