Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

.png)

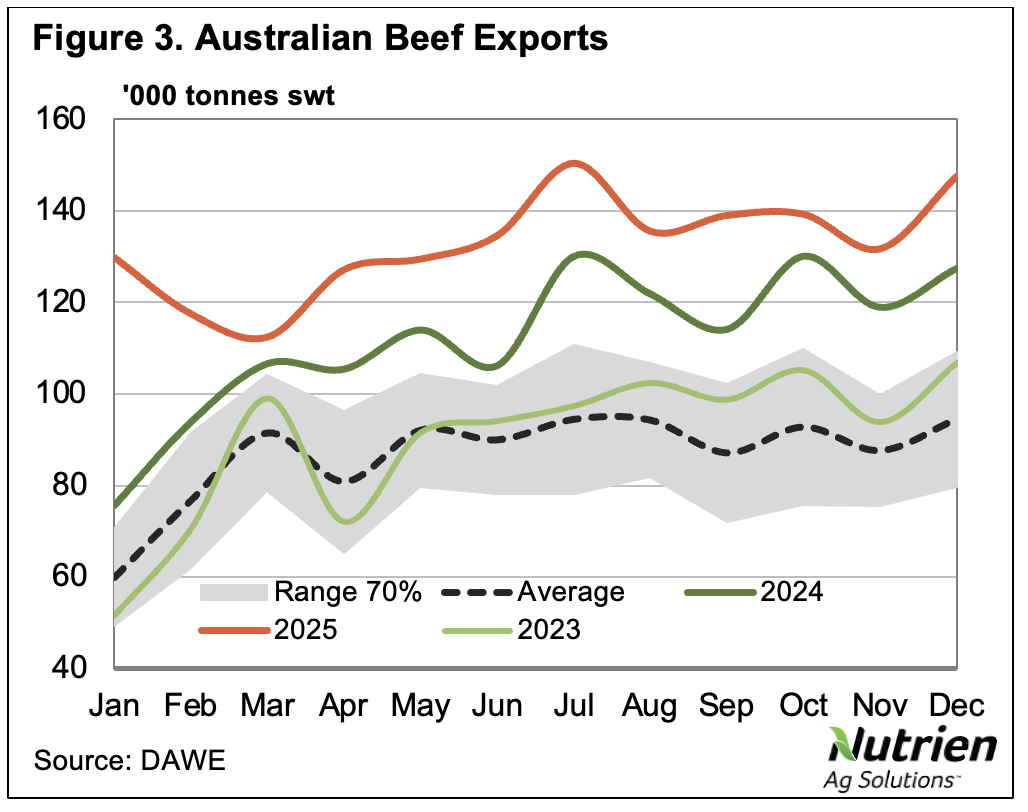

We are less than two weeks into 2026, but already the beef industry has faced a multitude of events which will continue to impact markets throughout the year and beyond. Domestically, the impact of horrifying stock and property losses from fire in the south and flood in the north are yet to be fully understood, and it will be some time before the flow-on to overall numbers, throughput and demand can be determined. Markets have opened the year resilient so far, between 5¢/kg and 25¢/kg above where they closed 2025.Global hurdles have also already been thrown at the Australian industry, which exports a majority of its beef, and these impacts are easier to forecast in the short term. The first day of the year brought with it the announcement that China had implemented safeguard measures on imported beef, effectively immediately, reportedly to protect its domestic cattle industry. The safeguards will place a 2.7 million metric tonne cap on China’s major beef suppliers this year, with that total quota increasing incrementally over the following two years.

Specifically, Australia’s quota for 2026 will be 205,000 tonnes, a figure which will increase by 4,000 tonnes in 2027, and the same again in 2028. Once the quota has been reached, an additional tariff of 55% will be applied. Last year, Australia exported 272,940 tonnes to China, an increase of 41% year-on-year, and significantly more than the new 2026 quota. Brazil sent about half of all its exported beef to China last year, a volume of 1.7 million tonnes, and their 2026 China quota is set at 1.1 million tonnes. Other countries in the Americas fared better, with Argentina, Uruguay and even the US receiving quotas well above their 2025 export volumes.

