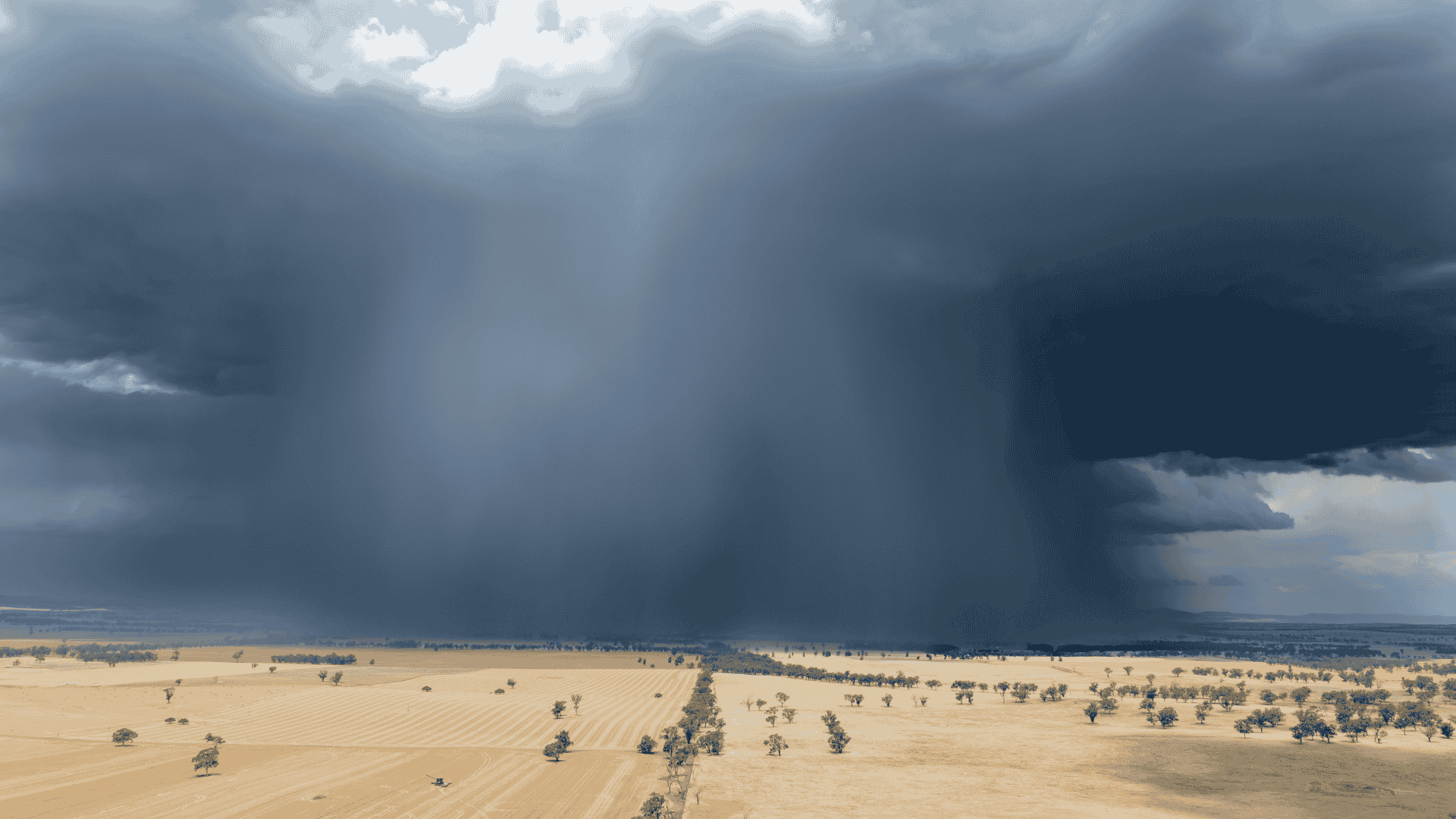

A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There has been plenty of speculation as to how US tariffs would impact our meat trade with the US and China. The April export figures have been released, so we can now get a first look at what, if any, impact the imposition of tariffs has had on the beef and lamb trade.

Before getting too far into the analysis, we need to remember that much of the business done for April exports took place before tariffs were implemented, so while we might get some idea of impacts, a few more months of data will be required to see how things are playing out.

The headline beef export number of 127,172 tonnes is close to the record beef export number set last October and the fifth highest on record. The all-important US market remained our largest customer, taking 37% more beef than April last year. Figure 1 shows exports to the US were lower than in January, and the peaks of the second half of 2024, but remain very strong.

Beef prices in the US continue to climb, and we are approaching the ‘grilling season’ when the firing up of barbeques increases demand. Prices for Australian beef to be exported to the US remain very strong. There is little sign of weakening demand due to tariffs just yet.

The other story in the beef space are the barriers to US beef being exported to China. In April, there was little indication of increased demand for Australian beef in China, although exports did rise against the seasonal trend (Figure 2). Since December, Australian beef exports to China have been stronger, as it continues to consolidate its spot as our second-largest market.

Lamb exports to the US did record a decline in April, falling 8% on the same month in 2024, and recording their lowest level since January 2024. This is of some concern, although total exports were very close to last year. Increases in lamb exports to China, Papua New Guinea, and Europe took up the slack in lamb exports.

As we move towards winter, and the supply of livestock tightens, it’s going to be hard to assess the impacts of tariffs on markets. We will at least get some time to assess market behavior before we get into spring and supply starts to grow again.

Angus Brown brings over 20 years of expertise analysing Australian agricultural markets, and also runs a mixed farming operation in Hamilton, Victoria.

Angus Brown brings over 20 years of expertise analysing Australian agricultural markets, and also runs a mixed farming operation in Hamilton, Victoria.

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...