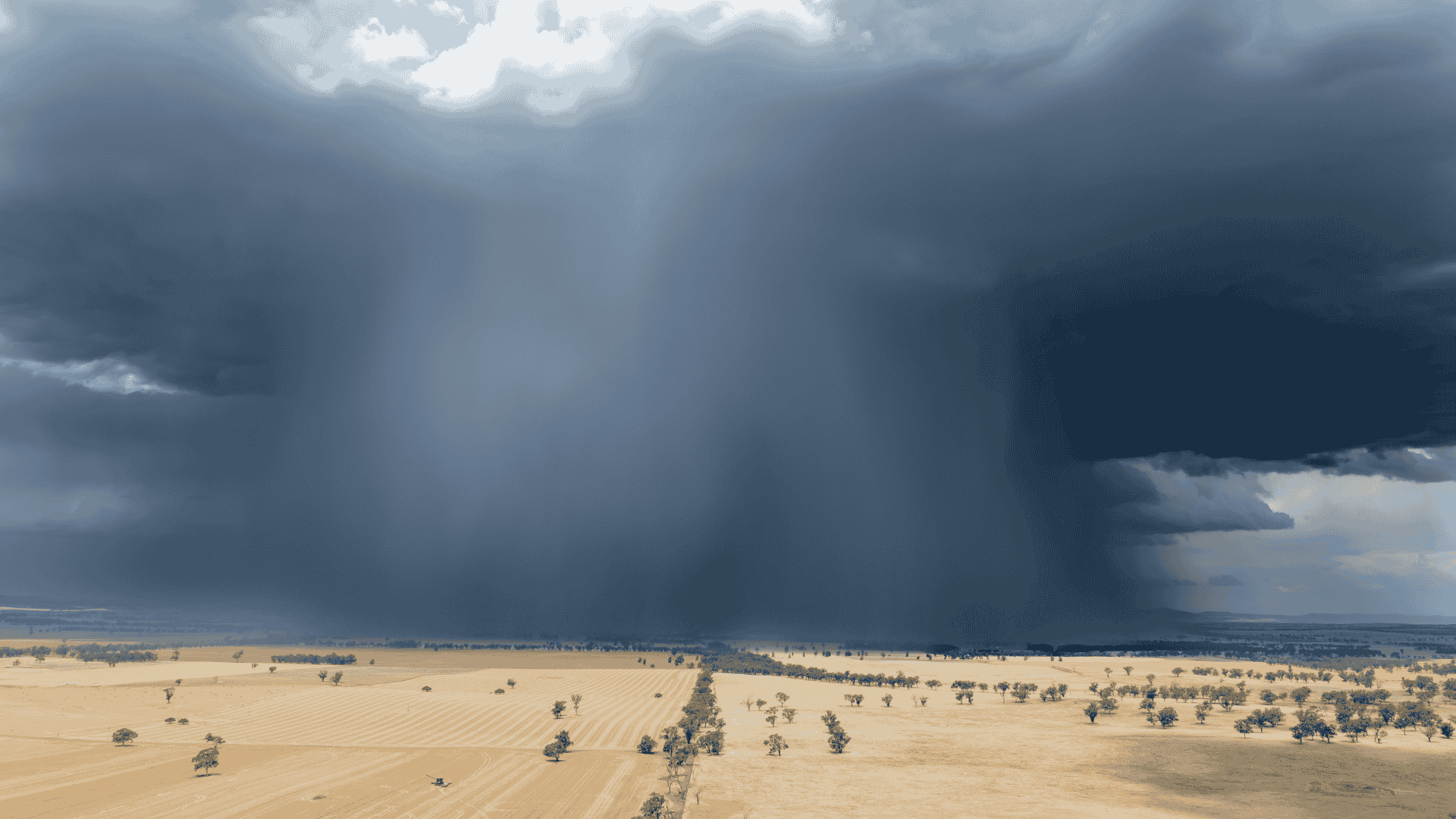

A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

I am not a large language model expert. I am certainly not a computer person. I've spent my whole life in agency. But I do believe in using all available data to help make on-farm decisions, so I've been playing around with artificial intelligence (AI) and thought I would test its ability to forecast cattle pricing.

This is the basic prompt I delivered to ChatGPT:

"You're an expert livestock market analyst. Please use all relevant publicly available, up-to-date datasets and information from trusted sources to produce a six to 12 month forecast of Australian cattle prices, including a confidence rating and the rationale behind it. Focus on 380-480kg steers delivered to Northern NSW feedlots.

This is what it spat out.

.png?width=800&height=450&name=Maximising_Livestock_Profits_Big_Data_Angus_Canva.pptx%20(Presentation).png)

It basically gave me a price scenario, best case, most likely and worst case, as you can see there, and it gave me a couple of the caveats around that, like it says the export grids may exceed for HGP free and EU accredited livestock.

And then it told me what is actually driving the market, and then told me the key indicators to watch.

It points to a forecast confidence of medium to high, and also that a dry spring risk remains key.

So it's telling us, untrained, straight off the model, that that is something that we need to be watching.

The bottom line is the most likely scenario, it said would be 350-370c/kg from May to November 2025.

That seems simple but has been distilled from about 30 data sets that the AI platform utilised because it is learning what I look at.

AI can take a large dataset and break it down simply for users in a way that is helpful.

It's something that would normally take us hours, many spreadsheets and still not be able to fully compute.

I also asked it for the forecast for November 2025 to May 2026.

%20(1).png?width=800&height=450&name=Maximising_Livestock_Profits_Big_Data_Angus_Canva.pptx%20(Presentation)%20(1).png)

The first thing to note is it's dropped its confidence level - it's now a medium confidence.

It points to external risk being the most important thing, and political, geographic, geopolitical developments and trade policies. You know, the great man in the White House, he's going to make a difference to ag, whether we like it or not.

But it lists the most likely price range for November to May to be 350-370c/kg.

It isolates what indicators to watch, to think about a weak dollar and the impact of grain prices.

It also isolates the worst case and what would impact that. From droughts, sustained high slaughter rates and stronger Australian dollar (it even shows what figures it believe will be tipping points).

I think what I want to sort of bring back to is that this is something as an industry, you need to really start to think about, can AI do some stuff for us? Are we paying enough attention to it?

We've always got to put a caveat in around this that there needs to be a human interaction here to just value check it.

However, as an industry we need to think about how we actually use our data, and how we can start to think about how our data can interact.

You get lots of reports every week, including our cattle report. You get wherever you live, and you can go and listen or read reports from across the country. You can digest it in different parts.

Speak to your agent, that on the ground information is really, really important, or a cattle buyer, or your feedlot. There are big data sets out there that I think we can start to look at, and think we can start to play with a little bit.

Reporting the data is one thing, but an insight is the really important piece. Our third parties analysts and our marketing and content team work really hard on delivering that, that good insight, and trying to connect the people with actionable insights.

But AI also has some insights to offer not in the far off future, but now. Have a play with it to see for yourself.

I can't wait to see how good the AI forecast is in the months to come.

Paul Holm is the General Manager - Network for AuctionsPlus. The article above is taken from a speech he delivered at the Neogen World Angus Forum in Brisbane last week.

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...