Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

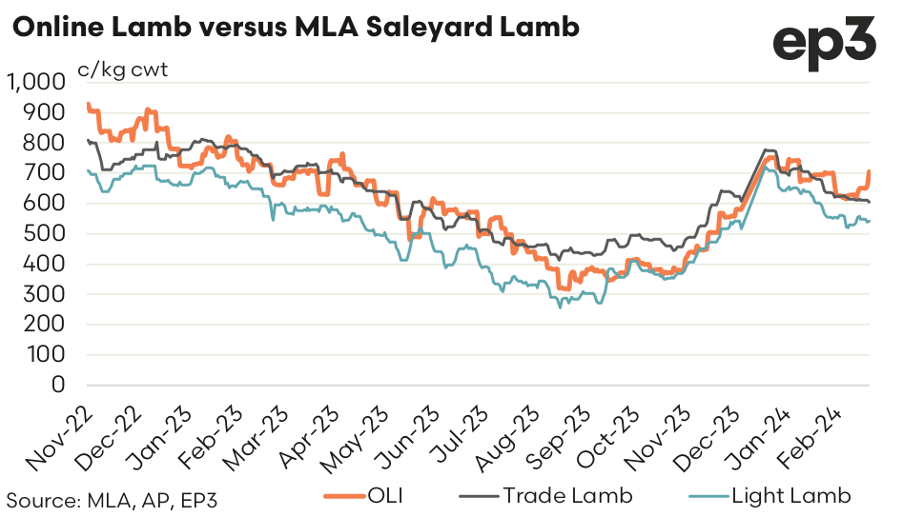

Lamb pricing moved higher through December and January, recovering well from the market lull seen in late 2023. However, some mild weakness returned to the market during February as strong saleyard throughput volumes saw prices ease by 22% for trade lamb and around 25% for light lamb, according to the Meat & Livestock Australia national indicators.

The AuctionsPlus Online Lamb Indicator (OLI) initially followed the physical market down through February easing by 18%, but in recent weeks has demonstrated strengthening prices. Since late February the OLI has gained nearly 15% to trade at 705c/kg cwt this week.

In contrast, the MLA trade lamb indicator has slipped a further 2% to 605c/kg cwt over March and the MLA light lab indicator has managed a meagre 4% lift to 534c/kg cwt.

