Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

1 min read

As the first batch of new season young lambs trickle through NSW saleyards, it’s important to acknowledge how the market has been recently challenged, where we are now and what is expected for lamb supply and subsequent market impact in the coming months.

Many key sheep and lamb production regions have faced severe drought or challenging conditions over the past 18−24 months, contributing to historically high mutton and record lamb turnoff in 2024.

With minimal feed on offer, some producers were forced to extensively hand feed or containment feed, compounded by an absent autumn break. Exacerbated supplementary feed and labour cost pressures heading into winter to ensure animal nutritional requirements were met, tested the resilience and adaptation of flock management strategies.

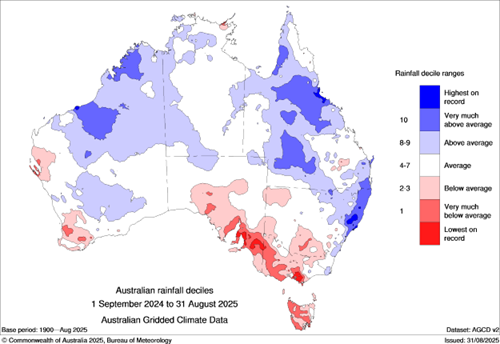

Image 1 - Bureau of Meteorology: Rainfall deciles (past 12 months).

These factors have impacted producer flock management intentions, with an expected reduction in self-replacement ewes (-9%) and wethers (-11%) for 2026 (outlined in the May 2025 Sheep Producer Intentions Survey).

Marking rates are also expected to be lower in significantly drought-affected regions, reducing lambs on the ground this year.

Approximately 70% of young lambs sold to processors across the eastern states are from saleyards located in “below average” to “lowest on record rainfall” regions over the past 12 months (image 1). The impact on core sheep production regions will likely reduce 2025 young lamb volumes.

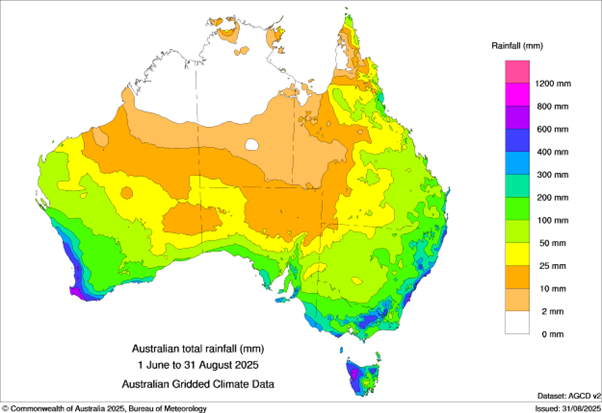

Positively, however, many of the worst affected regions have received rainfall (image 2) in recent months. This has promoted pasture growth, particularly in parts of SA, western Victoria and smaller pockets of southern NSW. Significant spring rain and warmer days are now required to motivate lagging pastures to ensure lambs are finished to desirable market weights.

Image 2 - Bureau of Meteorology: Rainfall (past three months).

Looking ahead, producers who persisted with supplementary feed should be rewarded by improved prices. They are currently up 40% from prices a year ago, supported by strong demand and lower supply. This will provide some consolation despite accumulating costs impacting profit margins. The rainfall and price outlook should instill producer confidence as we head into spring.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...