Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

It has been a while since we took a look at the EP3 Beef Processor Profitability Index (BPPI) and how times have changed for the sector during 2023.

In April 2023 we noted that after many months of negative margin that the BPPI had moved back into positive territory. As the local cattle price has continued to slide through the year and offshore beef export markets and export prices have held up firmly the profitability of beef processors, according to the index modelling, has continued to improve.

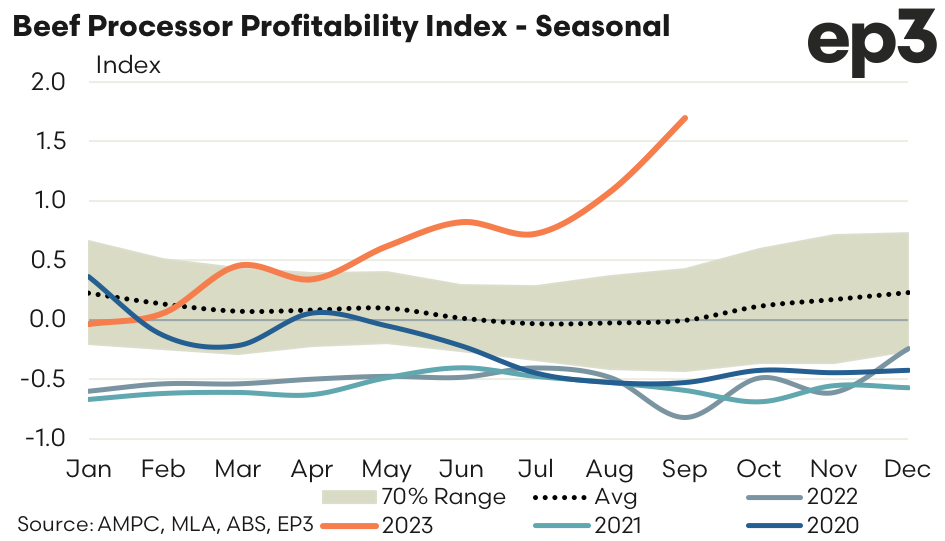

The average BPPI for September has come in at 1.69, which is the highest the index has been on record. Although, the strong recovery in the BPPI comes after spending 33 months in negative territory. As the seasonality chart shows the BPPI snuck into profitable territory briefly in April 2020, but you would have to go back to late 2019/early 2020 to have seen some consistent, above average profits being achieved. So it has been a long time between drinks for the nation’s beef processors – at least according to this index calculation.

It is important to note that this BPPI calculation is based upon a theoretical processor margin model and is a simple representation of the Australian beef processing sector.

A BPPI in negative territory does not suggest that all processors are losing money, similarly a BPPI in positive territory doesn’t suggest that all processors are making money.

A more useful reading of the BPPI would be that a negative index suggests a tougher processor trading environment, versus a positive BPPI which is reflective of a more beneficial processor trading environment.

Additionally, there have been recent labour cost increases to the red meat processing sector. One recent factor has been the application of the Pacific Australia Labour Mobility (PALM) scheme which the current modelling process doesn’t take into account, as data availability limits what the BPPI modelling process can utilise.

Happy days. Pic: Australian Meat Processor Corporation

Additionally, there are higher general labour costs as limited abattoir workforce numbers means that more overtime is being utilised and the raising of the TSMIT (Temporary Skilled Migration Income Threshold) in July of 2023 has increased broader wage costs in meat works. This means that the more recent index profitability levels maybe somewhat overstated.

Seasonality comes into play

As the seasonality chart highlights, the BPPI moved back into positive territory during the first quarter of 2023. Quarter two demonstrated some moderate growth in profitability with the index moving from an average of 0.34 in April to an average of 0.82 in June. Meanwhile, the third quarter of 2023 has seen a strong lift in the index from an average of 0.73 in July to 1.69 during September.

