Hefty demand for heavy steers

Heavy steer demand has been on the rise this month, with the national price indicator climbing 9% in the past three weeks. Strong export demand is a...

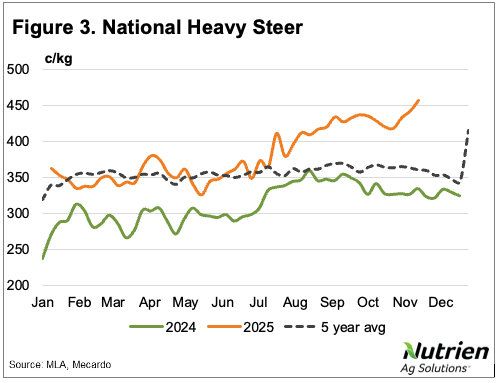

Heavy steer demand has been on the rise this month, with the national price indicator climbing 9% in the past three weeks. Strong export demand is a major driver of this, as is improved confidence in domestic seasonal conditions. While slaughter remains historically high, the availability of heavy cattle has been impacted by southern seasonal conditions and rainfall hindering access in the north. Will this be enough to see current values supported through to the new year?

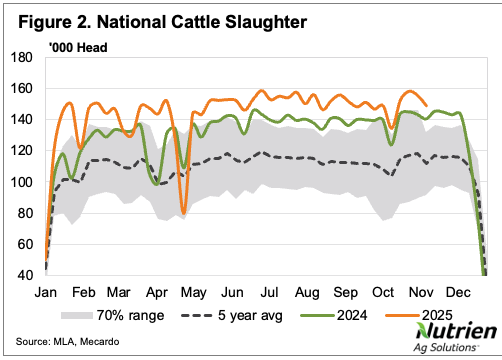

Cattle slaughter has been averaging more than 30% above the five-year numbers for all of 2025, and continues to do so, with the year-to-date total, according to Meat and Livestock Australia figures, 9% higher year-on-year. Historically, slaughter numbers hold at their current levels through until the last two weeks of the year, and the supply equation should support that this year as well. When it comes to the heavy steer category, however, the price bump indicates these remain a hot commodity, with weights impacted by the up-and-down season in the south, and rains potentially slowing supply early in the north.

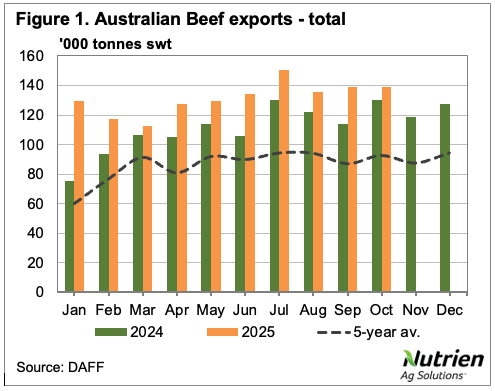

Global trade continues to drive demand, as more than 139,000 tonnes of Australian beef was exported in October, the second-largest monthly volume on record. This brought year-to-date figures 15% above the same period in 2024, and 35% above the five-year average for January to October. The US, Australia’s largest beef export market in 2025, was down slightly both from the previous month and year-on-year for October, but put in perspective remains historically strong, recording the fifth-largest monthly volume on record and bringing its year-to-date figure to 17% higher, more than 350,000 tonnes. And as of last week, the reciprocal 10% tariff applied in April to Australian beef has now been removed.

Trump’s backflip on tariffs could also benefit Australia’s competitors, as a number of South American countries have also had theirs lifted – albeit not Brazil, which remains at a 66% disadvantage. China is another market that could be impacted by the pressure being felt by Trump on trade. Australia’s second-largest beef market this year, their January to October volume is up a significant 45% year-on-year, having lifted imports by nearly 30% in October. While technically Australia could face competition from the US if trade talks allow their beef back into China, the current US supply dynamic means it is unlikely in the short term, regardless.

The National Heavy Steer Indicator has never been higher at this time of year, ending last week at 457¢/kg, which was 37% above year-ago levels and 27% above the five-year average. While the price was slightly higher at its peak in 2021, that was earlier in the spring. Using both the five and 10-year averages, historically, the indicator drops about 5% from now through to the end of the trading year. However, taking into account the supply and demand scenario above, with little likely to change in the next six weeks, this year could be more of an outlier, similar to 2021, where the price only decreased 1% from now until Christmas.

Jamie-Lee Oldfield is a seasoned agri-media, communications professional and livestock market analyst who lives and works on a family-owned stud and commercial beef and sheep operation in Coolac, NSW.

Jamie-Lee Oldfield is a seasoned agri-media, communications professional and livestock market analyst who lives and works on a family-owned stud and commercial beef and sheep operation in Coolac, NSW.

Heavy steer demand has been on the rise this month, with the national price indicator climbing 9% in the past three weeks. Strong export demand is a...

Weather extremes over the past 12 months have significantly impacted producer decision making as well as production and price variability. The...

.png)

Producers are heading into summer with a mixed set of conditions in front of them, however, livestock markets have delivered a standout week, keeping...