FTA fuels UK sheepmeat market

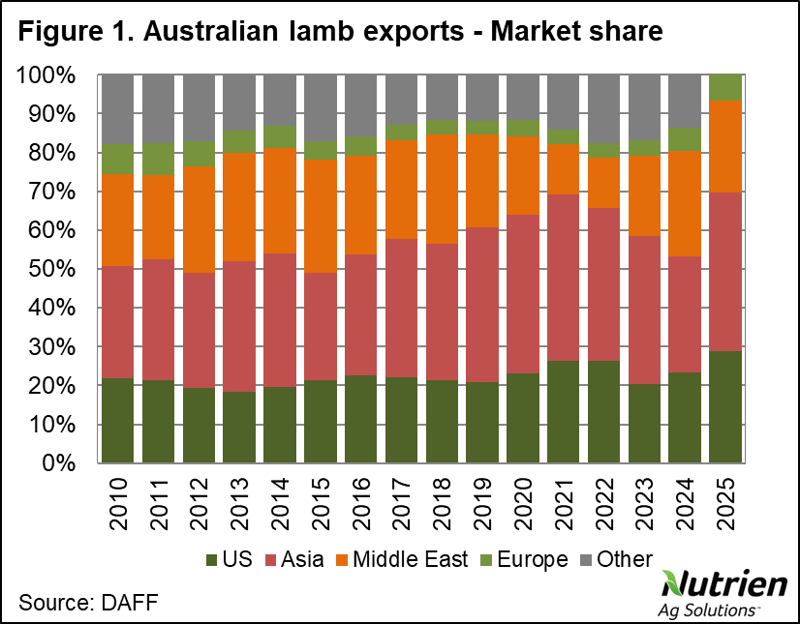

Australian sheep and lamb exports increased in September but remained subdued in relation to recent trends. The US took dominant market share for the...

Australian sheep and lamb exports increased in September but remained subdued in relation to recent trends. The US took dominant market share for the month, and in fact, most markets increased their intake of Australian sheepmeat year-on-year. China, however, took much less, sending monthly volumes 22% lower compared to 2024, as they remains the biggest market holder for sheep and lamb.

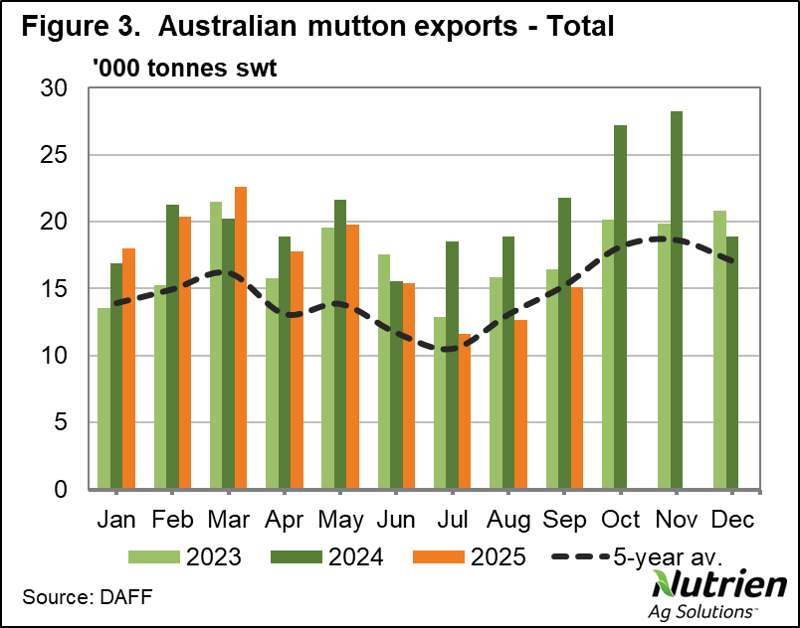

On a monthly basis, September lamb exports increased by 4% from August, while mutton was up 16%. Taking a wider look, however, both remained below the five-year average, and we have to go back to April 2023 to find a month with lower combined total export volumes. Year-on-year for September, mutton was back 31% and lamb 15%. Interestingly, of the top 10 market share countries for the month, only two declined year-on-year: China and South Korea.

