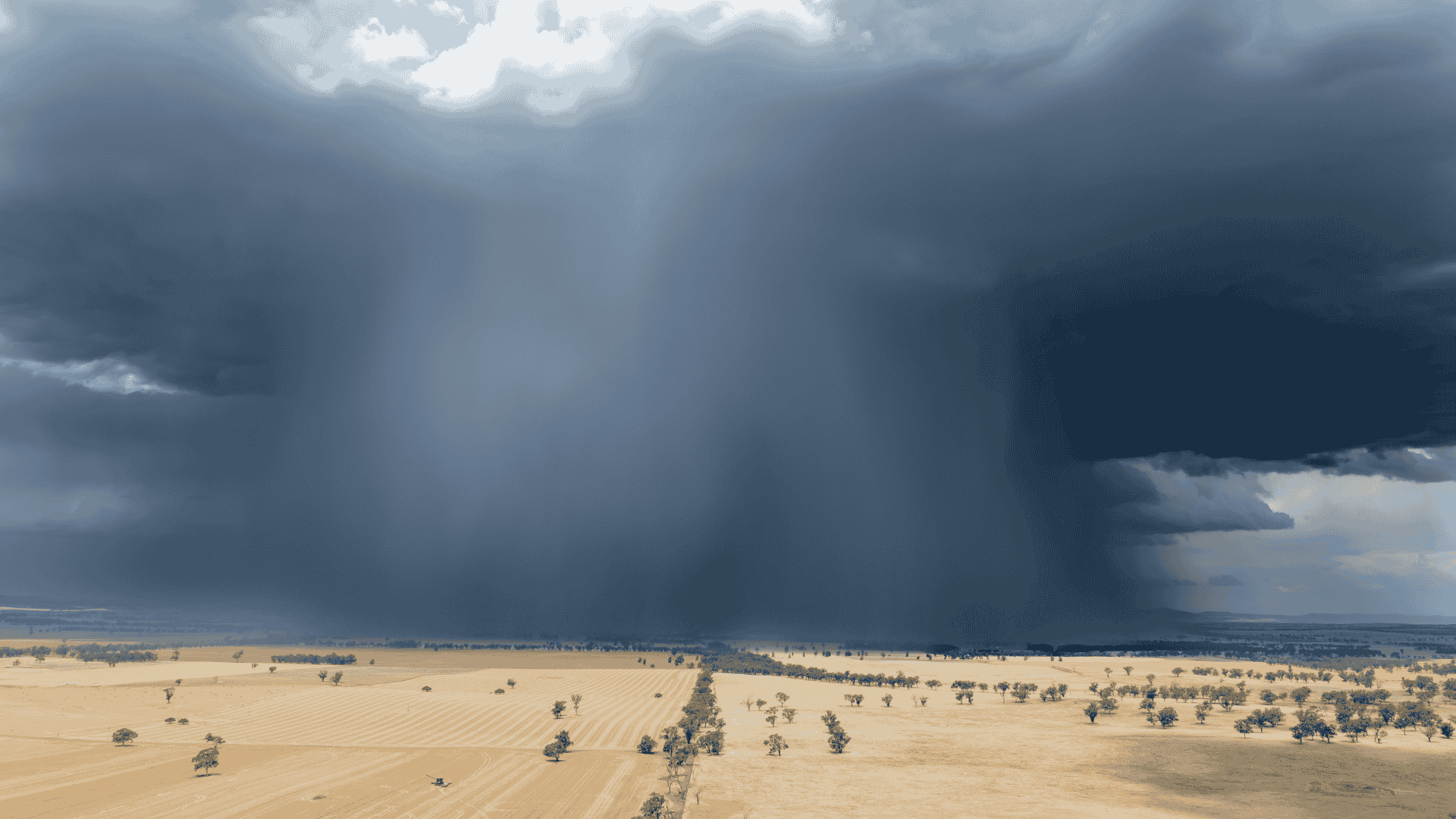

A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

2 min read

Angus Brown : Oct 10, 2024

Whenever saleyard prices fall heavily, there is always some consternation regarding the lack of a mirroring fall on retail shelves. Retail prices tend to be stickier than those in the saleyard, but over the long-term retail beef price movements do reflect cattle values, albeit with much less volatility.

With about 72% of Australian beef now destined for export markets, domestic market demand now has little impact on the price of cattle in saleyards.

The domestic market is still the largest single destination for our beef, but what retailers pay for beef or cattle is largely dictated by what the export market is willing to pay.

The cost-of-living crisis is making headlines, but at least in the red meat space, prices have eased over the last year.

Figure 1 shows the beef index reported in the quarterly Australian Bureau of Statistics (ABS) data has been on the decline since the March 23 quarter. The latest figures, from June, show a levelling out of beef prices at the retail level.

Beef competes on supermarket shelves with substitutes, chicken, pork and lamb. We can see in Figure 1 the retail price of lamb crashed in the December and March quarters, while chicken and pork, have been steady or rising. Chicken retail prices spent many years hardly moving, but energy, labour and feed costs have finally outstripped production gains and forced prices higher.

Figure 2 shows the annual change in the Beef price index, along with the National Heavy Steer Indicator. The fall in retail beef prices has been in the order of 5%, which is minor compared to cattle price falls in the second half of 2023, which was down 48% in the year to December.

However, we can see that in 2015 we saw massive increases in cattle prices, which were not matched by retail prices. This was repeated in 2021-2022 albeit to a lesser extent.

Contrary to popular belief, retail beef prices do respond to lower cattle prices on the downside, but it takes some time, and retailers are understandably keen to see lower livestock prices maintained before moving shelf prices lower. The 12-month timeframe shows this better than quarterly or monthly data.

Looking forward, the slower decline in retail values leaves some room for cattle prices to rise before consumers start seeing impacts on supermarket and butcher shelves. This is good for beef demand, but as explained at the start, we should be more worried about what the export market is doing, as it is a much stronger driver of local cattle prices.

Angus Brown brings over 20 years of expertise analysing Australian agricultural markets, and also runs a mixed farming operation in Hamilton, Victoria.

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...