Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

1 min read

Emily Tan - MLA Market Information Analyst : Jul 14, 2025

While the sheepmeat market experiences record prices, the Australian wool market is less robust.

The Eastern Market Indicator (EMI) showed a slight 7% price lift, but it’s nowhere near 2019’s record high of $20/kg. Increased costs from shearing, crutching and labour are likely contributing.

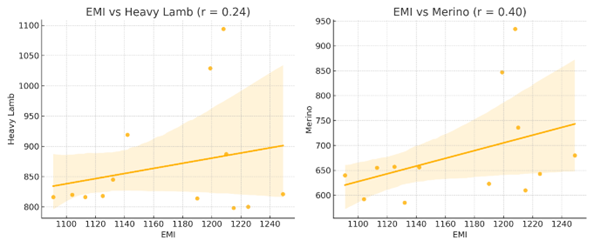

Data analysis indicates a moderate correlation between sheepmeat prices and wool prices.

This means increasing lamb prices (Merino Lamb Indicator) will not necessarily lead to increasing wool prices (Eastern Market Indicator).

READ MORE: Producers plan flock reductions. Why?

When analysts examine the meat and wool price relationship, they assess each variable using a correlation coefficient.

A positive correlation coefficient (r-value) indicates an increase of one variable will see a similar increase in the other variable.

A negative r-value suggests an increase in one variable will see a decrease in the other variable.

Analysis of the EMI and the Merino Lamb Indicator show a moderate positive relationship – likely reflecting that sheepmeat is a by-product of wool production in Merino-based systems.

National Heavy Lamb Indicator reaches record high.

Wool saw a modest 7% increase in the Eastern Market Indicator amid rising production costs.

Data suggests increasing lamb prices will not necessarily lead to increasing wool prices.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...