Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

1 min read

Erin Lukey, MLA Senior Market Information Analyst : Jun 23, 2025

Prices fluctuated due to inconsistent supply, climate variability and shifting processor strategies.

Ongoing unpredictability and supply gaps.

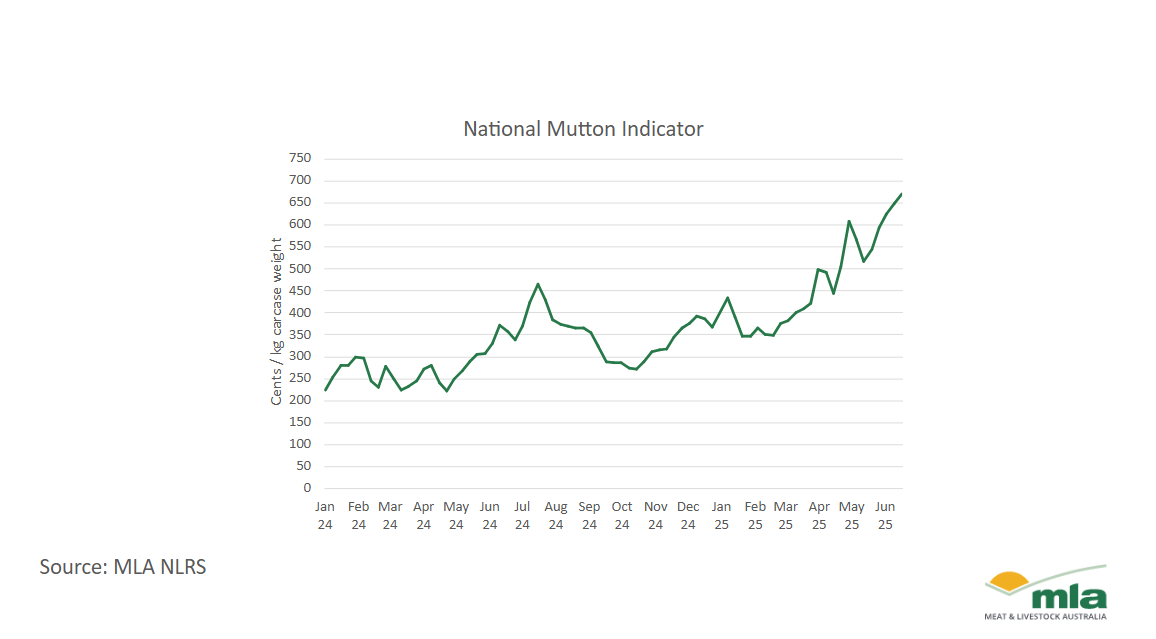

The National Mutton Indicator price surge continued, increasing 7¢ to 674¢/kg carcase weight (cwt), nearing the 731¢/kg cwt record. Higher seasonal supply has strengthened saleyard competition for finished animals, increasing prices. Lamb and mutton supply uncertainty has caused significant fluctuations. Recent positive climate conditions across southern Australia regions may have buoyed market confidence, encouraging retention for weight.

The mutton market has experienced large swings with processors using the category to manage margins. Lamb started the year strong, motivating processors to capitalise on affordable mutton. The first quarter of the year saw sheep slaughter over 3 million head (7% above 2024 Q1 figures). The strong processor demand caused an upward trend for mutton, increasing 57% from the opening sales’ week to current prices.

While prices continue an upward trend, there is much change week-on-week. MLA reported on the Record surge in the National Mutton Indicator in April, highlighting mutton prices jumping to a 498¢/kg cwt weekly average. However, the next two weeks saw prices ease substantially by 54¢.

Mutton prices surged again a month later as referenced in High mutton prices: what’s driving the spike? This article highlights a 60¢ lift followed shortly by a 103¢ lift. Prices corrected in the following weeks reducing 90¢.

Factors influencing surges could be:

elevated global demand

China granting access to additional abattoirs

the seasonal supply contraction.

However, demand inconsistency could also be attributed to supply uncertainty. Climate conditions caused growth in some sheep-producing regions but retractions in others. Strong lamb and mutton turn-off has led to uncertainty of the total flock size. Prices have, therefore, experienced heavy movement as processors dip into the saleyards while also promoting longer direct contracts.

Prices remained strong over several consecutive weeks suggesting a return to market stability. With winter’s end typically showing tighter supply, the current price trend could continue.

However, considerably volatile recent months have offered no clear pattern. This ongoing unpredictability, driven in part by processors fluctuating in and out of saleyards, continues to undermine consistent demand, adding a layer of outlook uncertainty.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...