A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

2 min read

Alex McLaughlin

:

Jun 6, 2024

Alex McLaughlin

:

Jun 6, 2024

Global beef production is anticipated to decline in the latter half of 2024, bolstering global prices, as outlined in Rabobank's recently released Global Beef Quarterly Q2 2024.

Despite a slight increase in beef production forecasted for the second quarter compared to last year, volumes in the third and fourth quarters are expected to drop year-on-year.

This decrease is attributed to contractions in Europe, the US, and China outweighing potential increases in Australia and Brazil.

RaboResearch Senior Animal Protein Analyst and the report’s lead author, Angus Gidley-Baird, noted: "Contractions in beef production in Europe and the US are expected to be too big for the increases forecast in Australia and Brazil to offset. And China’s production is set to increase in the second quarter before contracting later in the year."

Looking at global pricing, Mr Gidley-Baird observed a dual-speed cattle market, with North America nearing record highs due to local production declines, while other regions remain subdued.

Despite recent production upticks in Europe, it remains in a middle position. These regional differences are influencing international trade, with the US increasing imports while major Asian markets maintain steady levels.

In Australia, although the beef market remains balanced, rising import demand from the US is impacting it.

Mr Gidley-Baird noted the flow-on effects of reduced US production, with Australian export volumes to the US significantly rising.

“Australian export volumes to the US were up 117% in April and year-to-date volumes to the US are up 89%,” he said.

Meanwhile, export volumes to other major markets are not showing the same increase.

“The contraction in US production – particularly the reduction in cull cow and bull slaughter – provides opportunities for Australian lean trimmings export volumes,” Mr Gidley-Baird said.

However, this trend isn't mirrored in other major markets. He highlighted opportunities for Australian exports to Asian markets due to decreased US supply.

“It also provides opportunities for Australian volumes into key Asian markets where the US is a comparable supplier to Australia,” he said.

Despite increased export volumes to the US and rising US import prices, Australian cattle prices have not fully reflected these changes due to factors like ongoing soft demand in Asian countries.

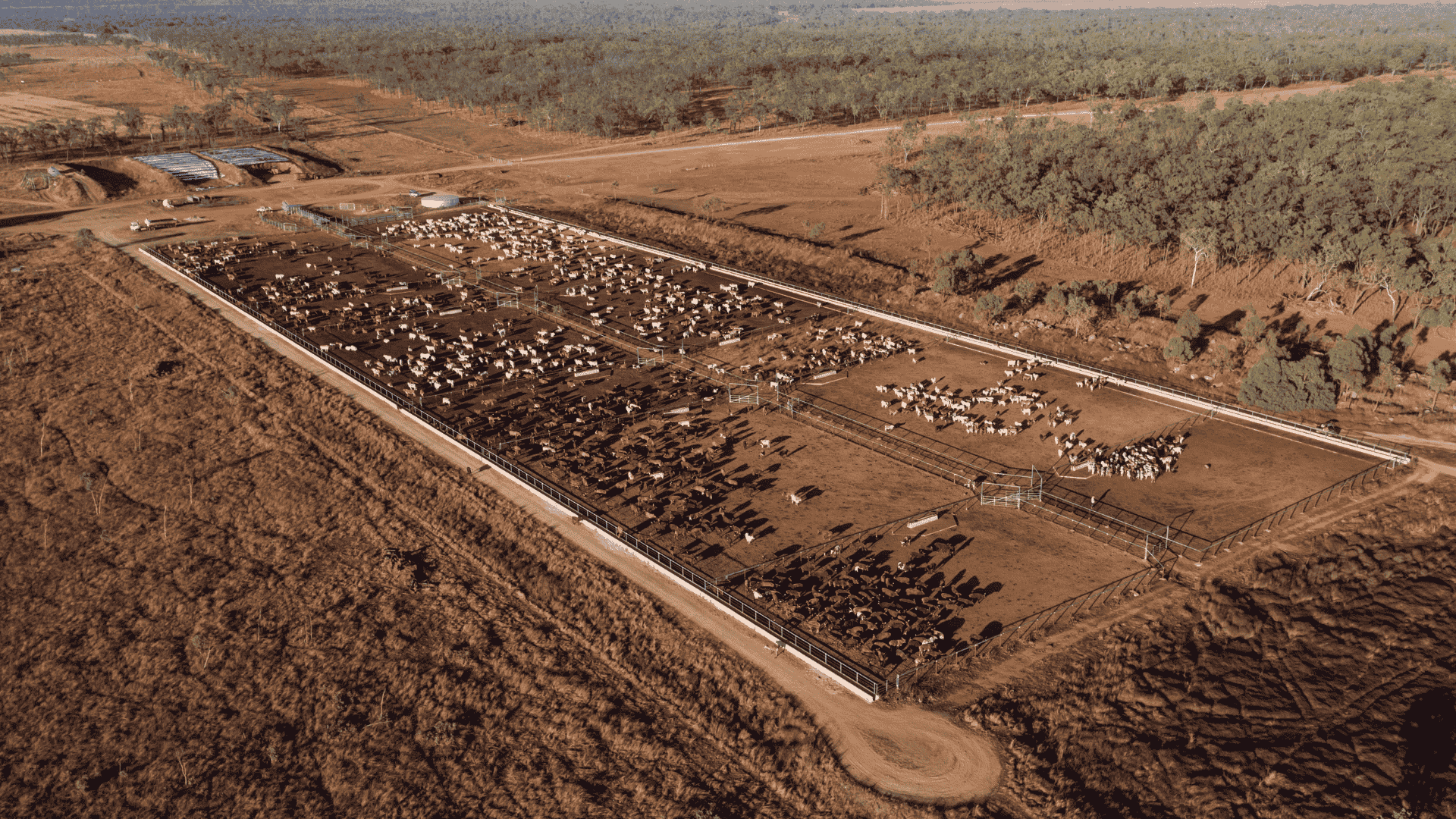

The report highlighted a significant increase in Australian slaughter and production volumes in the first quarter of 2024 compared to the previous year, reflecting continued herd rebuilding activities.

