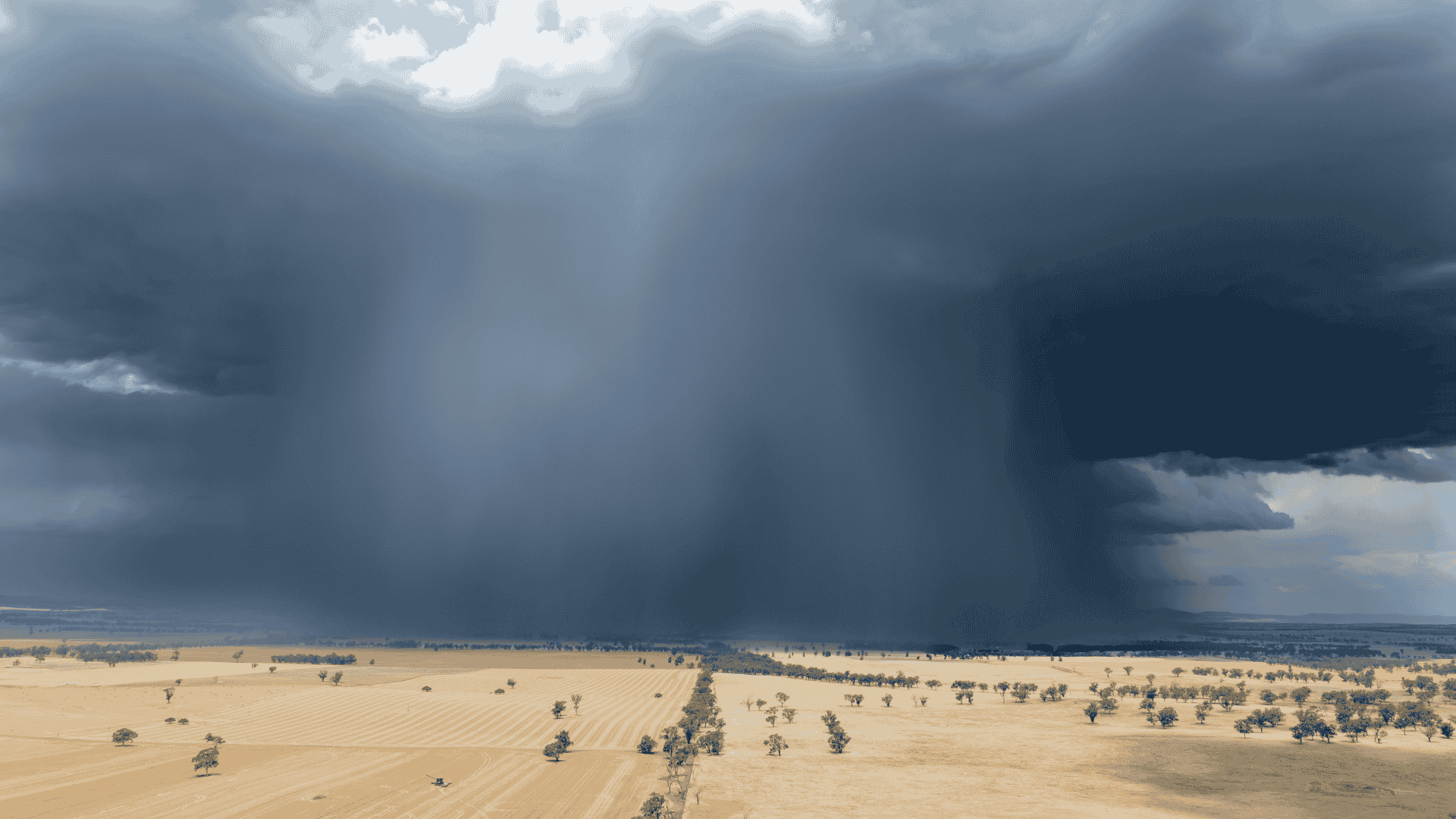

A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

In the latest AgWatchers+ podcast, industry experts Matt Dalgleish and Andrew Whitelaw discuss what's been happening in cattle, grains and sheep over the past fortnight for APlus News.

Australia’s grain sector continues to exceed expectations, according to insights from Mr Whitelaw and Mr Dalgleish.

"It looks like those frost events weren’t quite as bad as expected. So we’re actually talking about a reasonably large crop around the country, and it has exceeded expectations, especially in Western Australia," said Mr Whitelaw.

Advancements in technology have also played a significant role in boosting yields, with this year shaping up to be exceptional. "This year is going to be a well-above-average crop," he added.

However, the sector is navigating a softer pricing environment. "It’s definitely a lower-priced environment than we’ve experienced in the last couple of years," Mr Whitelaw said.

Meanwhile, the barley trade has made headlines, particularly with China’s return as a dominant buyer. "75% of all of our barley that’s left these shores has gone to China in the past 12 months," said Mr Whitelaw.

This figure represents the second-highest level of barley exports to China, with the record being 77%. While diversification in trade remains a priority, these numbers highlight China’s critical role in the barley market. "Diversification is good, but at the end of the day, it's the dollars and cents that make a difference in the trade," Mr Whitelaw explained.

On the livestock front, cattle supply dynamics have shifted notably. "A little while back, we were reporting that we had good numbers coming forward to cattle out of Queensland and not as many in the south. But in the last probably month, it’s been a bit of a turnaround," Mr Dalgleish said.

Rainfall and reduced suppliers in Queensland have led processors to look south.

"There have been reports of cattle making the trips up to Central Queensland abattoirs, even as far south as kind of Cowra, NSW."

Key pricing trends include:

Heavy steers: Queensland prices rose five cents to 320c/kg, while Victorian prices dropped by 20 cents to 315c/kg.

National Young Cattle Indicator: Increased seven cents to 340c/kg, with the AuctionsPlus online indicator even higher at 360c/kg.

The ongoing liquidation phase in Australia’s cattle herd continues, though at a slightly reduced pace. "The female slaughter ratio has backed off a little bit ... but we’re still in liquidation territory," Mr Dalgleish said.

The spring flush for lambs arrived later than usual but has gained momentum. "A month ago, we were running about 20% behind in terms of sale yard throughput for lamb. Now we’re probably about 15% above the average trend," Mr Dalgleish said.

Prices have stabilised, with heavy lambs maintaining a premium. "Heavy lambs are around 860 cents, trade lambs at 815, and light lambs at 720 cents."

Looking west, the sheep flock in Western Australia continues to decline due to high liquidation rates. "By this time next year, I wouldn’t be surprised if we’re down to eight [million head]," Mr Dalgleish said, emphasising potential challenges for future East Coast restocking.

Listen below or on your favourite podcast platform

AgWatchers+ provides a fortnightly update on the drivers of the main agricultural markets in Australia. AuctionsPlus powers the podcast, which is written and recorded by independent industry analysts Matt Dalgleish and Andrew Whitelaw from AgWatchers.

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...