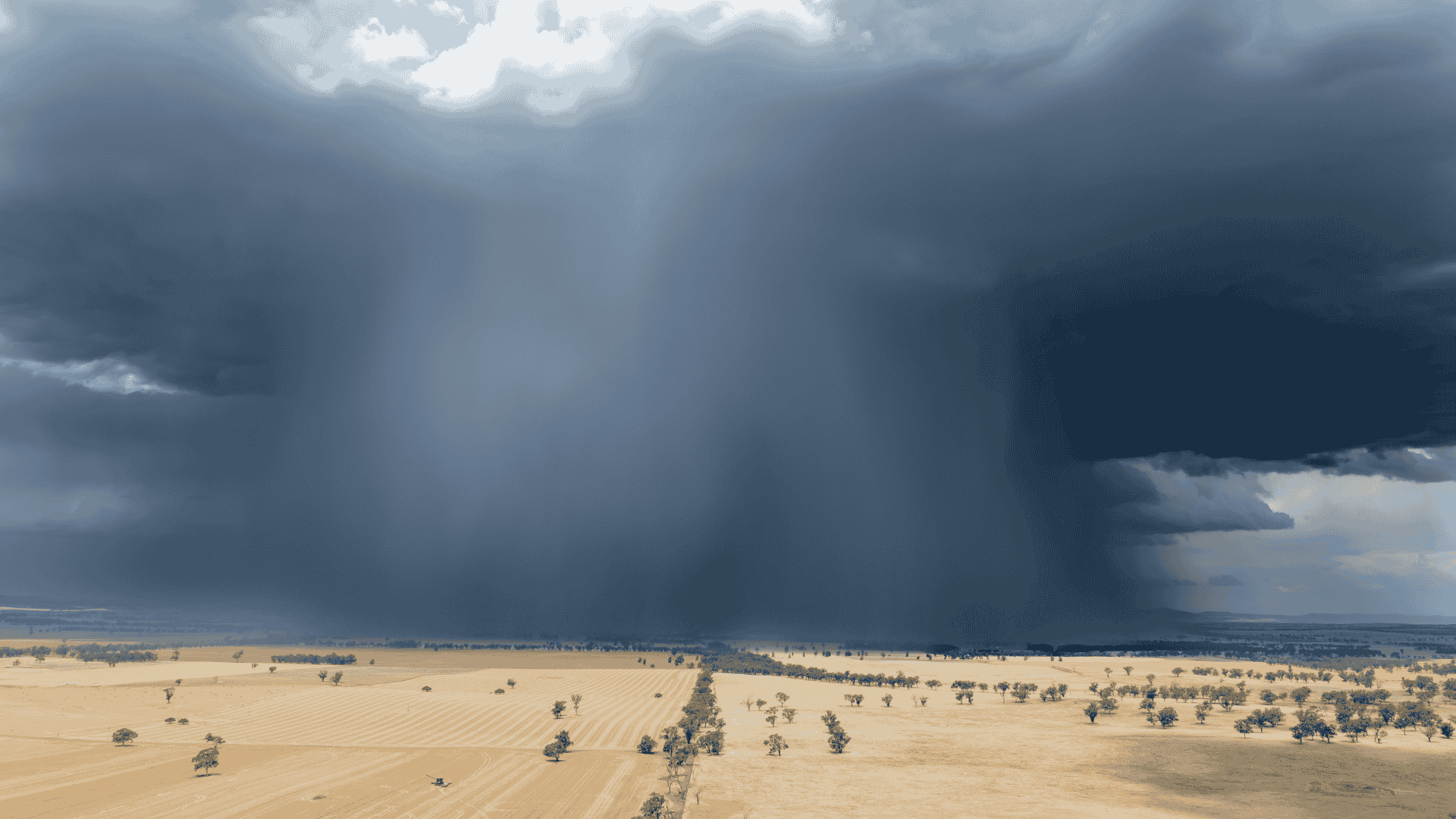

A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

Hot on the heels of the Wagyu Edge 2025 annual conference held in Perth undertaken by the Australian Wagyu Association we take a look at F1 Wagyu pricing versus the Meat & Livestock Australia (MLA) National Young Cattle Indicator (NYCI) and National Feeder Steer Indicator (NFSI).