The first-quarter Australian slaughter and production volumes had seen a 17% and 15% increase year-on-year respectively, reflecting the increased number of cattle in the system following consecutive years of rebuilding activity.

The Rabobank report noted volumes in the first quarter of 2024 were similar to those in the last quarter of 2023 – illustrating a sustained increase in Australian beef production.

Without any strong demand or supply forces on the horizon, Mr Gidley-Baird said, the bank believed Australian cattle prices would continue to trade around current levels into the third quarter.

The report also emphasised ongoing monitoring of animal disease risks globally.

Mr Gidley-Baird mentioned the transmission of H5N1 avian influenza to US dairy cattle, underscoring the importance of vigilance.

Additionally, Brazil's recent declaration of freedom from foot-and-mouth disease without vaccination could boost its trade prospects pending official recognition.

Lastly, the report addressed the growing demand for climate disclosures in beef supply chains, presenting both opportunities and challenges.

Mr Gidley-Baird said the beef industry was facing a particular challenge, with its Scope 3 emissions, which were substantial, yet difficult to measure.

“Scope 3 supply chain emissions represent a significant portion of food retailers’ greenhouse gas emissions. Under the reporting regulations, large beef companies will be required to navigate the complexities of collecting and reporting accurate emissions data,” he said.

“At farm level, carbon calculators and measurement tools will become important to facilitate a bottom-up approach to measurement.”

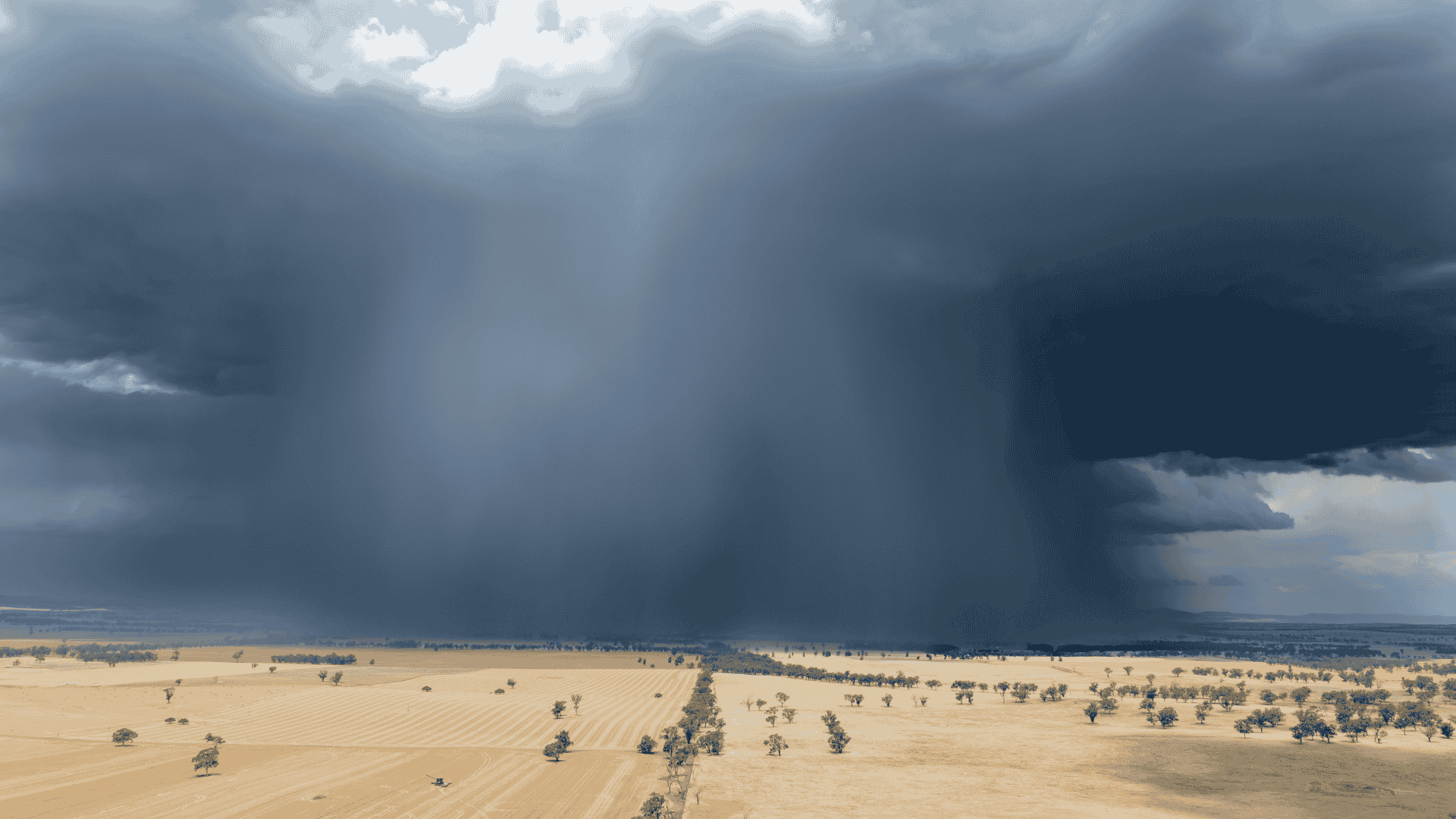

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...