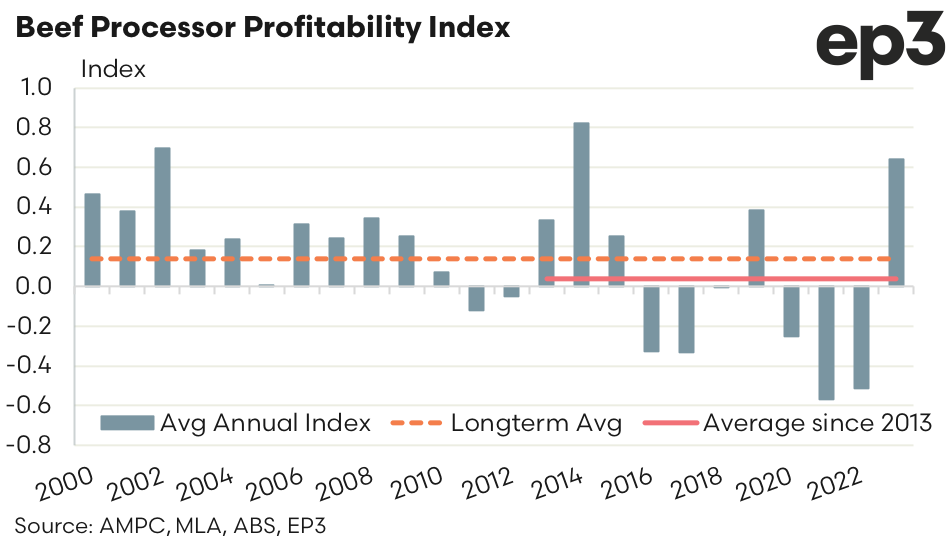

The annual average BPPI for the 2023 season sits at 0.64, which is below the annual average peak of 0.82 that was achieved during 2014.

The long-term average BPPI calculated from 2000 to 2023 sits at 0.14 (represented by the orange dotted line on chart). Analysis of the average BPPI achieved since 2013 shows that the last decade has been pretty bleak for beef processors with a BPPI of just 0.04. Since 2018 the average BPPI has been -0.05, so the current improved environment is providing an opportunity for beef processors to claw back some of the more recent losses incurred.

Profit picture has moved in favour of processors

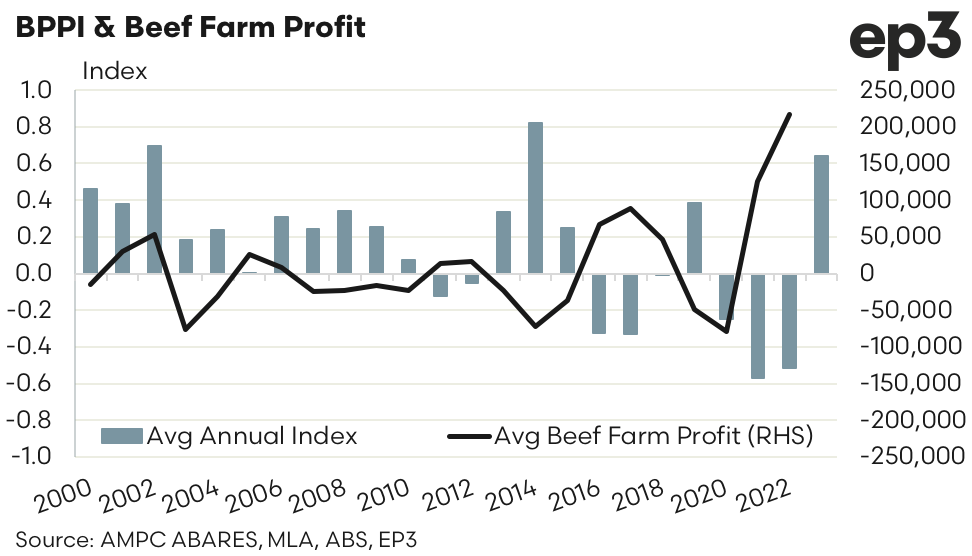

A comparison of ABARES annual beef farm profitability data compared to the beef processor index highlights that the pendulum of profitability has indeed swung in favour of the processor into 2023. ABARES are yet to release their calculations for 2023, but given the pattern set over the last decade it is fair to assume that beef farm profitability will be down from the record peak seen in 2022.

Historically, beef farm profitability often takes a hit when the BPPI turns positive. Similarly, when beef farm profitability improves it usually coincides with a tougher trading environment for the beef processing sector. Like many commodities, there is a cycle of boom and bust and the beef sector is no exception. It’s just that the beef processor and the beef farmer are at opposite ends of the price cycle.

Matt Dalgleish will be analysing how the AuctionsPlus Restocker Lamb Indicator is faring next week.

This post originally appeared at Episode3. Republished with permission.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...