Cattle prices lift on back of rainfall across south eastern Australia

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia’s cattle herd from my perspective isn’t in liquidation, rather it's making way for younger, more productive females to join the herd, encouraged by strong cow prices.

Looking forwards, continued growth in the herd, driven by the northern production systems could be expected if the 2024-25 wet season delivers.

An inverted market on the StoneX Cattle swaps from the market indicates supply is expected to pressure prices in Q1 2025.

As an industry, we need to apply a nuanced approach to the liquidation/rebuild discussion and on its own the Female Slaughter Rate (FSR) figure it isn’t enough to qualify which direction the herd is taking and at what pace.

Since 1976, the FSR or the quarterly number of females relative to the total, measured as a percentage has averaged 46.3%. The Australian beef industry considers the 47% figure to be the tipping point between liquidation and rebuild. On that basis, those suggesting the herd is liquidating would be correct.

However, I believe, Australia’s cattle herd isn’t liquidating and any reduction in the southern cattle herd’s numbers in 2024 will be amply offset by the growth in the northern herds, where most of Australia’s cattle are anyway.

This is a complex dynamic and understanding how production systems operate and applying that knowledge alongside the data, paints a different picture.

Herd size: Australia’s cattle herd is far bigger than it has been in at least a decade. In my mind, we may be moving towards a herd size not seen since the Australian Bureau of Statistics (ABS) released their new estimated numbers, which only goes back to 2005.

Higher fertility and lower mortality: The Australian cow herd is significantly more productive than it ever has been, fertility rates are higher, and mortalities lower, which means the herd grows faster and more productively (less deaths) than it has before.

2020-2023 rebuild: This period of rebuilding the herd was one of the most intense on record, at least since the 1990s, with a large retention of females and slaughter figures the lowest consecutively in 40 years.

