Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

2 min read

Damien Thomson

:

Jul 27, 2023

Damien Thomson

:

Jul 27, 2023

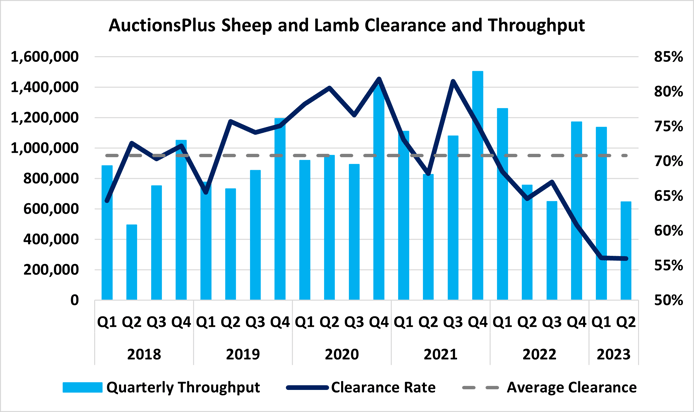

Throughput of commercial sheep and lambs on AuctionsPlus has slowed due to lower prices on offer and favourable pasture conditions allowing the retention of stock on farm. Meanwhile, clearance rates have stabilised as vendors and buyers come to grips with the uncertainty of market movements.

AuctionsPlus sheep and lamb listings for the second quarter of 2023 (1 April – 30 June) reached a total of 645,863 head – down 43% from the previous quarter and 15% lower than last year.

Key Points

NSW Central West takes out top AuctionsPlus listing region with 130,131 head in Q2 2023

Clearance rates have stabilised as vendors adjust expectations to price trends

NSW Riverina secures top purchasing region on the back of favourable seasonal conditions.

Joined ewe listings accounted for 44% of the offering across the quarter, while lambs made up 43% and not station mated ewes contributed 9%.

Lamb prices continued to slide over the second quarter of 2023, with crossbred lambs falling from $106 to $85/head by the end of June. SIL first-cross ewes fluctuated up and down, but ended up where they started at $174/head.

Clearance rates stabilised from Q1, averaging 56% in Q2. However, this is well below 65% in Q2 2022 and 68% in Q2 2021.

Clearance rates have averaged 71% over the past five years, with the average of 56% in Q2 2023 representing a subdued restocking market.

Throughput of sheep and lambs follows a very strong seasonality, with Q2 consistently the lowest as it falls between the usual sell-off of excess females in autumn and the spring lamb flush.

Listings are expected to increase as longer days bring us closer to the start of the spring flush. Watch this space for just when and how those lambs will come online.

Figure 1: AuctionsPlus quarterly sheep and lamb clearance rates and throughput, 2018 – Q2 2023.

Figure 1: AuctionsPlus quarterly sheep and lamb clearance rates and throughput, 2018 – Q2 2023.

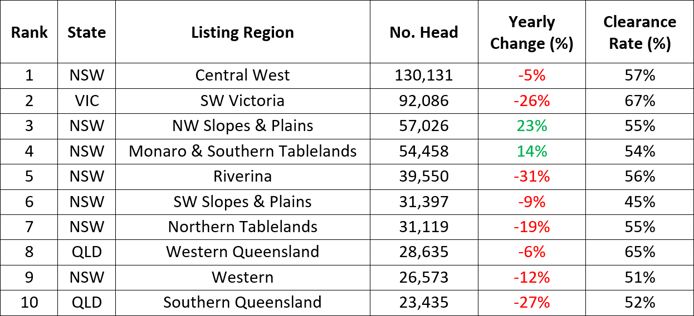

Central West NSW has taken the reins from SW Victoria for the highest sheep and lamb listings region in the second quarter of 2023.

A total of 130,131 head were offered for the quarter, just 5% lower than last year. SW Victoria slipped back to second place with a respectable 92,086 head – down 26%.

The NW Slopes & Plains came in at third with 57,026 head – 23% higher than last year and the highest year-on-year rise in the top 10 listing regions.

Table 1: AuctionsPlus sheep and lamb top 10 listing regions Q2 2023.

Table 1: AuctionsPlus sheep and lamb top 10 listing regions Q2 2023.

On the purchasing side of the market, the Central West and the NSW Riverina swapped places, with the Riverina coming out on top at 68,295 head.

The Central West purchased 52,302 head, while SW Victoria secured a podium finish with 41,557 head. The largest rise in purchases was experienced in lower south-east SA with 15,509 head – up 12% on last year.

Table 2: AuctionsPlus sheep and lamb top 10 purchasing regions Q2 2023.

Table 2: AuctionsPlus sheep and lamb top 10 purchasing regions Q2 2023.

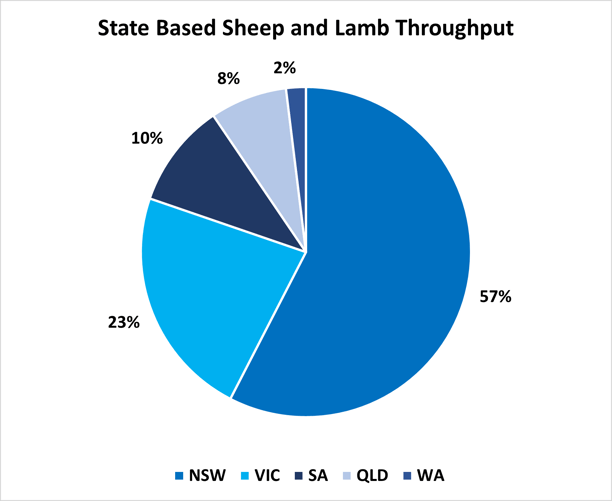

NSW dominated state-based listings in the second quarter of 2023 with 57% of national listings. This is up from 53% in the corresponding quarter last year.

Victoria contributed 23% of listings, while SA accounted for 10% and Queensland made up 8%. Victoria was back slightly year-on-year, while SA and Queensland were steady.

Figure 2: AuctionsPlus sheep and lamb state-based listings Q2 2023.

Figure 2: AuctionsPlus sheep and lamb state-based listings Q2 2023.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...