Cattle prices lift on back of rainfall across south eastern Australia

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Duxton Farms has sold its 8,000ha Timberscombe property to PSP-owned Altora Ag Pty Ltd for $70 million.

The sale was confirmed in a release to the ASX, which reported the contract for sale was successfully executed on Thursday and settlement was due to occur in four weeks, subject to Foreign Investment Review Board approval.

Altora Ag was created by the rollup of BFB and Daybreak Cropping in December 2022. Public Sector Pension Investment Board (PSP Investments), one of Canada’s largest pension funds and one of the largest foreign investors in the Australian agricultural sector, took a majority stake in Temora-based BFB in 2019. Daybreak Cropping was purchased from fund manager Warrakirri in April 2022 and was added to the portfolio. The combined entity

READ MORE: Why Australian ag is in global funds' sights

Timberscombe came onto the market last November, when the West Wyalong, NSW, property was billed as "one of the largest and most desirable ... broadacre properties in NSW". It accounted for more than a third of Duxton's $158m in assets and had been part of the portfolio for 15 years.

READ MORE: Property Roundup: $6.5m plus for Tenterfield Wagyu backgrounder, 40,000ha ‘Boanbirra' ends era

At the time the company said it was offloading the asset to diversify away from broadacre farming assets and focus on higher growth areas.

The release confirmed this, saying the proceeds would be used for direct and equity investment in the Northern Territory, Victoria and NSW, for debt reduction and a distribution to shareholders.

Duxton Farms Chairman Ed Peter said: “This sale allows us to redeploy capital into growth and development projects that are better suited to the Company’s expanding strategic scope, and to pay a small distribution to investors as a thanks for their support so far.”

The divestment follows a loss-making year that was heavily impacted by flooding in the Murray Darling Basin.

For the financial year ending in 2023, the company made a loss of over $10m. Its winter grain crop, planted in late 2022, was only 8,600 tonnes compared to 37,000 the previous season and more than 60,000 in the previous corresponding year.

It was unable to plant a summer crop of cotton for the 2023 season.

In its annual report the company said it had renewed banking facilities with Commonwealth Bank including increasing term facilities from $15m to $68m but noted "a condition of this funding is that the Group have in place a plan to substatially (sic) reduce borrowings by 31 March 2024".

"Balance sheet management remains a critical area of focus for the Board, who are actively considering a number of routes towards normalising the Group’s gearing over the next few seasons after funding two consecutive years of losses," the report said.

In its annual report, Duxton Farms said the adverse operating conditions caused by the floods had convinced the company of the risks associated with geographic concentration and the "need to add breadth and scale to the portfolio".

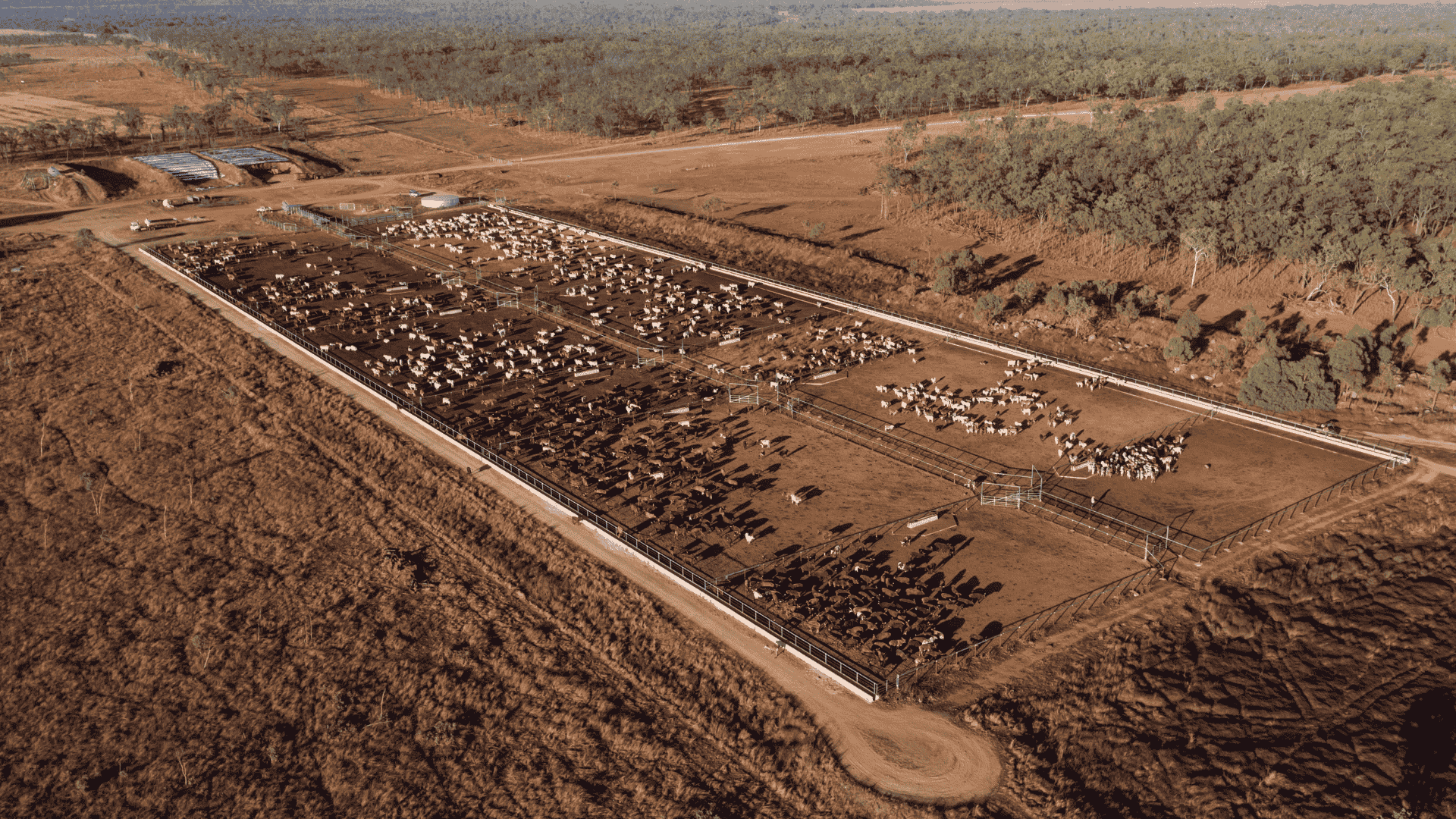

That diversification strategy has seen it purchase the 1,185ha Piambie Farms on the Murray River in Sunraysia that is being planted with pistachios. Duxton also noted the stronger than usual returns from livestock, including cattle, sheep and wool and said that with the addition of the 141,000ha Mountain Valley Station in the Northern Territory in December last year, it would see livestock revenue increase.

The firm has plans to convert Mountain Valley to irrigated cropping with Chairman Edouard Peter attesting in the annual report preamble that, "rainfed cropping has the potential to completely change the nature of the Northern Territory’s agricultural sector", and is "one of the most intriguing opportunities available in all of Australian agriculture".

Since its listing in February 2018 at $1.58 per share, Duxton shares peaked at $1.90 in July last year but since then has been on a downward trajectory, to close at $1.44 on November 28, 2023 when Timberscombe was put on the market.

This morning the shares started at $1.30, but they rallied after 2pm due to the announcement of the sale of Timberscombe to sit at $1.42 at 4pm.

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...

The Australian Bureau of Statistics (ABS) released it’s quarterly ‘Livestock Products’ data and statistics on Friday. There is plenty of data to dig...