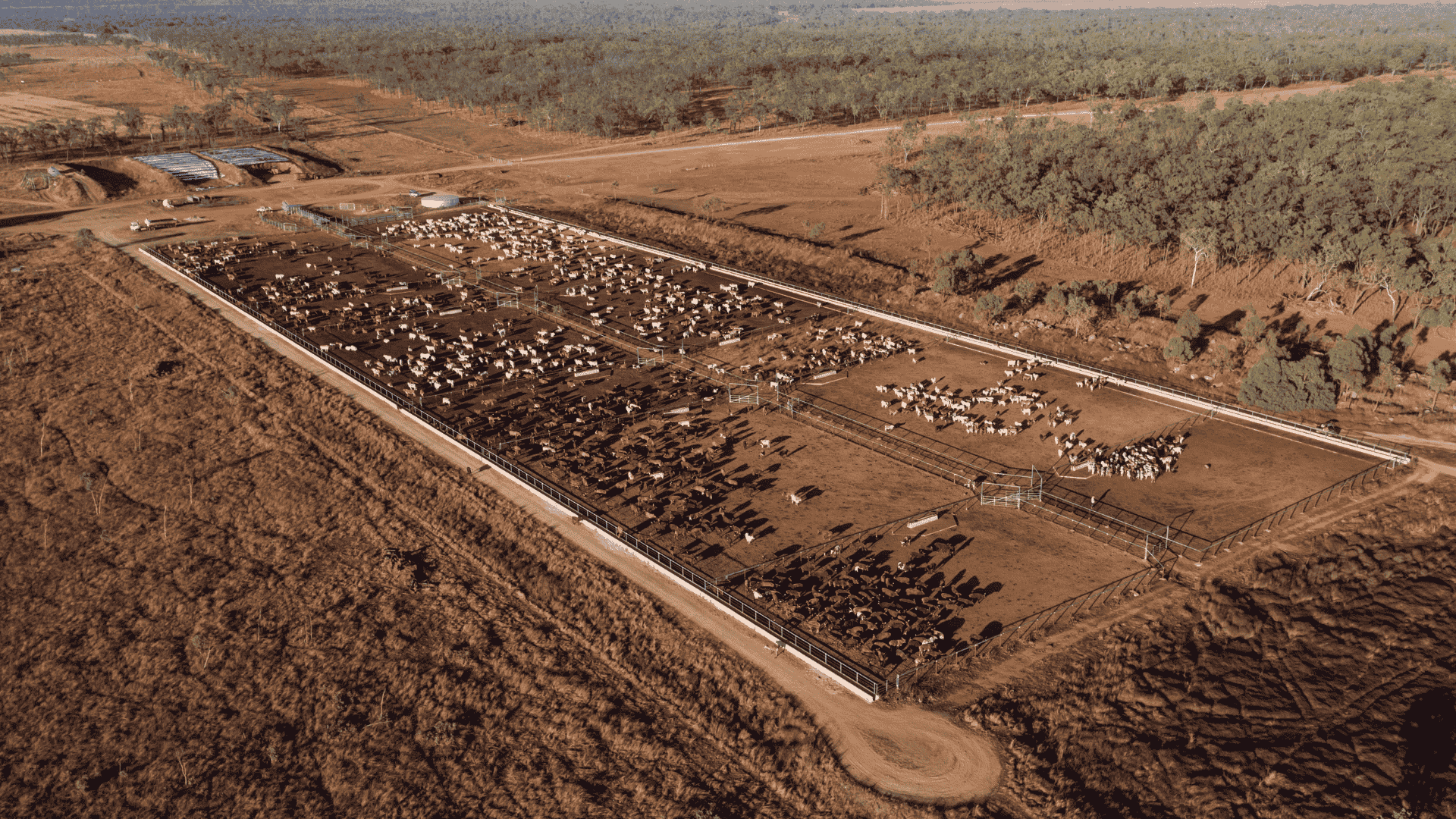

Land and management improvement: Operational management by producers is better than it has been - investment in genetics which is delivering improved fertility is an example of this. Increased carrying capacity by the opening up of land, particularly in northern Australia, through water and infrastructure improvements allows for larger numbers to be managed.

Grainfed production: As we gradually move towards a more grainfed production system and we are feeding cattle for longer, grainfed turnoff (the majority being steers) lessens male kill numbers on a quarterly basis, further inflating the female kill rate.

In Q3 2024, female kill numbers were at their highest levels since Q4 2019, during the depths of the widespread drought. The major cattle regions, north of Dubbo, aren’t “liquidating” their herds, they’re simply selling older cows into a strong cow market with solid prices to make way for younger, more productive heifers.

Heifer discounts to steers in 2024 can also be partly explained by this dynamic, with producers having ample supply on farm, there isn’t the demand for heifers in the marketplace.

The rebuild of the herd ended in the first half of 2023, putting the size of the herd, back to where it was prior to the 2017-2019 drought starting.

Looking forwards, dependent on the strength of the 2024-25 wet season (which I’m following closely) I expect the herd to grow further in 2025, with this growth realised in late 2025 into 2026 when these numbers reach maturity and are turned off, be that direct off grass or finishing their feeding programs.

Which means I see the total cattle herd, calves included, close to MLA’s Beef Producer Intentions Survey (BPIS) at or around 37 million head by the end of this year.

Continued trading interest and market activity is occurring across the first four months of January/February/March and April 2025 for the StoneX Cattle Swap. Bids (buyers) and offers (sellers) are actively engaging in the market and looking to both hedge their risk and also lock in margin on a portion of the cattle they’ll deal in across each month.

The market is pricing itself in inverse – meaning the forward markets are lower priced than the spot market, feedback from users and bids/offers, indicate that a further rise in supply is due early in the new year with cattle held back following recent rain and a drier start to pressure price.

Out to May 2025, the market is pricing itself lower, with higher supplies of cattle expected to pressure price. Although this cattle supply delivery will hinge on the wet season timing which will in turn adjust the swaps pricing.

The StoneX cattle swap is a tool that can be used for any cattle type in any market and for producers of any size. Which can be used as a risk management tool to deal with continued volatility in cattle markets which presents risk.

Table 1. StoneX Cattle Swap forward prices - dated 03.12.2024.

|

Month |

Bid |

Offer |

MMM |

Spread |

|

Dec-24 |

3.60 |

3.65 |

3.63 |

0.05 |

|

Jan-25 |

3.65 |

3.70 |

3.68 |

0.05 |

|

Feb-25 |

3.60 |

3.65 |

3.63 |

0.05 |

|

Mar-25 |

3.55 |

3.65 |

3.60 |

0.10 |

|

Apr-25 |

3.50 |

3.65 |

3.58 |

0.15 |

|

May-25 |

3.40 |

3.60 |

3.50 |

0.20 |

|

Jun-25 |

3.40 |

3.65 |

3.53 |

0.25 |

|

Jul-25 |

3.45 |

3.70 |

3.58 |

0.25 |

|

Aug-25 |

3.45 |

3.75 |

3.60 |

0.30 |

|

Sep-25 |

3.5 |

3.75 |

3.63 |

0.25 |

|

Oct-25 |

3.5 |

3.75 |

3.63 |

0.25 |

|

Nov-25 |

3.5 |

3.75 |

3.63 |

0.25 |

Ripley Atkinson's experience in the red meat industry and current role at StoneX developing price risk management tools for Australia’s sheep and cattle sectors ensures he delivers unique, whole of supply chain insights and analysis across key factors such as prices, supply, production and the drivers of the sheep and cattle cycles.

StoneX Disclaimer The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries. Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...

The Australian Bureau of Statistics (ABS) released it’s quarterly ‘Livestock Products’ data and statistics on Friday. There is plenty of data to dig...