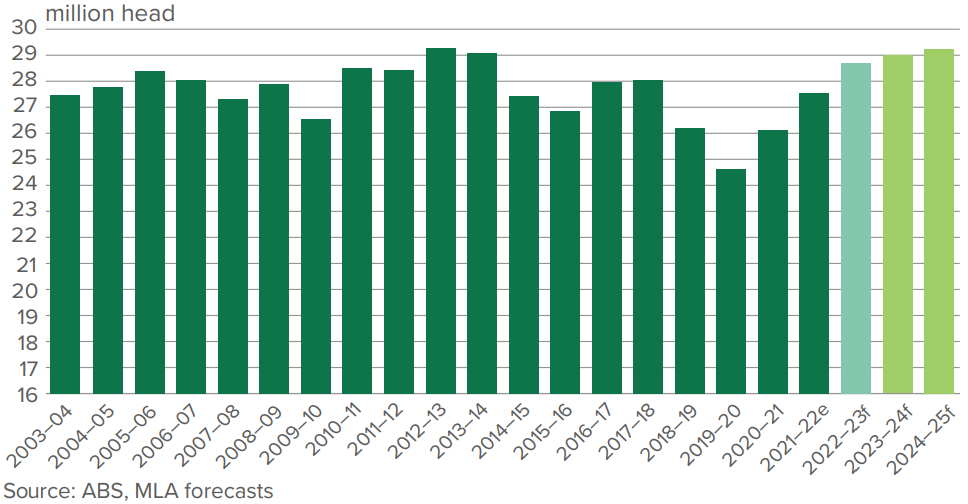

The national cattle herd is on track to reach its highest level since 2014 at 28.7 million head, with agents and analysts expecting an influx of both young cattle and finished-weight animals to market next year.

The national cattle herd is on track to reach its highest level since 2014 at 28.7 million head, with agents and analysts expecting an influx of both young cattle and finished-weight animals to market next year.

The latest cattle industry projections from Meat & Livestock Australia are a slight revision down from what was released back in January however, with an increase in slaughter numbers accounting for the 117,000-head reduction to the 2023 herd size.

The northern production system will play a large role in this continued growth, on the back of several good seasons allowing breeder herds to be rebuilt over the past 12 to 18 months.

Charters Towers agent Liam Kirkwood, Ray White Geaney - Kirkwood, said in addition to high reproduction and marking rates, there had been a strong focus on increasing herd quality.

“Coming off the back of good markets and good seasons, people had more money in the bank to be able to go out and improve the fertility of their herds - buy better bulls and cull more heavily in their cows, keep heifers, etcetera - so I think everyone over the past 12 or 18 months in the north has definitely tried to better their herd,” Mr Kirkwood said.

“Productivity is the key, especially at times like this when we’ve got a softening market; if your herd is as productive as it possibly can be, you’re far better off than someone who may not have as good a fertility rate or calving percentage in their herd.”

While the herd rebuild in the north has been forecast to ‘gain significant pace’ over the remainder of this year, Mr Kirkwood said many restockers had likely hit their limit for now.

“We’ve come out of what was a good wet season and we’re coming into some drier weather now, and obviously with the change in cattle prices, I’d say people will pull up now and see where it all settles," he said.

“The thing that will dictate it will be the season."

Mr Kirkwood also noted the big turnaround in the destination of cattle.

"We are seeing there’s very little southern interest in our markets now, whereas you go back 12 months ago and probably 60 per cent of the cattle were going into the southern states," he said.

"We’re hoping a lot of western Queensland graziers have still got good feed, so hopefully once they make a trade of cattle in the new financial year, we’re confident that we'll see a little bit more regenerated restocker interest."

Above: National cattle herd figures.

Southern herd above long-term averages

The herd in southern Australia is significantly larger than it has been in the past 10 years, with above-average stocking rates across most southern states, particularly New South Wales.

MLA expects the solid supply of cattle to market from NSW will continue this year, and Victorian producers will deliver large numbers of weaners to the annual sales in the first months of 2024.

Echoing the sentiment from the north with regard to the impact of a run of good seasons and improved fertility, Wodonga agent Kevin Corcoran, Corcoran Parker, said there had been a significant increase in breeding numbers in the south.

"Wodonga was extremely wet last winter and there was a pretty big body of feed through the spring and early summer, so obviously people kept those few extra livestock, for better or worse," Mr Corcoran said.

"In our immediate area, I wouldn’t call it restocking; it’s probably more just freshening the herd up - joining more heifers and putting more younger heifers into the bottom end of the herd.

"Particularly last year, there was a big input to keep heifers for that reason of the season being better, so instead of joining 25 heifers for every 100 cows, people joined 35% to 40%."

Couple this increased joining with 'fertility rates in the mid to high 90s', and it makes for a lot of weaners on the market.

"I would have thought that all our weaner sales have been probably 105% on the previous few years, although that's probably more in respect to the steer section," Mr Corcoran said.

"The heifers last year, probably lesser overall numbers were presented because the heifer portion were either joined on farm or bought by NSW restockers.

"The flow of particularly Angus heifer weaners out of Victoria into central and northern NSW was figures in the tens and tens of thousands of them."

As for what's about to hit the market, Mr Corcoran agreed there would be a huge supply of cattle under 12-months-old.

"They're getting bred every day and we’ve got another wave of spring-calving herds about ready to calve any time soon, from July onwards."

Beef production on the rise

Beef production is also forecast to increase strongly this year, as a result of improvements in processing capacity to date in 2023, higher slaughter volumes and historically-elevated carcase weights.

Slaughter for 2023 is forecast to reach 6.95 million head, a revision upwards of 5% or 325,000 head on MLA’s January figures.

Driving the higher volume this year will be:

-

Strong numbers of grass-fed steer turn-off from key production regions of Queensland, including the Channel Country.

-

Significantly higher numbers of cast-for-age cows, as numbers of breeding females on-farm allow the turn-off of older stock.

MLA senior market information analyst Ripley Atkinson said processors were continuing to manage higher supplies of slaughter-weight stock and the trend was expected to continue for the remainder of the year.

"So far in 2023, the cattle market has operated as it typically does throughout the first six months of the year,” Mr Atkinson said.

“It’s not uncommon for higher turn-off of stock leading into winter to place downward pressure on price.

“However, the previous three years have been the exception, due to the rebuild following years of drought and the impacts of COVID.

“In considering these major events, it is important to acknowledge these years were outliers when it comes to examining trends in cattle prices.”

Market expectations

As part of the report, MLA also collates price forecast information from industry analysts.

These analysts’ forecasts to the end of the year indicate a stabilisation in prices relative to the volatile market of 2022, although with forecasted levels to be below longer-term averages for both the EYCI and the Feeder steer.

Based on current rates, analyst forecasts to December 31 are for the EYCI to be 546c, a 10c/kg carcase weight (cwt) or 2% decline. If this forecast eventuates, the price would be 13.5%, or 85c, lower than the 10-year average.

The remainder of 2023 is expected to see continued improvements in both supply of cattle and beef to market, as slaughter rates increase.

“This places Australia in an enviable position to take advantage of shifts in the global marketplace, including greater market access for Australian beef, supply adjustments to key competitors and a continued strong domestic market,” Mr Atkinson said.

Results

Results-3.png)