A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

1 min read

Erin Lukey, MLA Senior Market Information Analyst : Jul 29, 2024

Lamb prices have fluctuated unpredictably this year, starting strong, easing off and then rising 30% since May.

Trade and Heavy Lamb Indicators surged, but Restocker Indicators lagged with a smaller 25% increase.

After recent highs the market corrected, and attention is now on the new-season lambs.

The sheep market typically follows a strong seasonal pattern. Prices generally start low at the beginning of the year, then rise moving into autumn, peaking at the end of winter due to a constrained supply of finished lambs, before easing with the arrival of new-season lambs. In 2024, however, lamb prices have been unpredictable and unprecedented, continuing a volatile two years of trade.

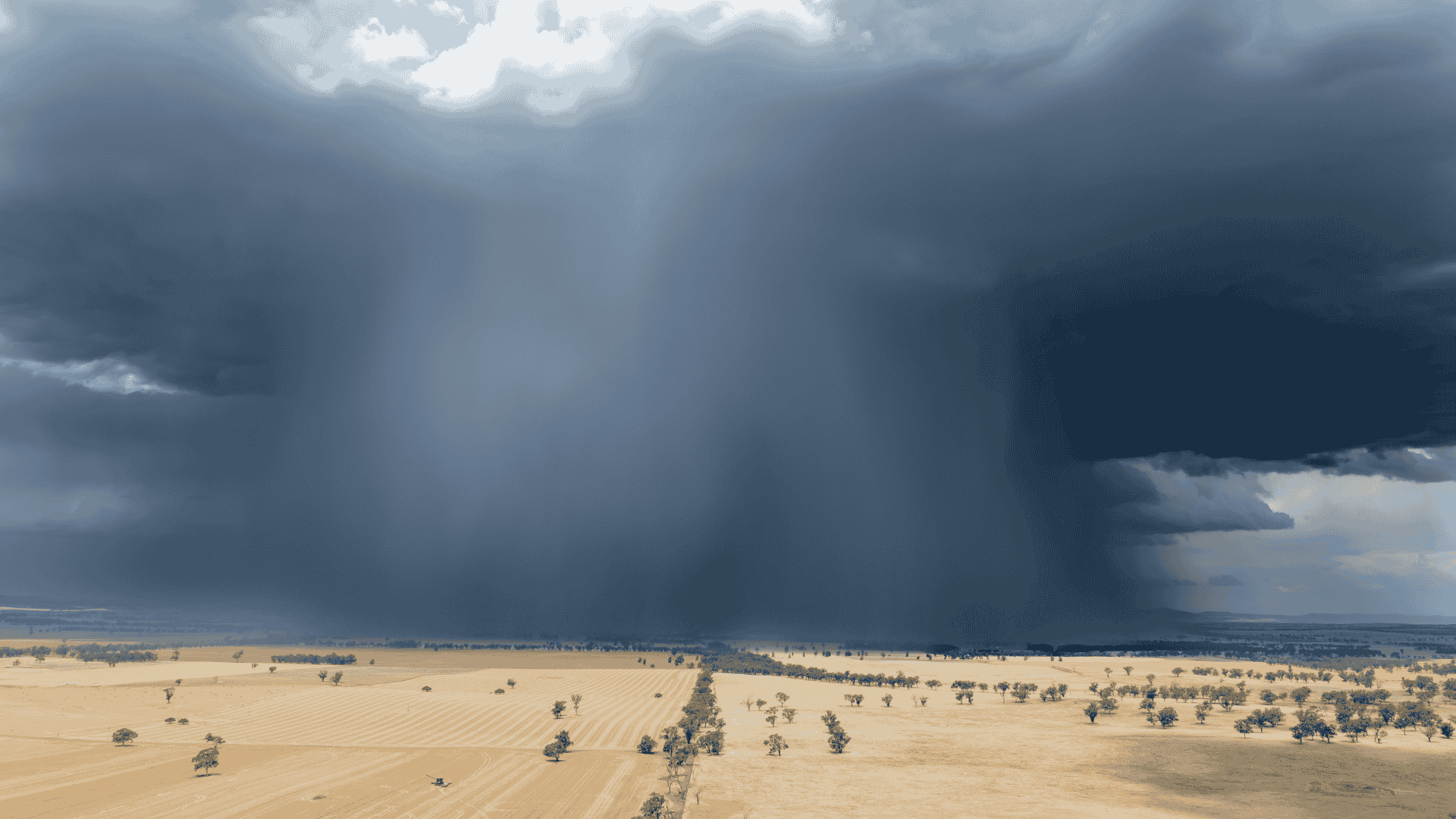

Prices started strong in the early sales of the year, reaching near year-long highs. However, due to a wet summer and decent supply, prices eased for the first three to four months. High supply and drying paddocks across Victoria and SA affecting producers’ confidence in the future of the market. Since May, prices have returned to more seasonal trends, with a 30% lift in the last four months significantly impacting producer sentiment.

Despite strong returns across processor lambs in the Trade and Heavy Lamb Indicators, the Restocker Indicators have not felt the same relief. While restocker prices have lifted by 25%, the Trade Lamb Indicator has increased by 33% and the Mutton Indicator by a solid 38%. This disparity shows that restocker prices have not kept pace with the swift recovery of heavier lamb prices, which may continue if finished animals are rewarded.

Two weeks ago, trade lambs were receiving 242¢/kg carcase weight (cwt), the second highest price gap on record, just below the August 2018 high of 250¢/kg cwt. The premium of 33% over restockers is well above the five-year average of 10%, pushing current market conditions into unprecedented territory.

In the short term, the market saw heavy lamb prices reach levels not seen since 2021 two weeks ago, and trade lamb prices higher than those in February 2022. However, last week’s market corrected with sheep yardings lifting, lamb yardings easing, and all indicators falling by 50–89 cents. The highs of last week were short-lived due to rainfall across sheep country, and reduced enthusiasm from export buyers.

Looking ahead, the market is awaiting the arrival of new-season lambs. Historically, new-season lambs enter the market through NSW saleyards in late July. Last week, 500 young lambs were sold through the Forbes saleyard, fetching over 930¢/kg cwt. Although this indicates a slow start to the season, it provides confidence that premiums will be available when young lambs enter the market.

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...