Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

1 min read

Erin Lukey, MLA Acting Market Information Manager : Sep 29, 2025

The National Processor Cow Indicator has lifted to its highest weekly price on record, reaching 390¢/kg liveweight (lwt) as of Wednesday, September 24.

For context, this time last year, the indicator was nearly one dollar cheaper. The last major peak occurred in October 2022, when the post-drought rebuilds supported record cattle prices across all indicators.

Unlike 2022 – when producer restocking pushed female cattle prices to records – the current high is processor-led. Two years ago, as the national herd recovered from drought, restockers paid premiums to secure breeding females. In contrast, processors are now selectively targeting cows to maintain throughput, supported by this year’s strong slaughter volumes.

This shift has been made possible by a combination of high cow availability, underpinned by favourable seasonal conditions across much of cattle country, and strong export demand. The United States (US), in particular, is progressing towards a herd rebuild. This has intensified demand for imported lean trim and helped underpin processor margins.

READ MORE: Southern herd rebuild hopes falter

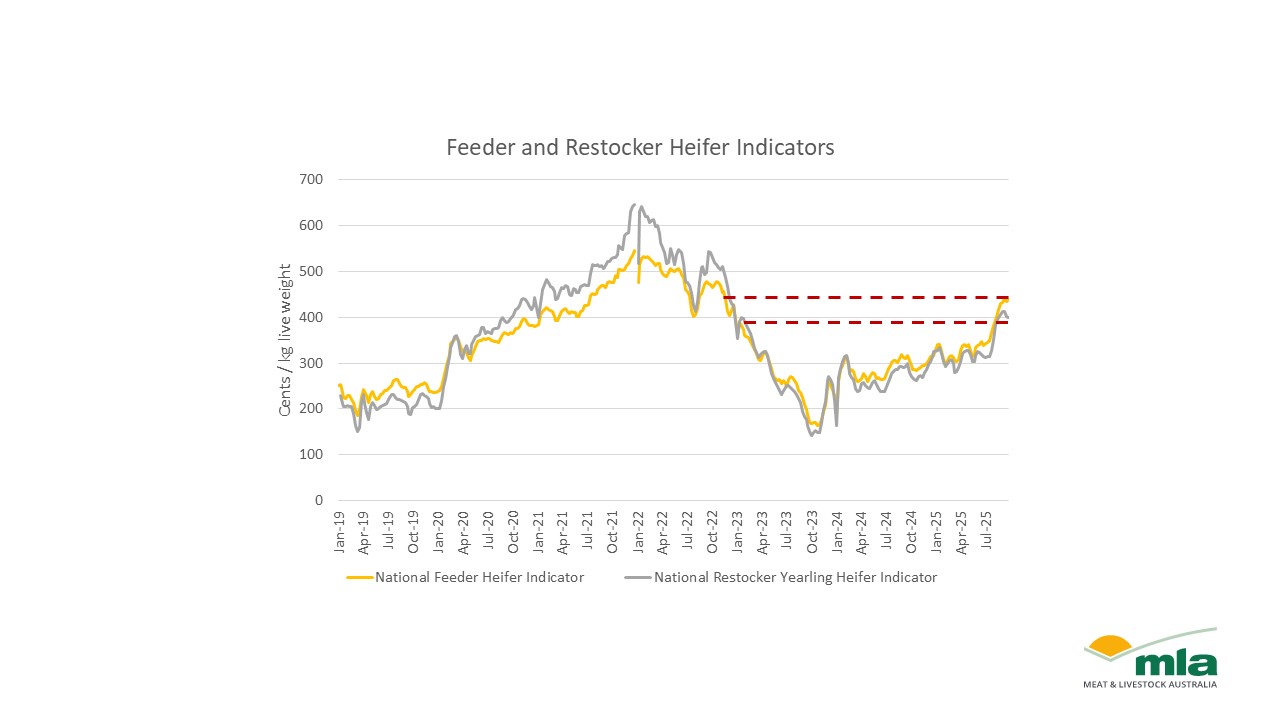

While processor cows have surged, restocker heifer demand has softened. Last week, the National Restocker Heifer Indicator fell 22¢ to 394¢/kg lwt, slipping 400¢ for the first time in a month. The decline was most pronounced in Queensland, where average prices dropped to 375¢/kg lwt, reflecting weaker rebuild intentions, despite ongoing seasonal strength.

Feeder heifer values, however, remain more stable. Prices eased 7¢ last week to 437¢/kg lwt, but the market has largely held onto the 90¢/kg lift accumulated over the past two months. This relative stability highlights ongoing feedlot demand, even as restocker activity retreats.

For producers, the divergence between processor and restocker demand is worth monitoring. Current conditions suggest processors will remain the primary driver of female markets in the short term, provided slaughter volumes stay elevated and US demand for lean beef continues. However, if seasonal confidence holds and restocking momentum revives, competition for females could again reshape market dynamics.

Processor demand pushes cow prices to record highs.

Restocker heifer demand declines, especially in Queensland.

Feeder heifer prices remain stable despite minor easing.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...