Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

2 min read

Erin Lukey, MLA Senior Market Information Analyst : Oct 24, 2025

.jpg)

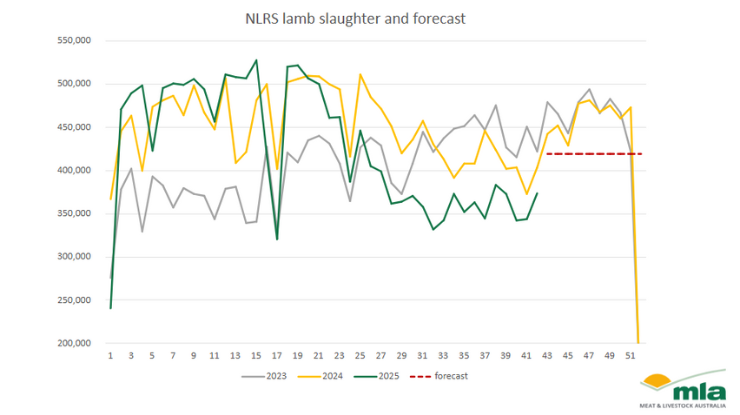

Meat & Livestock Australia (MLA) analysts started investigating the new season lamb supply halfway through spring. Last week, we discussed current spring yardings and how the anticipated supply lift has impacted the market. This week’s focus is on slaughter throughput and how it’s tracking against MLA forecasts from earlier in the year.

The National Livestock Reporting Service (NRLS), as of 17 October 2025, has reported 17.8 million lambs slaughtered in 2025. The voluntary NLRS survey consistently represents an 89% coverage of total ABS slaughter volumes. Adjusting for this coverage calculation, the sector has processed 81% of the forecasted 24.9 million slaughter volume.

These figures align closely with the past three years, where at this time (42nd week), volumes were between 79–82% of total annual slaughter. This indicates industry is on track to reach the forecasted volume.

New season lamb supply through saleyards is down 17% year-on-year (YoY), however, public processor grids, especially across NSW, have indicated strong forward supply. While the market is still strong, it has softened − pointing to this supply/demand shift.

Historically, the October long weekend is the turning point for lamb supply. After the long weekend, most plants have finished their maintenance closures and are operating at capacity. It is then, traditionally, when a supply kick begins.

If the Australian lamb sector is to reach the MLA forecast of 24.9 million head, supply needs to lift notably in the remaining ten weeks of the processing year.

Accounting for NLRS coverage, a weekly average of around 418,000 lambs processed per week for the next 10 weeks would be required – a 16.6% lift on the past ten week average. This is definitely within industry reach, but how the remainder of spring and summer play out will determine when these numbers flow through.

Conditions across southern Australia have not been as good as initially hoped. A missed Autumn and a lacklustre spring in several sheep-producing regions could delay new season lambs to market. This, alongside a probable delay to harvest − enabling mixed farmers to hold on to sheep a bit longer − means there is a strong chance we will see a few weeks’ delay of the southern new season market.

Bonus – cattle slaughter updated on projectionsNLRS cattle slaughter, as of 17 October 2025, is 5,950,327 head. Adjusted for NLRS coverage of 79%, this is 83% of MLAs’ projected slaughter figure. To reach the forecast figure of 9.02 million head, an NLRS processing week average of more than 149,900 head for the next eight weeks would be required − noting slaughter slows coming into summer as the wet season hits across the north. Current supply is strong, despite some hiccups with hot weather impacting transport. Total calendar slaughter is likely to land close to, or above, MLA’s forecast of 9.02 million head.

|

Lamb slaughter tracking at 81% of estimated annual slaughter.

Weekly lamb slaughter to year’s end must average around 418,000 for annual slaughter to reach 24.9 million.

Cattle slaughter tracking at 83% of estimated annual slaughter.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...