A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

3 min read

Newsroom

:

Mar 7, 2024

Newsroom

:

Mar 7, 2024

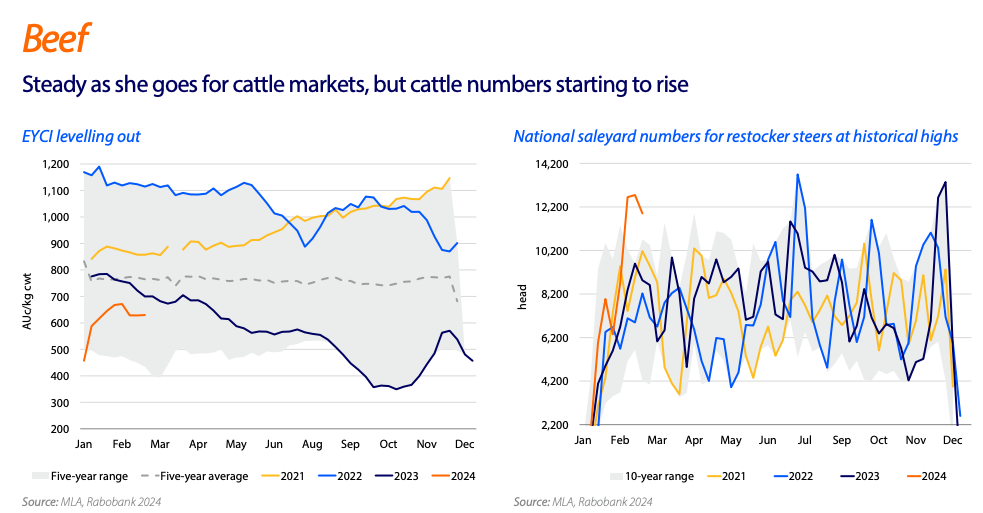

Rabobank is reporting that good seasonal conditions are buoying producer confidence, underpinning steady prices in the face of some of the highest restocker steer and heifer throughput in the past 10 years.

Senior Analyst Animal Protein Angus Gidley-Baird said cattle prices were steady for the past couple of weeks of February.

The national saleyard restocker steer price traded between 360c and 376c/kg from 18 February to 3 March after peaking at 391c/kg on 11 February.

“Restocker steer and heifer numbers going through saleyards are at some of the highest levels we have seen in the past 10 years, but good seasonal conditions are giving producers confidence and prices are holding," Mr Gidley-Baird said.

“Producers are still paying a premium, but this gap has narrowed in recent weeks suggesting producer demand for restocking cattle is easing.

“Feeder cattle have followed a similar trend and were trading at 335c/kg on 3 March.

“We believe prices are at a more balanced level given all the forces in the market at the moment, and we expected them to continue to trade around the current range for the next month.”

ABS quarterly production volumes were released in mid February, with the total cattle slaughter for 2023 up 20% at 7.03 million head.

The average slaughter weight was down slightly at 314kg, leading to a production increase of 18% reaching 2.2m tonnes.

Mr Gidley-Baird is not convinced cattle are in liquidation, despite the proportion of females in total cattle slaughter being high for the past three quarters, with quarter 4 numbers again over 47%.

“We continue to see male slaughter numbers rise, reflecting the overall increase in cattle availability, and the female proportion has not yet pushed to the highs of 2014 or 2019,” he said.

“I believe the data reflects the higher livestock numbers, less restocking activity, and some of the older cows cycling through the market.”

Meanwhile, beef exports continue to increase, with January volumes up 47% YOY and February volumes looking to be up about 33%.

“Encouragingly, volumes to Japan are recovering – up 43% YOY for February – following the reduction in meat inventory levels late last year,” he said.

Exports to the US also remain strong, with volumes up 83% YOY for February and imported trimmings prices up 5%.

Mr Gidley-Baird said the industry should be carefully watching the upcoming northern cattle muster and weaner sales in the south .

