Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

1 min read

Emily Tan - MLA Market Information Analyst : Aug 7, 2024

Diesel price hikes are impacting farm decisions as input costs soar, affecting business margins and livestock transportation choices in the agricultural industry.

Input costs are having a major impact on business margins.

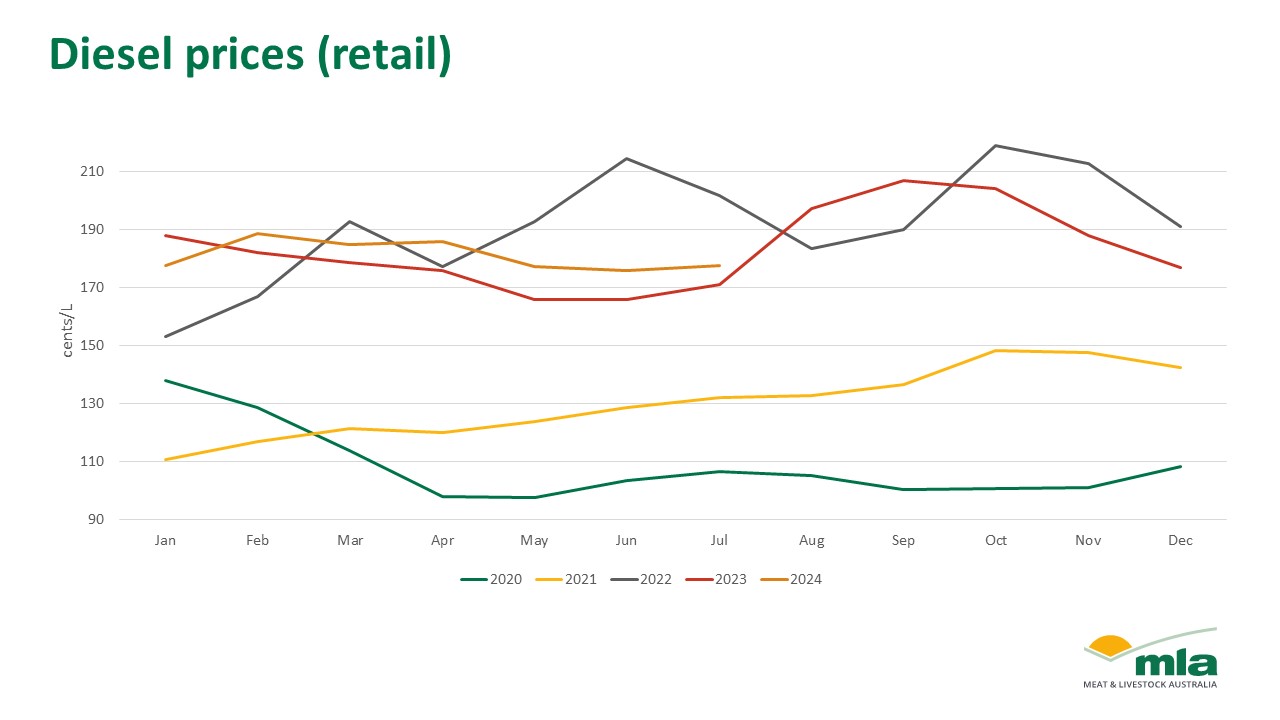

Diesel prices have increased by 70% over the last four years.

Increased costs will encourage producers to purchase cattle with the lowest transportation cost.

In the agricultural industry, one of the largest costs impacting profitability is diesel. The costs of running on-farm machinery and trucking livestock can put a huge amount of pressure on farm businesses.

Here, the MLA Market Insights team delves into input costs and how they’re relative to profitability. For example, in 2020 and 2021 when cattle and sheep prices were the highest on record, inputs costs contributed to a larger proportion of business margins.

In 2020, diesel prices averaged approximately 108¢/L at retail level excluding the diesel fuel rebate – at this time livestock prices were around 500¢/kg liveweight (lwt). When compared to 2023, average diesel prices were at 183¢/L and livestock prices dipped to around 250¢/kg lwt.

Over the last four years, diesel prices have increased by 70%. This increase is another added rising cost for businesses which has become a struggle to keep up with.

Diesel prices are currently about 5% above those of 2023. These prices are unlikely to ease, with inflation expected to maintain at 3.6% due to the cost-of-living. The result of these increased costs may encourage producers to weigh up the benefits of purchasing better quality cattle that is further away or average quality cattle that has lower transportation costs.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...