Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

2 min read

Natasha Lobban

:

Apr 4, 2024

Natasha Lobban

:

Apr 4, 2024

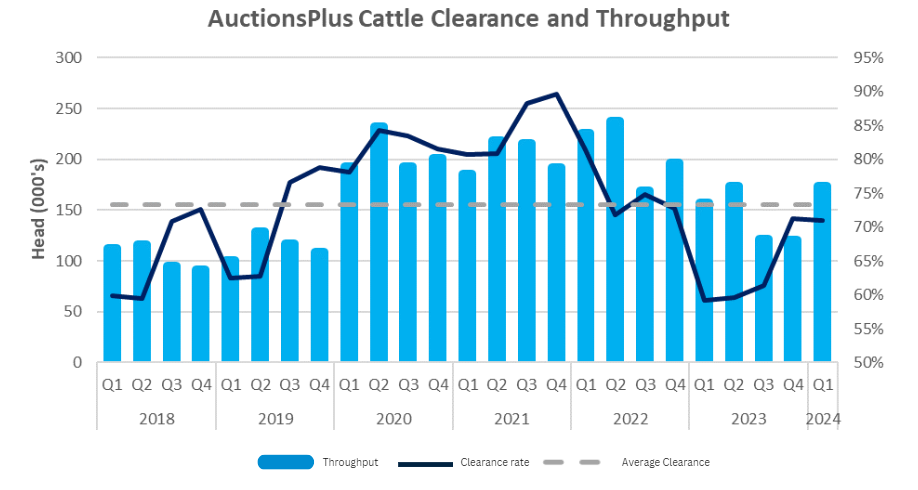

With the first quarter of commercial cattle sales finished for the year, the results of AuctionsPlus’ commercial cattle offerings have been tallied. We look at how regions have been buying and selling during the first quarter of 2024.

Q1 throughput jumped 44%, with Queensland vendors increasing their listings the most

Clearance rates slipped 3% in Q1

Q1 buying activity lifted significantly in Central West NSW and Western Queensland

Q1 listing activity increased significantly in all locations apart from Central West NSW

Cattle producer confidence was buoyed in Q1 as prices began to lift in response to forecast El Nino conditions fizzling out across much of Eastern Australia.

Throughput jumped as producers sought to collect in what has been a volatile market. Livestock held back due to low prices in Q4 2023 also hit the market.

Central Western NSW was the region to watch, It was not only bumped from the top of the leaderboard for listings this quarter, but dropped a massive four ranks. On the flipside, buyers from the same region increased activity by 121% with opportunity buying to take advantage of green feed.

AuctionsPlus Network Partner for Central and Southern NSW, Hugh Courts, said producers in the Central West had offloaded cattle in the second half of 2023 in response to dry conditions, but they had been full steam ahead since the dry broke around Christmas.

“Feed availability increased and they have managed to sow some early grazing canola and now plenty of winter cereals are in the ground with current conditions creating a great outlook," Mr Courts said.

“They are confident in buying cattle, and in that region there has been plenty of competition so it’s unsurprising that there has been an increase in buyers turning to AuctionsPlus and shopping around for lots out of the region to find the cattle they are after.

“Everyone is seeing the opportunity there. There’s plenty of opportunity to put weight into cattle or if buying PTICs (Preg Tested In Calf) and CCs (Cow and Calf) they will be able to sell off a second unit or grow them out after a good winter.”

Commercial cattle offerings during Q1 totaled 173,967 head, with a 53,367 head increase from the previous quarter. Throughput was also 11% greater than Q1 in 2023.

With the sharp increase in listings, the total throughout increased by 44% from the previous quarter. However, the clearance rate did not experience the same trajectory, with a 3% decrease from the Q4 2023.

The top-10 listing regions for Q1 are outlined in the table below. As expected, NSW and Queensland dominated commercial cattle listings. However, the big mover was Central Western NSW, which dropped four spots from the top to number 5 in the rankings.

Southern Queensland and Metro Queensland continued to be the dominant buyer, increasing its share of the market by 49% to account for 35% of all purchases. Central Western NSW buyers increased their activity by 121% in Q1, to rise to second place on the table. However, they are a distant second with just 13% of the market share.

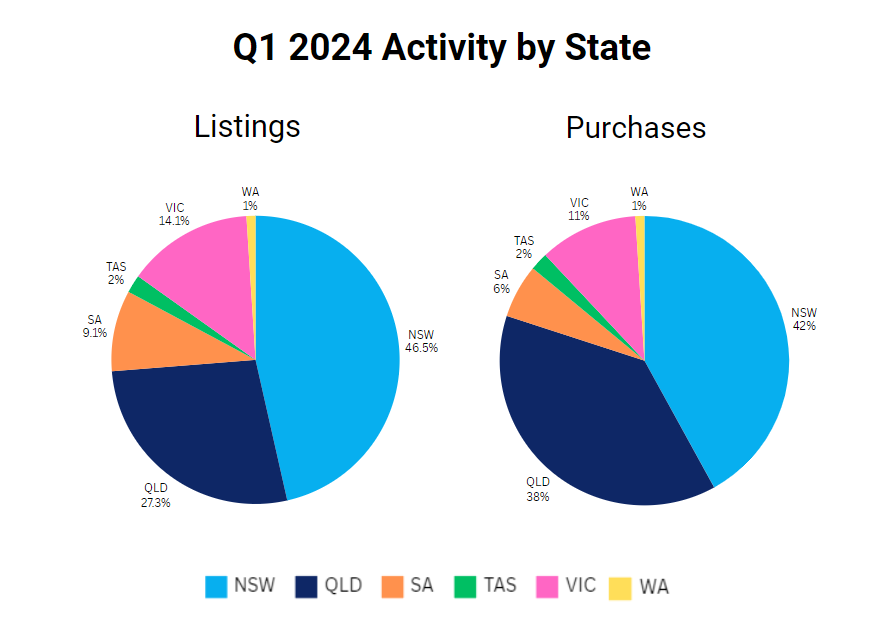

The figure below illustrates the share of listings and purchases by state in Q1 2024. NSW kept the lion's share of listings and purchases. Queensland purchased more than it listed, whereas Victoria and South Australia listed more than they purchased. Western Australia and Tasmanian activity had no nett impact, with both selling and buying the same percentage of livestock.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...