Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

The mutton market has the potential to go mad if southern Australia gets a solid and widespread autumn break.

That, obviously, is quite a big if, but let’s look at some of the signs that are pointing towards positivity in the sheep trade for 2026.

While we’ve already pointed out this year that ewe flock numbers are more like guestimates at the moment, sustained historically strong prices, failed seasons and global appetite have meant plenty of sheep have been turned off in the past six months.

The supply-demand equation looks set to continue, and even increase further, in favour of producers if restockers get enough rain to both leave and enter the market.

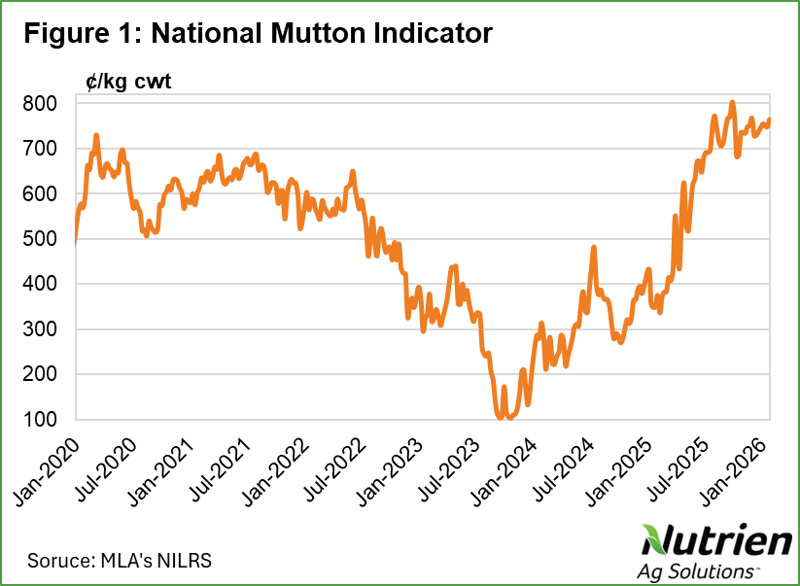

About this time last year, we looked at the sheep market and noted that historically high slaughter for the first month of 2025 had pushed prices lower, when traditionally the mutton indicator remains stable through to the winter rise.

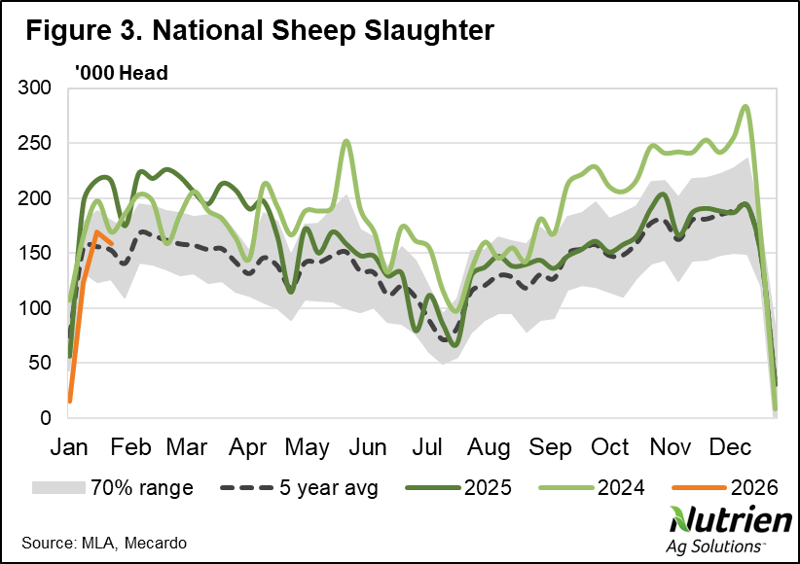

For the first four months of 2026, total national sheep slaughter has fallen 11% year on year. That was coming from record figures for those four weeks, however, and this year’s throughput still remains historically strong, about 12% above the five-year average sheep slaughter figure for that period.

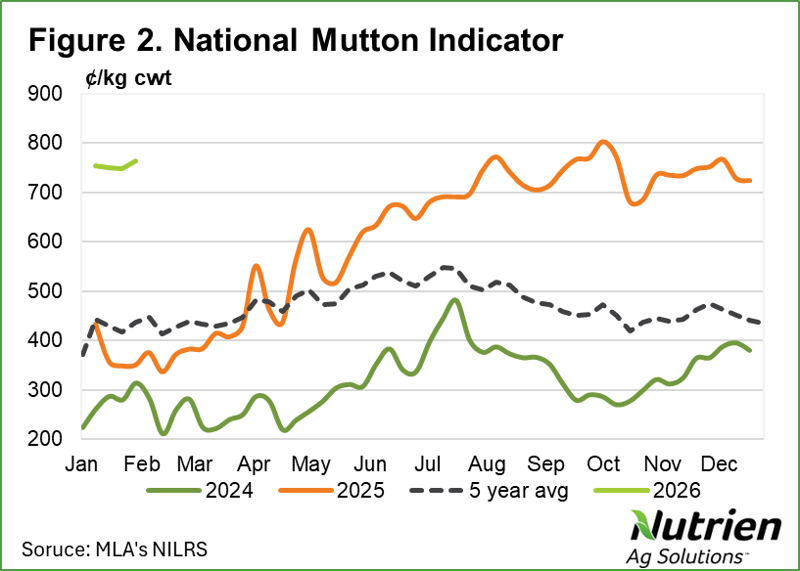

Despite the above-average supply, prices have not lost any ground. The National Mutton Indicator is averaging 754¢/kg for the year to date, with every week-end NMI a record high for that specific week of the year. It currently sits about 120% above year-ago levels, 74% higher than the five-year average, and 80% above the 10-year price.

The National Livestock Reporting Service equates the current price to an average of $200/head. Putting this into perspective, the same week last year was $93/head.

Looking at the longer-term average price for the NMI, the annual peak occurs in the second week of June, and rises 19% between now and then. In the past five years, the high has occurred slightly later, in the third week of July, and has risen 20% from the end of January. Using the mid-point of the two, this would bring the NMI to above 900¢/kg come winter, surpassing the current record set in October of 810¢/kg.

There are always outliers, and we’ve recently seen the sheep market tank on the back of a forecast dry spell, never mind an actual one, but the mutton market rise in the first half of the year has been a fairly consistent occurrence throughout the past decade. It’s a somewhat turbulent time for global trade, but the need for protein is unlikely to diminish.

The real question mark on just how valuable sheep will become is around domestic seasonal conditions, if rain falls where and when it should, and processors have less supply and more competition, pushing prices even further.

National Mutton Indicator recording historical highs for the period throughout January.

Slaughter down year-on-year, but still well above the five and 10-year average figures.

Scope for winter price increase would take the sheep market to new highs.

Jamie-Lee Oldfield is a seasoned agri-media, communications professional and livestock market analyst who lives and works on a family-owned stud and commercial beef and sheep operation in Coolac, NSW.

Jamie-Lee Oldfield is a seasoned agri-media, communications professional and livestock market analyst who lives and works on a family-owned stud and commercial beef and sheep operation in Coolac, NSW.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...