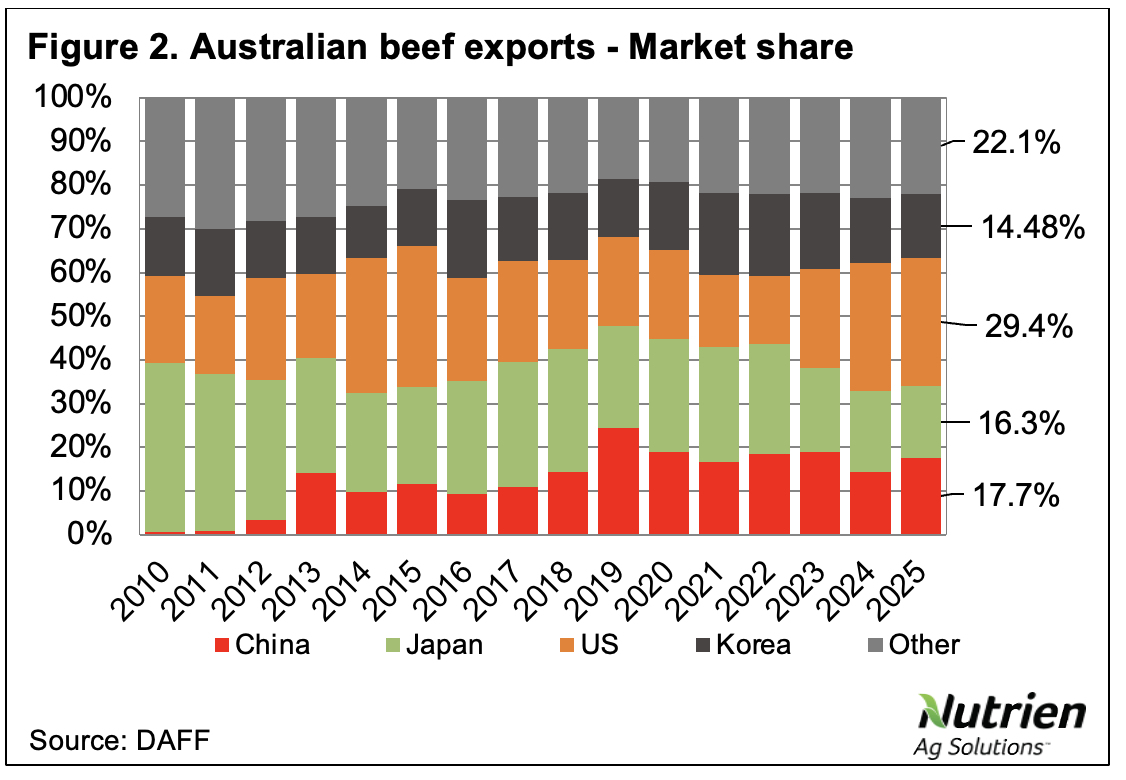

This announcement comes off the back of record volumes of beef, and total red meat, being exported from Australia in 2025. America’s low herd numbers offset the new 10% tariff implemented by that country on Australia in April, and meant it remained Australian beef’s biggest market, with exports to the US rising 16% year-on-year, 48% above 2023 levels. Steiner expects US domestic supply to remain constrained for the first half of the year at least, and Australian imports should increase further, albeit only marginally. Imported beef prices in the US have opened firm to stronger, as exporters from Australia and Brazil turn their attention to getting product into China as soon as possible to avoid the out-of-quota tariff.

China was Australia’s second largest market in 2025, making up nearly 18% of our exported beef trade, and if everything else remains even, including our domestic production, the new tariff could start to impact trade to China as early as August. Meat & Livestock Australia say the tariff will impact “our customers within China significantly”, while AMIC suggests it could reduce Australian beef exports to China by one third.

Jamie-Lee Oldfield is a seasoned agri-media, communications professional and livestock market analyst who lives and works on a family-owned stud and commercial beef and sheep operation in Coolac, NSW.

Jamie-Lee Oldfield is a seasoned agri-media, communications professional and livestock market analyst who lives and works on a family-owned stud and commercial beef and sheep operation in Coolac, NSW.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...