AuctionsPlus provides one of the few public price points for Wagyu cattle. Analysis of their data allows an F1 Wagyu indicator to be calculated that attempts to mirror the cattle live weight specifications that are used to calculate the NYCI. AuctionsPlus price data is filtered for F1 heifer and steers to create a weighted average monthly price in c/kg carcass weight (cwt) for F1 Wagyu cattle that weight between 200-400kg.

After a price peak near to 2350 c/kg cwt in the final quarter of 2022, amidst a strong national cattle herd rebuild phase in Australia, a combination of cost of living pressures in key Wagyu export destinations and increased supply have seen F1 Wagyu price ease significantly.

Following the broader Australian cattle market down, F1 Wagyu pricing reached a monthly low of 431 c/kg cwt in October 2023 as fears of an impending El Nino and potential drought saw cattle producers rush for the exit. Thankfully the concern over a return to significant dry conditions during the final quarter of 2023 proved unfounded. The Australian cattle market recovered during 2024 and the F1 Wagyu prices improved gradually too, opening up a slight premium to the NYCI.

Historically, the F1 Wagyu indicator created with the AuctionsPlus data, holds about a 45% premium to the NYCI over the last decade (see black dotted line below). For about 70% of the time since 2015 the F1 premium to the NYCI has ranged between 10% to 80%. For much of the 2024 season the F1 premium has ranged between 10% and 40%. Increased F1 Wagyu numbers on feed in 2024 have kept the premiums below longer term average levels.

Occasionally, criticism has been levied at the AuctionsPlus F1 pricing data, with suggestions that the data doesn’t fully encapsulate enough of the F1 market within Australia. During a flood of F1 Wagyu cattle 2018/19 it was claimed by some industry representatives that the AuctionsPlus platform was mainly being used to clear inferior F1 types or F1 cattle from producers that were relatively new to the sector that had been unable to establish a reputation among key feedlot buyers. During this time it was suggested that the F1 price reported on the AuctionsPlus platform was discounted to prices being achieved in the direct market.

Episode 3 have been fortunate enough to collect private F1 Wagyu pricing from several industry sources since 2016, including some occasional publicly quoted monthly average price levels beyond what is available on the AuctionsPlus platform. Aggregating these multiple data sources into an indicative “industry price range” it can be shown that during the 2018/19 period the F1 pricing on the AuctionsPlus platform did appear to be discounted for a period.

However, a brief visual assessment of the “industry range” versus the AuctionsPlus indicator from 2016 to the present suggests that the AuctionsPlus data is a pretty good proxy (most of the time) for the broader price trend for F1 Wagyu cattle and that it is usually pretty close to the lower end of the “industry range”. From this perspective it appears to be a very useful publicly available indicator of F1 Wagyu price levels.

Calculating a c/kg spread of the F1 Wagyu, using the mid-point of the “industry range” versus the MLA National Feeder Steer indicator demonstrates that while the F1 Wagyu was heavily discounted during the 2018/19 period it did not trade at a discount during this time, like the comparison to the AuctionsPlus indicator demonstrated in the percentage spread chart highlighted earlier in this analysis.

Much of the 2024 season has seen the aggregate industry F1 pricing trade at similar levels seen to the 2018/19 period of F1 Wagyu oversupply, with a premium broadly ranging between 50c to 200c. In our next fortnightly instalment we will explore the growth in the Wagyu market over the last decade and demonstrate just how significant the increase in Wagyu numbers seen in 2018 and 2024 have been.

Matt Dalgleish is a director of Episode3.net and co-host of the Agwatchers podcast.

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...