A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

4 min read

John Francis

:

Nov 16, 2023

John Francis

:

Nov 16, 2023

Close your eyes and imagine your farm with fat cattle, good looking pastures and good profits … Now wake up and choose what you can forgo, because you can't have all three.

If you need good profits, you’re not alone. Across the country farm businesses are crunching their numbers in response to increasing costs and the livestock price crash.

Now is not the time to take your foot off the pedal, in fact, it could be the time to invest.

Before you make any big decisions take a look at your Key Performance Indicators (KPIs) to see how they can help your business make informed decisions.

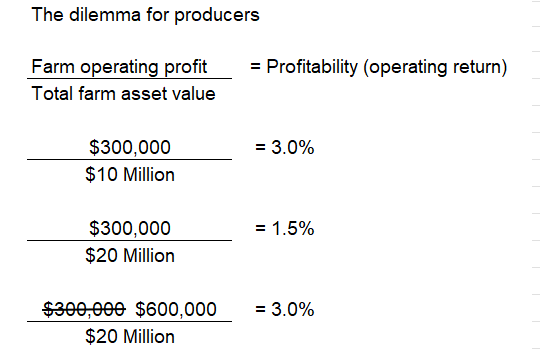

The table below outlines how to calculate the profitability, or operating return, of your farming business. Knowing your financial resource efficiency allows you to compare your farming business to other businesses outside of agriculture.

In a livestock business, assets under management are usually 80-90% land, with the remainder being the livestock. At the moment livestock accounts for about 5% of assets because of its significant drop in value.

The dilemma facing farm managers is that in just the past five years the value of agricultural land has doubled in Australia (shown in the 3rd line of numbers above). If the operating profit doesn't double with it then the financial resource efficiency in our industry is effectively halved.

When operating returns are low and there’s a lot of capital invested, people tend to look elsewhere to get a better return.

Some might think that seeing land values double while farm profit stays the same isn’t a terrible thing, as either way wealth is being created. But if you don’t measure your farm profit against your total asset value, you fail to ensure that you are as efficient as possible, and can be caught out, either with cash flow requirements of meeting your financial commitments, or being ill prepared for when things change. Once that capital growth stops, you’re sitting on a low operating return and no longer generating wealth.`

The key to farm profitability is optimising your cost of production, and the first element of doing that is calculating returns on a per hectare basis. For meat production businesses, you should measure the number of kilograms of meat produced per hectare. There’s also the kilograms per Dry Sheep Equivalent (DSE). One tells you about the system and the other tells you about the resource efficiency and how well you've used your capital.

Let's take the example of two businesses - one where there is low feed utilisation and one where the business really pushes the potential output. The following tables show how difference the performance can be.

Let’s take a beef business with 650mm of rainfall and say they are producing 176kg of beef liveweight per hectare. We want to go a bit deeper and work out how many kilos are produced per 100mm of rain, so we divide that 176 by 6.5 (which 650mm÷100mm) to tell us that we are producing 27kg liveweight per hectare per 100mm.

Now, the most profitable businesses I have worked with can produce 45-50kg of beef per hectare per 100mm of rain and we can see straight away that we are operating at almost half of the potential of the optimised business.

So what do we do? Let’s say our low utilisation business is producing 23 kilograms liveweight per DSE.. If we are producing 176 kilograms liveweight per hectare and our production system delivers 23 kilograms liveweight per DSE then we must be running at a stocking rate of 7.6 DSE per hectare.

Let’s compare that to our high optimisation business. We’ve given them a lower per animal production target of 21 kilograms liveweight per DSE, because there may be less ability for animals to select only the high quality feed. Based on the same approach of dividing production per hectare (295kg lwt/ha) by production per DSE (21kg lwt/DSE) we need to be running a stocking rate of 13.9 DSE per hectare to achieve the production target.

So we know now, that to push this business, we should think about investing to improve the potential stocking rate.

Tying it all together shows why this is so important.

Approximately 80 percent of the costs in a typical beef business consist of overhead costs. These are the costs that do not differ significantly with changes in production. The value of optimising production is that the majority of the operating cost structure remains fixed while the minority (the enterprise costs) increase with each additional production unit. This is why optimising our production brings down the operating cost per DSE from $51 to $31.

Now, if we divide that operating cost per DSE by production per DSE we can calculate cost of production. Under the old operating model the operating cost of $51 per DSE divided by 23 kg/lwt/DSE delivers $2.22 cost of production per kilogram liveweight and under the new model and we have brought it down to less than $1.50 per kilogram.

With prices for steers at under $2/kg lwt, we have gone from making a loss to actually making a margin out of the business all by increasing production rather than looking to screw down costs.

When calculations like the above are presented to a client they can be very excited. However change can be challenging and this has a lot to do with psychology and really depends on the temperament of the business owner.

There is a significant feed deficit in many regions at the moment and in dry times a lot of time and energy goes into feeding and watering livestock, with little time or energy left for business planning.

But this is the perfect time to have a good hard look at your business to understand where the opportunities for improvement are.

Knowing your numbers may also alleviate some stress because you have a plan to get through this period.

I acknowledge that it's not easy given the current seasonal conditions and commodity prices but having open communication with financiers is of the utmost importance at this time.

It is also important to not just present a set of cash flows that look nice on paper without the commitment to getting that over the line.

It reminds me of two producers from southern NSW who increased their stocking rate to optimise feed utilisation just prior to the 2018-19 drought demonstrating that its not as easy as buying the livestock and getting on with it.

The banks were at their heels, but they were adamant they didn’t want to sell their livestock. Fast forward to 2020 when the drought broke and they were able to optimise feed utilisation when they needed it most.

It cost them a lot through the drought, but it would have been equally as challenging or more so to get into a rising market on the other end.

They kept the banks at bay, but importantly they always kept the banker informed.

Their informed decisions, backed by solid advice, planning and open communication with their bank, meant they reaped the reward of three very high rainfall years where they had an optimised stocking rate.

They now also have the skills, support and the information, thanks to understanding their KPIs, to make bold decisions as seasonal and market conditions continue to change.

Visit Agrista's event page to sign up for the following events

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...