Cattle prices have been declining since October 2022 due to a higher supply of slaughter-ready cattle and subdued restocker demand. The pullback to long-term averages has occurred sooner than many expected and now the question is, when will it find solid ground?

Key Points:

Analysis of prices and Value Over Reserve (VOR) suggest the cattle market may be near the bottom, but not there yet

Comparison to Over the Hooks goatmeat prices suggests price support may arrive very soon

Whenever the market finds a floor, prices are expected to remain flat for a period before rising again

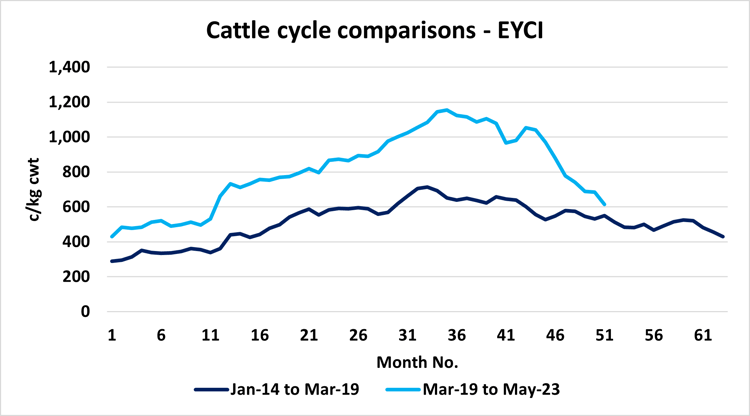

If you look at the last two cattle cycles defined by the lowest weekly prices, the first cycle runs from 25 January 2014 when the EYCI was 281c until 16 March 2019 when the EYCI retraced to a low of 392c. This cycle peaked at 723c on 8 October 2016.

The second cycle is the one we are in currently. It runs from the low in March 2019 to 568c on 15 June 2023 and peaked at 1,190c/kg cwt on 22 January 2022.

As you can see in Figure 1, both cycles increased at similar rates and peaked around the same time, about 33-34 months from low to high. However, the first cycle declined by about 46% over a period of 29 months, whereas the current cycle has declined by about 53% in 17 months.

The comparison of the last two cattle cycles suggests we are currently in the equivalent position as March 2018, or month 51. If the current cycle was to follow the same time frame as the previous cycle, we could expect the bottom of this cycle to occur around May 2024, or month 63 in the cycle.

Figure 1: Monthly average EYCI January 2014 – May 2023. Source: MLA

Figure 1: Monthly average EYCI January 2014 – May 2023. Source: MLA

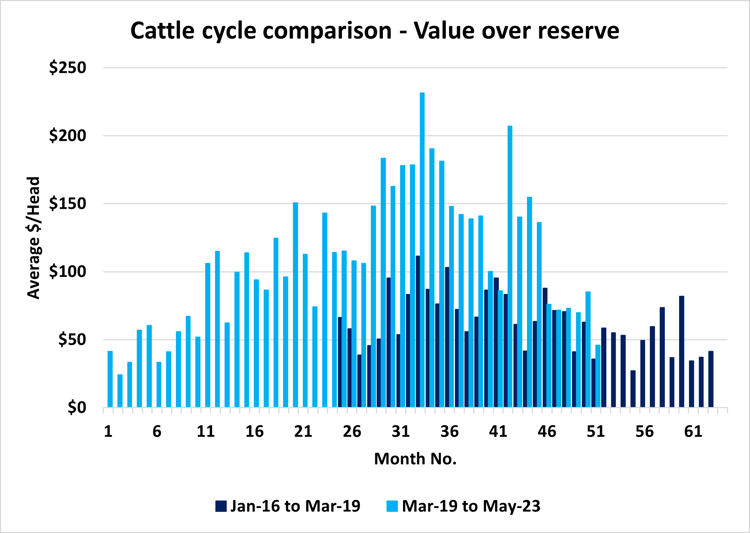

Another measure of the peaks and troughs of the price cycles is average value over reserve (VOR). In figure 2, we can see that VOR follows the same pattern as prices for the last eight years. The peak VOR precedes the peak monthly prices by 1-2 months, around the 33–34-month mark of the cycle.

In the current cycle, the average VOR of $46 in May 2023 is the lowest result since September 2019. Looking at the previous cycle, the lowest VOR recorded in AuctionsPlus commercial cattle sales (with data available from 2016) was $27 in July 2018. This suggests that the cattle market could be near the bottom, but not there yet.

Figure 2: AuctionsPlus commercial cattle VOR January 2016 – May 2023

Figure 2: AuctionsPlus commercial cattle VOR January 2016 – May 2023

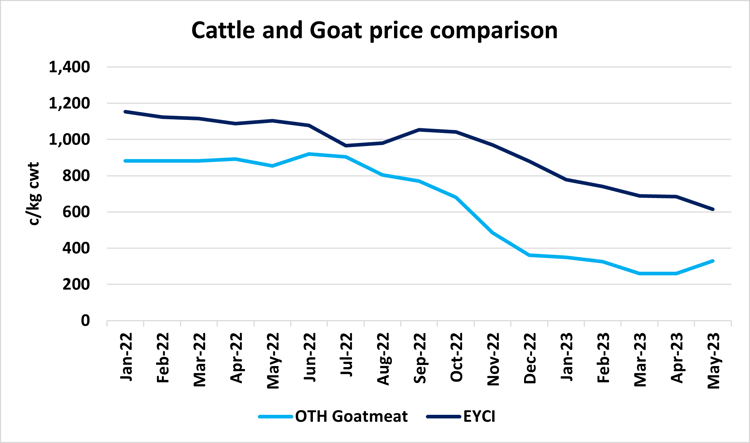

Previous analysis from the AuctionsPlus Insights team has raised the idea that the goat industry can be considered the ‘canary in the coalmine’ when it comes to Australian livestock prices. Over the Hooks (OTH) prices for goatmeat have declined by 72% in nine months from their peak of 920c/kg cwt in June 2022 to 260c/kg cwt in March 2023. We are yet to see if March 2023 remains the bottom for the goatmeat prices. However, if it is, and we assume the cattle market follows a similar trend, this would suggest that the steep decline in cattle prices may ease in July 2023, nine months after they started to fall.

Figure 3: Monthly average EYCI and OTH goatmeat prices January 2022 – May 2023. Source: MLA

Figure 3: Monthly average EYCI and OTH goatmeat prices January 2022 – May 2023. Source: MLA

This is the first such attempt (that we know of) to find a link between VOR and cattle price peaks and troughs, so feedback is welcome. This analysis, and the goatmeat comparison above, offer some novel suggestions as to when the cattle market could find some support. It’s important to note that although the bottom of the last cattle price cycle was in March 2019, prices did not increase significantly again until January 2020. Once the cattle market reaches a floor, it is expected to remain relatively flat for a period before rising again.

We welcome your feedback on this analysis as we look for new ways to derive insights from AP data. Email dthomson@auctionsplus.com.au with any suggestions.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Subscribe to our weekly newsletter and monthly cattle, sheep, and machinery round-ups.