The US took 9% more sheep and lamb in September than it did the same month last year, but its year-to-date total sits lower than in 2024, down by 6% after importing about 60,000 tonnes. China, on the other hand, reduced their total sheepmeat imports from Australia in September by nearly 50%, but their year-to-date tally is only 2% lower than the same time last year.

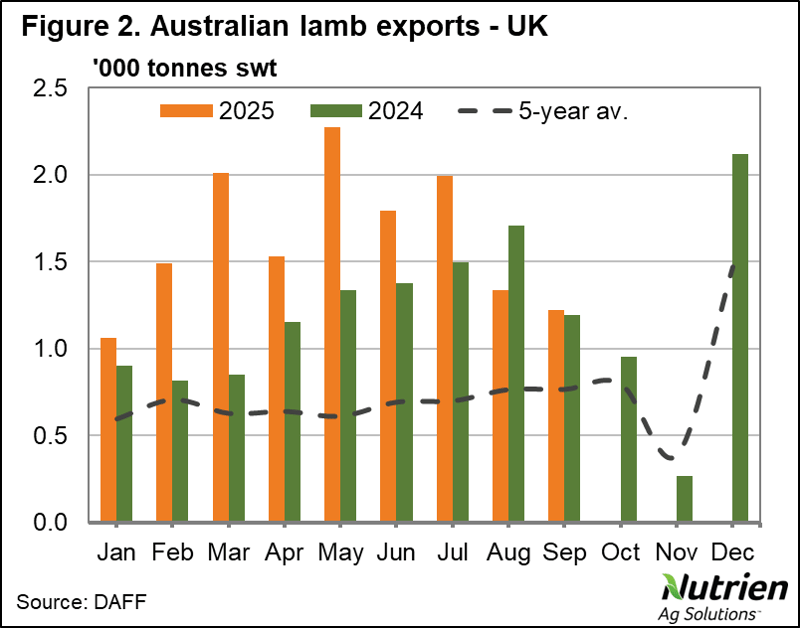

Breaking this down further, and despite lamb experiencing less increase overall, both the US and China increased their intake for the month considerably, 17% and 14% respectively. This brought China’s imports of Australian lamb 2% higher for the year-to-date compared to 2024. Dubai was the third largest market for lamb in September, also up 15% year-on-year, but still sits lower than last year for the January to September period. Also to note is the 37% increase year-on-year into the UK for the first nine months of 2025, making it the sixth largest market for lamb.

Meanwhile, in mutton, China continues to hold a significant majority market share, but they imported 72% less year-on-year in September, taking its year-to-date tally 18% lower. Malaysia, on the other hand, sits in second place in terms of Australian mutton imports for the year-to-date and increased its September volume by more than 80%. Mutton imports into the UK increased by more than 120% in September and are up more than 50% for the year-to-date compared to 2024.

Much of the decrease in sheepmeat exports can be attributed to Australia’s current domestic production, with both sheep and lamb slaughter trending well below year-ago levels for 2025 so far. When it comes to the US, having been across many non-coastal states myself in recent weeks, the lack of beef in the country remains a hot topic, but there is no lamb on any menus I’ve seen, which could indicate that further growth potential is limited regardless of the supply-demand equation in the US itself.

The UK is more interesting, having increased its intake of Australian sheepmeat by 47% year-on-year in 2024 on the back of the A-UKFTA, and sitting another 41% above that this year. Malaysia is another market showing strong growth, while demand is split in the MENA region, depending on economic status and could be further impacted if strong seasonal conditions allow for heavier lamb carcase weights.

Jamie-Lee Oldfield is a seasoned agri-media, communications professional and livestock market analyst who lives and works on a family-owned stud and commercial beef and sheep operation in Coolac, NSW.

Jamie-Lee Oldfield is a seasoned agri-media, communications professional and livestock market analyst who lives and works on a family-owned stud and commercial beef and sheep operation in Coolac, NSW.

Australian sheep and lamb exports increased in September but remained subdued in relation to recent trends. The US took dominant market share for the...

Tasmanian farmers are the most confident in the nation, while Western Australian primary producers are the most worried, according to a new survey....

.jpg)

Australia’s stud selling sector continues to show confidence and stability, with AuctionsPlus interfaced stud bull sales in Q3 2025 (July–September)...