Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

2 min read

Vivian Harris, MLA Market Insight Manager : Jul 28, 2025

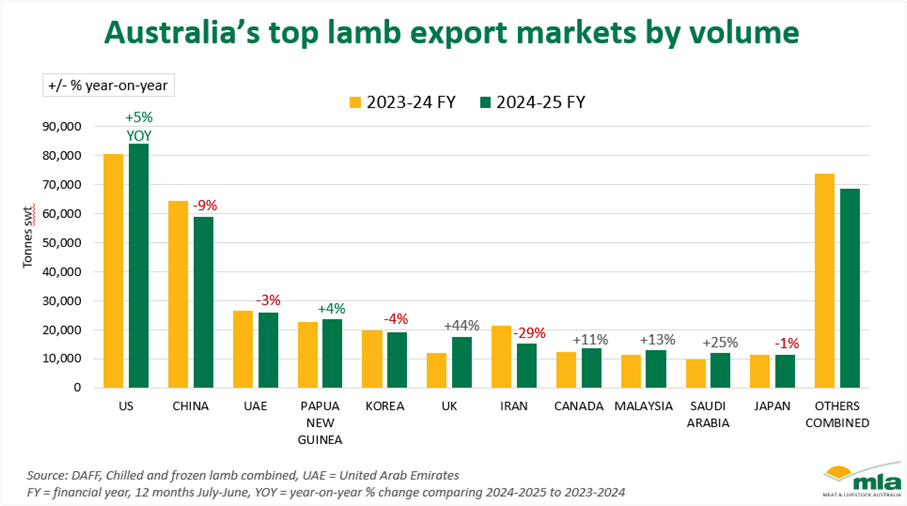

Australian lamb export value exceeded A$4 billion for the first time over a 12-month period and was up 14% year-on-year (YoY) figures. Export volume was slightly lower (-1%), but still the second highest ever at 363,109 tonnes shipped weight (swt).

Top lamb export destinations were consistent with previous years, but volume shifts occurred:

United States and Canada: Both the US (+5%) and Canada (+11%) saw YoY growth. The US increased lamb carcase, shank and boneless loin while Canada saw carcase, manufacturing, breast and flap plus leg growth.

Papua New Guinea (PNG) and Malaysia: PNG saw a 4% growth with the expanding young and urbanised population driving consumption. Lamb flap demand increased due to popular gathering and celebratory dishes. Malaysia saw a 13% increase due to strong economic growth.

Middle East: Saudi Arabia (+25%) and Qatar (+30%) increased YoY with consumption driven by tourism industry growth and more expatriate workers. Lamb cut exports have greatly diversified over the past decade with carcase volume falling from 74% in FY2014−15 to 58% in FY2024−25.

China: Lamb export volume decreased 9% YoY while mutton increased 18% YoY driven by heightened demand for lower-priced products. Consumers remain cautious in their discretionary spending.

Iran: Export volumes to Iran were significantly lower (-29% YoY), largely due to flight disruptions because of regional conflict.

Market diversification continues as a key risk management strategy to enhance industry resilience and sustainability.

Australian lamb export volume to top markets has experienced a downward trend for the last 30 years. However, export destination numbers have increased. Both are indicators of increased market diversification.

China: Chilled lamb exports to China have almost quadrupled in FY2024–25, in part due to a significant increase in approved chilled access establishments – up to twenty from just one.

Middle East Gulf Cooperation Council (GCC): GCC shelf-life of Australian chilled vacuum-packed sheepmeat has increased from 60 to 90 days – following years of research. This allows more sea-shipped product, reducing freight and wastage costs.

The United Kingdom (UK) (+44% YoY) and India (+124% YoY) are both experiencing above-average market growth due to improved market access because of recent new free trade agreements.

Aussie lamb exports have experienced extraordinary growth since enforcement of the Australia-UK Free Trade Agreement (A-UK FTA), aided by decreased domestic UK production, zero tariffs, record Australian production and lower Australian prices.

Roasted Australian frozen bone-in lamb legs have been long-time British favourites for Easter and Christmas celebrations. MLA’s UK team has focused on expanding opportunities for chilled lamb and cut ranges with importers, buyers and consumers. This has resulted in larger volumes of boneless legs, half legs, rack, shoulder, short loin, skirt, and breast and flap options.

Richard Sanders, MLA’s UK Country Manager explains, “The A-UK FTA is opening new doors for exciting collaborations and growth.

“British consumers are enthusiastic – not just about the familiar Aussie favourites, but also for a growing range of value-added cuts. Aussie lamb is also carving out a place in UK foodservice, where its mild, versatile flavour suits a wide range of global cuisines.”

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...