The Australian cattle market sustained its historically high level throughout February, with average prices for most categories considerably higher than the same period in 2020. While a few stock categories did ease slightly in value from January, the relatively small decrease in prices needs to be kept in context, especially when compared to the prices and seasonal conditions from the same period last year.

Overall demand for the month was driven by producers competing fiercely for suitable young cattle, while rebuilding intentions placed a floor through the proven and assessed joined females. With four uninterrupted weeks of sales, the number of cattle offered exclusively through AuctionsPlus jumped 74% on the previous month, to 78,146 head. Even with the large increase in supplies throughout February, the unrelenting demand from buyers ensured prices remained firm, reinforcing the level of confidence in the market.

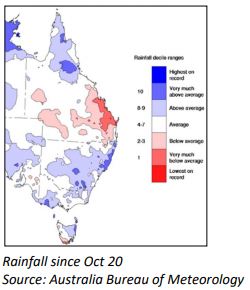

Listings for the month were dominated by Queensland, who offered 43% of total numbers. The surge of listings from the state was largely a result of northern producers selling into the demand from southern restockers, as the record prices proved too lucrative, especially with seasonal conditions remaining marginal through large swathes of Queensland. The poor wet season for early 2021 has meant dry conditions have forced many producers to make alternative selling options, cashing in on eastern state demand. This was highlighted by the 1,500% increase in listings month on month from Northern Queensland for February, along with a 159% increase from the same period last year.

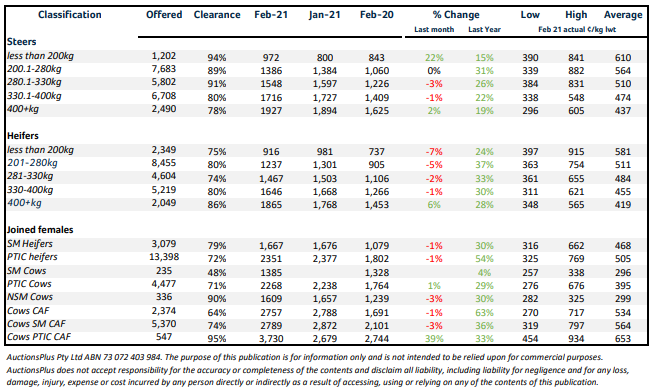

Light steers under 200kgs were in high demand for the very limited 1,202 offered - resulting in a 94% clearance rate for the month. Prices increased by 22% from last month, to average $972/head. In comparison, the same heifer category resulted in an easing market trend, falling 7% - to average $916/head for the 2,349 head offered. All other steer categories were steady on last month, with no significant price movements. Feeder heifers on the other hand rose 6% on last month, averaging $1,865/head for the 2,049 offered. This may be an indication that restockers are looking to heavier weight heifers with the intention to trade as a joined unit, either being PTIC or cow and calf unit, as the demand and prices received for joined cattle continues to be extremely enticing.

A feature of the market has been the sustained demand for heavy heifers, both joined and unjoined, as herd rebuilding dominated buyers’ intentions. For February, PTIC heifers averaged 30% higher than the same period in 2020, at $1,667/head, with the 13,398 head offered making it easily the largest reported category for the month.

The cow market also remained steady with most stock categories firming on last month. The only price movements to report were for PTIC cows and calves which increased by 39% from last month, to average $3,730/head. The significant price increase was attributed to the lower supply and quality of the PTIC listings through January.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Subscribe to our weekly newsletter and monthly cattle, sheep, and machinery round-ups.