Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

4 min read

Ripley Atkinson

:

Nov 5, 2025

Ripley Atkinson

:

Nov 5, 2025

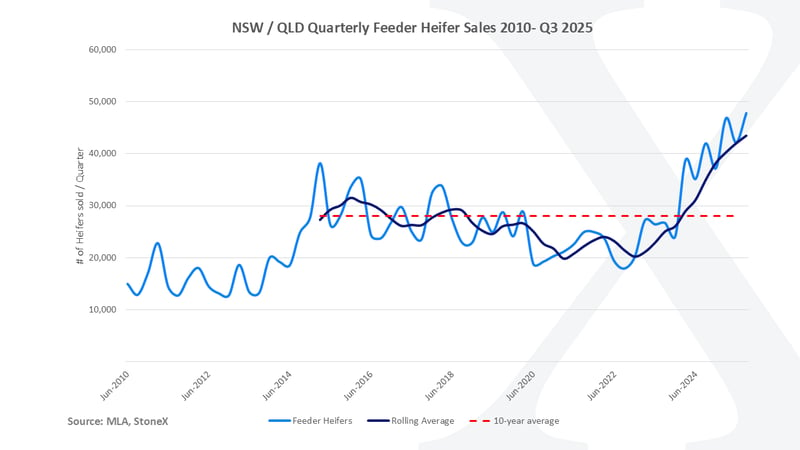

As Australia’s feedlot industry has grown and evolved, so has the buying patterns and behaviour of feedlots buying heifers to feed on.

The feedlot industry has grown rapidly in the past five years, to the tune of 56% or nearly 570,000 head increase in numbers on feed between Q2 2020 and Q2 2025. With that growth has delivered, naturally, an increase in demand from lot feeders for cattle and that shift has brought a sharp adjustment in the buying patterns of heifer purchases.

As Figure 1 below shows, the numbers of heifers purchased by feedlots has risen rapidly since Q3 2022, increasing nearly three fold in the space of three years. That growth in numbers and the sustained quarter-on-quarter rises indicate a shift in lot feeders' buying patterns and a structural change in the market place.

Large numbers of heifers have been traded and backgrounded throughout 2023 to today, with buy-in prices and the discount for heifers relative to steers, encouraging producers to utilise this trade option. The alignment of optimal trading conditions to background heifers and substantial growth in feedlot capacity has brought about this structural change in the marketplace.

Beneath the overlaying data, there are a several factors which is adding weight to heifer demand and interest:

As lot feeders have expanded, the requirement for larger numbers of cattle has naturally grown, which has encouraged some lot feeders to consider feeding heifers in larger numbers than they had before. The learnings taken from this and the improvements in feeders abilities to feed heifers efficiently has brought about a greater acceptance for them to feed. Thus driving increased numbers purchased.

Furthermore, with the reapproval of market access into China for several large beef export processors, this has brought about renewed demand for Hormone growth promotant (HGP) free cattle. Heifers are well suited to a shorter feeding program and without the influence of HGPs, marble and they perform better when processed to meet that brand or market segmentation which has expanded under the reapproval of licensing into China.

Finally, as the cattle cycle matures, the increasing numbers of the herd more broadly has meant a reduced need for producers to retain larger numbers of heifers, thus increasing availability of heifers in the market to be sold. On the feedlot side, the buy price relative to steers has been steadily growing in dollar terms, yet the rates feedlots receive for fed heifers relative to steers has not, this has encouraged them to pursue heifers as an alternative feeding option.

Ripley Atkinson's experience in the red meat industry and current role at StoneX developing price risk management tools for Australia’s sheep and cattle sectors ensures he delivers unique, whole of supply chain insights and analysis across key factors such as prices, supply, production and the drivers of the sheep and cattle cycles.

StoneX Disclaimer The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries. Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...