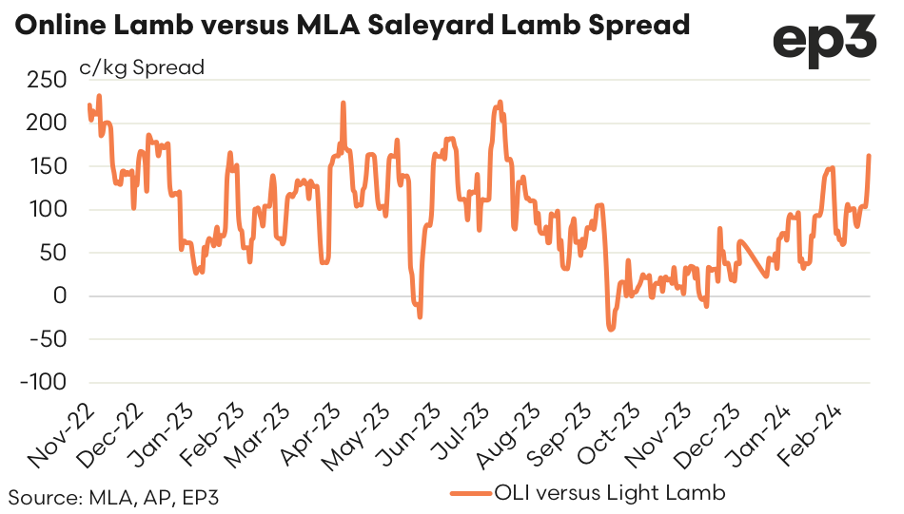

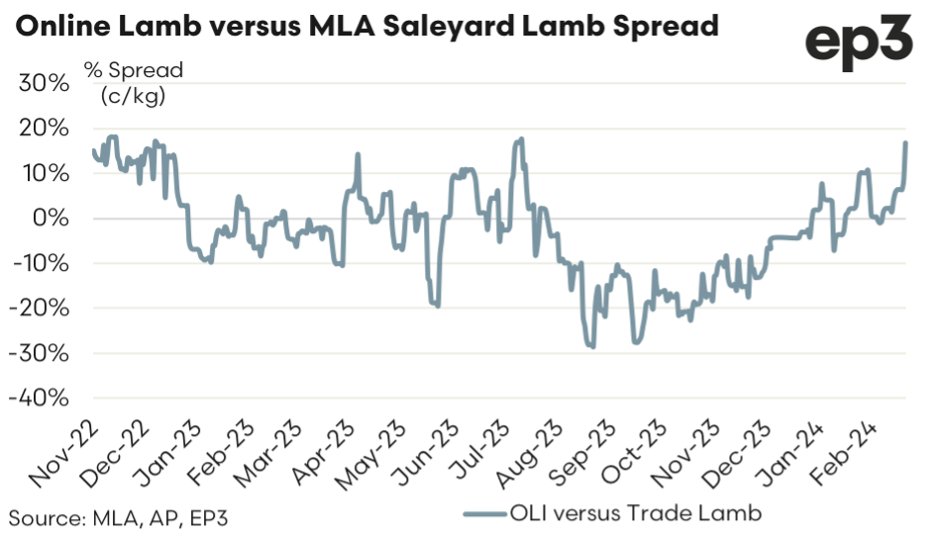

The recent divergence between online and physical markets is demonstrated clearly in an assessment of the price spread in c/kg with the OLI rising to a 162 cent premium to the MLA light lamb indicator, the highest this premium has been since early August 2023.

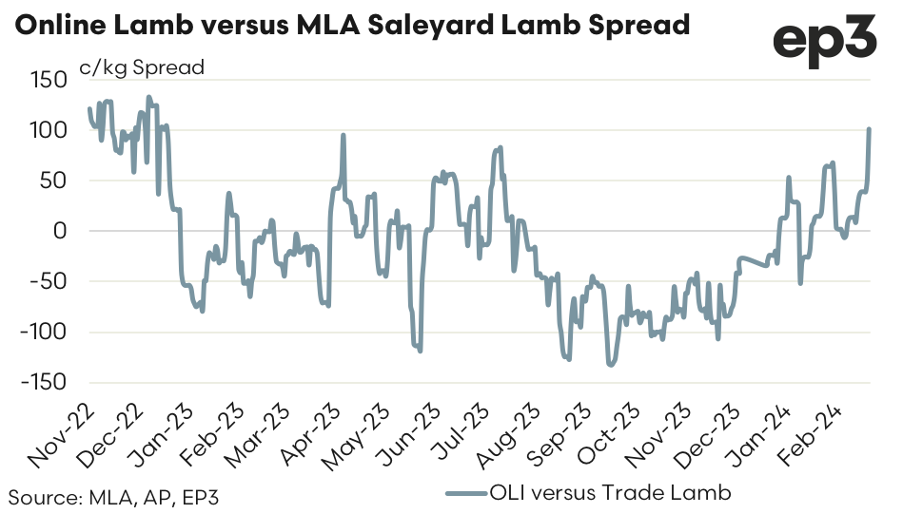

Meanwhile the OLI c/kg spread to the MLA trade lamb indicator has shown an impressive rise, lifting to a 101 cent premium this week and reaching the highest premium since early January 2023.

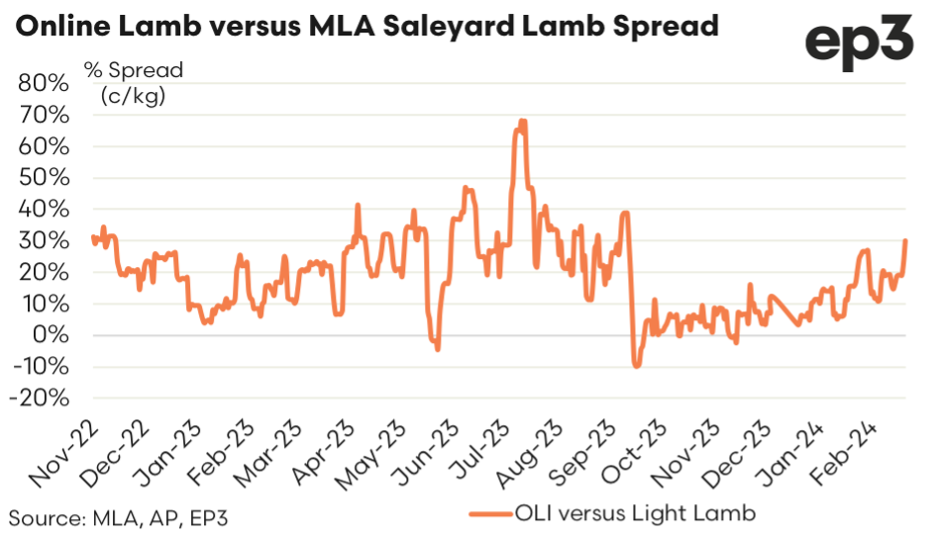

Anyone that follows our work knows that we like to measure price spreads in percentage terms so that we can account fairly for changes to the underlying price too. For example, a 50 cent premium on a 500c/kg cwt price is the same in percentage terms as a 70 cent premium on 700c/kg cwt price.

In percentage spread terms, the OLI has moved to a 30% premium to the MLA light lamb indicator this week, the best result seen since late September 2023. Similarly the percentage spread premium for OLI to trade lambs has increased to 17% this week, the highest it has been since the end of July 2023 and only 1% off the record high achieved since the OLI reporting via MLA began of 18% premium.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...