“With the market nicely balanced currently, the risk of a strong northern muster and increased weaner sales in the south could see a large number of young stock enter the market over the coming months,” he said.

“Male and female restocker cattle numbers through saleyards are already at their highest levels in the last 10 years.

“While seasonal conditions remain favourable, we believe producers should be able to accommodate these numbers – with maybe a little softening in prices.

“But if seasonal conditions deteriorate, such a large number of young stock could depress prices.”

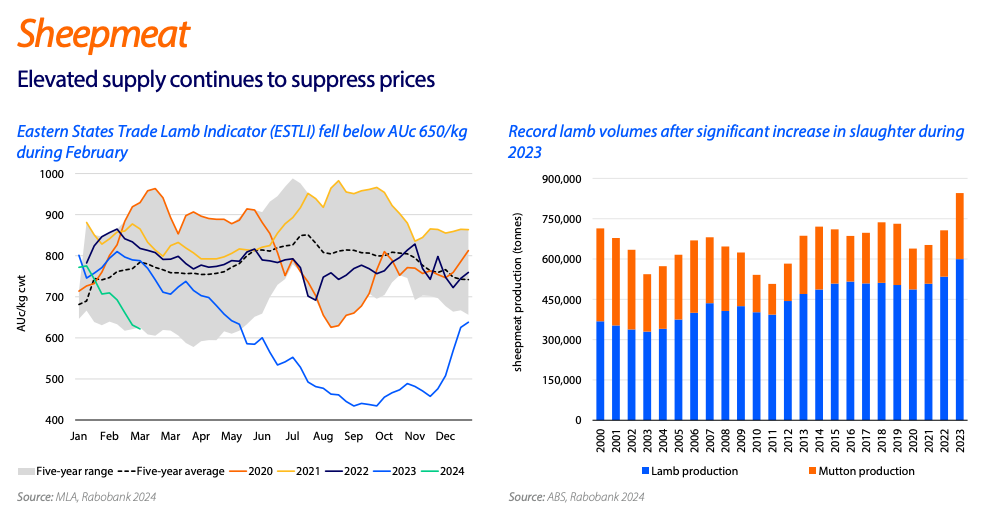

Meanwhile Rabobank’s Associate Analyst Agriculture Commodities Edward McGeoch reported that lamb indicators softened slightly in February but remain well above levels seen prior to November 2023.

Mutton prices fell through February alongside the other indicators, but saw an increase before ending the month around AUD 2.75/kg, a 7% decrease MOM.

“The rallies seen at the back end of 2023 have eased as drier conditions in some regions and the natural seasonal influx of lambs fill the market,” Mr McGeoch said.

Lamb production reached a record 599,461 tonnes, up 12% YOY, according to the ABS.

Victoria saw a significant 18% increase in lamb production, with average carcase weights sitting just above 24kg before falling to 22.9kg in Q4.

Sheep production climbed 42% YOY to 246,300 tonnes with NSW and WA increasing 53% and 56%, respectively, while Victoria saw production jump 24%.

Carcase weights climbed from 24.1kg in Q2 to 26.1kg in Q4 2023.

“These significant increases were driven by elevated inventory levels and the dry conditions,” Mr McGeoch said.

Weekly lamb slaughter volumes increased 20% YOY and showed an 8% lift on January totals. Weekly sheep slaughter numbers were also strong, increasing 6% YOY and 15% MOM.

In 2023 Australian lamb export volumes to the US fell 16% YOY as US demand for lamb fell.

“Given that lamb is viewed as a more premium product in the US market, consumption suffered as consumers looked to tighten their spending,” he said.

“As conditions appear to be improving, Australian exports to the US got off to a strong start in 2024, up 42% in January and on track for a 28% increase in February.

“If this growth remains, it will provide an opportunity to absorb the high volume of Australian lamb expected to hit the market over the next few months.”

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...