Consecutive years of record high bull prices are on the line as sale results return to more normal levels in line with commercial cattle prices. One area to watch will be demand for heifer bulls.

Key Points:

Bull prices are expected to ease on the back of lower commercial cattle prices

Strong demand for heifer bulls is likely to remain

Favourable seasonal conditions are expected to support high supply of bulls

Commercial cattle prices and bull prices move together due to their close relationship in a beef production system, albeit, with a slight lag due to changing herd numbers.

For example, the EYCI averaged 51% higher in 2020 compared to 2019 due to drought-breaking rain and intense restocking demand (Table 1). However, bull prices increased by only 24% in comparison as breeding female numbers were still historically low. As the herd rebuild gained momentum in 2021, so did average bull prices, increasing 42% from 2020 to 2021.

If we look at the current market — January to May 2023 — the EYCI has averaged 33% less than the 2022 average. AuctionsPlus bull prices for the same period, however, are only 9% lower than last year’s average. This is due to the historically high breeding female numbers associated with the forecast of 28.7 million head in 2023, the highest herd population since 2014.

Table 1: year-on-year EYCI and average AuctionsPlus bull prices comparison (All breeds)

| Year |

EYCI average (c/kg cwt) |

EYCI % change |

Bull price average ($/head) |

Bull price % change |

| 2018 |

510 |

-15% |

$6,558 |

-18% |

| 2019 |

487 |

-5% |

$5,841 |

-11% |

| 2020 |

736 |

51% |

$7,216 |

24% |

| 2021 |

966 |

31% |

$10,271 |

42% |

| 2022 |

1,046 |

8% |

$11,736 |

14% |

| 2023* |

701* |

-33* |

$10,674* |

-9%* |

*Year to date: Jan – May 2023

Demand for heifer bulls

Demand for heifer bulls grew during the intense herd rebuild in 2020, 2021 and the first half of 2022.

While it can be subjective, depending on the breeder, one of the main factors behind the classification of heifer bulls is their birth weight Estimate Breeding Value (EBV).

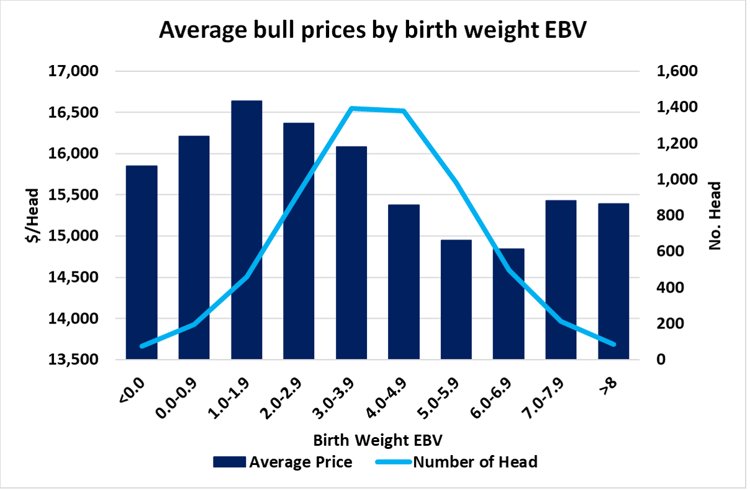

Analysis of average Angus bull prices in Spring 2022 at varying birth weight EBVs shows a 7% premium for bulls with a birth weight EBV below breed average (+4.1);

3,188 bulls with a birth weight EBV under +4.1 averaged $16,190 per head

2,864 bulls with above average birth weight EBV averaged $15,120 per head

Interestingly, prices rebound for bulls with an EBV higher than +7, averaging $15,418 per head across 297 bulls. That suggests there may be a separate market segment for these bulls.

Figure 1: AuctionsPlus average Angus bull prices by birth weight EBV, Spring 2022

Figure 1: AuctionsPlus average Angus bull prices by birth weight EBV, Spring 2022

Heifer bull demand to moderate

The herd rebuild has now matured, leading to lower restocking of heifers. However, low prices and broadly high pasture availability mean that retention of homebred heifers is very high, with producers choosing to offload their older and heavier cows first. As a result, demand for heifer bulls is expected to ease slightly but remain relatively strong.

Supply to remain high

With consecutive years of favourable pasture availability supporting growth rates and more bulls reaching target weights for sale day, the supply of bulls is expected to be high this year.

Is it possible we will see another record year of sales? Last year was a bumper one with the record number of bulls sold in a single sale on AuctionsPlus jointly held by Booroomooka Angus, NSW and Landfall Angus, Tasmania who both sold 241 bulls in Spring 2022.

It looks like buyers will be spoiled for choice in 2023.

As always, if you have any questions or suggestions, feel free to email me at dthomson@auctionsplus.com.au

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Subscribe to our weekly newsletter and monthly cattle, sheep, and machinery round-ups.