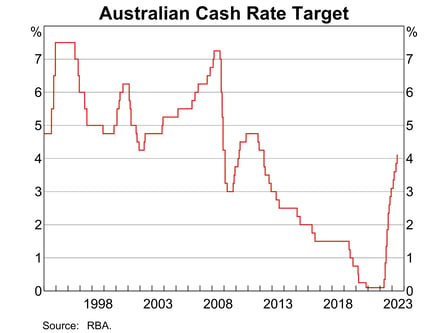

The decision by the Reserve Bank to hold interest rates steady this month would have been a relief to many, but producers are under no illusions that we've seen the peak.

The decision by the Reserve Bank to hold interest rates steady this month would have been a relief to many, but producers are under no illusions that we've seen the peak.

Instead, they're bracing for further pain, as economists continue to forecast more RBA rate hikes, tumbling inflation, and a high chance of recession.

On Tuesday, the RBA board decided to leave the cash rate target unchanged at 4.1% and the interest rate paid on exchange settlement balances unchanged at 4%.

RBA governor Philip Lowe said holding interest rates steady for now will provide some time to assess the impact of the increase in interest rates to date and the economic outlook.

"Inflation in Australia has passed its peak and the monthly CPI (consumer price index) indicator for May showed a further decline, but inflation is still too high and will remain so for some time yet," Dr Lowe said.

"High inflation makes life difficult for everyone and damages the functioning of the economy. It erodes the value of savings, hurts household budgets, makes it harder for businesses to plan and invest, and worsens income inequality.

"If high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment."

Couple the increasing interest rates with decreasing commodity prices, and producers are understandably worried about debt.

Ben Law, a former rural financial advisor and host of The Financial Bloke podcast, said the rapid pace of rate rises is starting to put pressure on businesses.

"This is the most debt we've seen the rural industry carry for a long period of time," Mr Law said.

"Even though property prices have increased, people are carrying more debt than ever before and because of that, people are far more sensitive to interest rate rises.

"As someone commented recently, it used to take two decks of cattle to pay the interest bill for the month, now it's taking five."

Two more interest rate hikes this year

A panel of 27 leading economists assembled by The Conversation to forecast the new financial year expects two more interest rate hikes this year.

They predict a cash rate of 4.5% by the end of this year, followed by a decline to 4.3% by the middle of next year, and to 3.9% by the end of 2024.

Asked to specify the month in which the cash rate will peak, and how high it will go, the panel settled on a peak of 4.7% in November.

A looming recession

The panel is forecasting Australian economic growth of just 1.2% in 2023 – the lowest rate outside a recession in more than 30 years - climbing to just 1.5% in the year to June 2024 and 2.3% in the year to June 2025.

AMP chief economist Shane Oliver said if the low growth rate turns into what is usually called a recession (two consecutive quarters of shrinking gross domestic product), it will be because the Reserve Bank pushes up interest rates too far for highly-indebted Australians to withstand.

He said consumer spending is almost certain to shrink as debt servicing costs hit a record high.

This reduction in consumer spending and the recession 'we need' to have were oncoming headwinds flagged by finance guru Mark Bouris at the Lambro Future Directions Field Day at Holbrook last month.

Mr Bouris said the current inflation problem was created by the government pumping too much money into the system for too long, and controlling it would require a recession.

"The Reserve Bank believes it and I think, therefore, the Reserve Bank will put rates up in order to achieve that," he said.

"And I think the Reserve Bank governor doesn't care because he won't be there in September when the recession hits.

"He's not going to leave that role with inflation raging; he's not going to leave that as a legacy because no economist, which he is, wants to be the person responsible for leaving an enduring inflation number in an economy that he is supposed to be managing, and there's just no way they're going to renew him."

Looking for the signs to reinvest

Amid the oncoming pain of further rate hikes, and 'a period of maintenance' that will follow, Mr Bouris said producers need to 'hang in there, save where you can and get ready to look for the signs to reinvest'.

He said there will come a point when producers will need to get ready to expand and start investing in their businesses again to 'get ready for what might not be a boom, but a return to normalisation' when you will need to 'supply a better level of demand for whatever your product might be'.

Getting to that point will require a strong understanding of cashflow, Mr Law said.

"The most sophisticated producers are consistently redoing their budgets, factoring in higher rates and lower commodity prices," he said.

"People are starting to focus on their banks and what they are offering. Could they be moving banks, getting a better deal elsewhere?

"If you are nervous, the absolute most important thing is keeping your bank informed. Even if things are not looking good, a bank will operate with you far better if they know your position."

Beyond that, Mr Law said it's important to keep in mind this has happened before and people have survived it.

"It's about having that right mindset and not sticking your head in the sand."

Results

Results-3.png)