A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

1 min read

Emily Tan - MLA Market Information Analyst : Apr 28, 2025

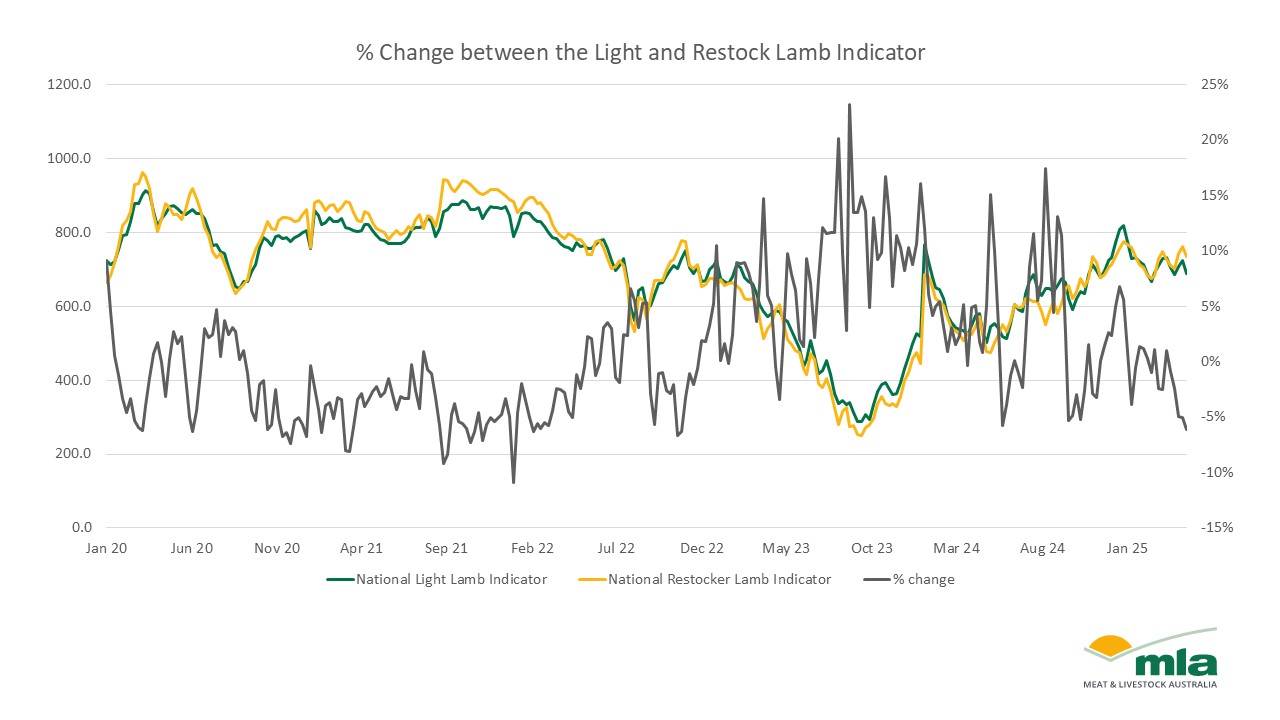

Favourable seasonal conditions will result in more light lambs being sold back into the paddock – widening the gap between indicators.

On the other hand, a smaller price gap between the two indicators can reflect competition for light lambs from both restockers and processors.

The largest price differential for the Light Lamb Indicator in the past five years was in August 2023.

The current average price difference between the Light Lamb Indicator and the Restocker Lamb Indicator eased by 2%, however the gap is continuing to widen, reaching -6% in the past two weeks. As a result, the Restocker Lamb Indicator price has risen to 735¢/kg carcase weight (cwt) while the Light Lamb Indicator remains at 690¢/kg cwt (as of 20 April 2025).

A smaller price differential suggests light lambs are either being sold to restockers or processors, while a larger difference in price – as we are seeing at the moment – can indicate one is more favourable than the other due to seasonal conditions or market dynamics.

As southern Australia continues to recover from the impacts of dry conditions from 2024, a large number of light lambs have been sold to processors for the Middle East market. The shift in seasonal conditions as this year progressed has changed producers’ decision-making. More potential pasture available for autumn has led to light lambs being sold back into the paddock – they will then likely be sold as heavy or trade lambs later in the year.

Historically, the largest price difference between the indicators was in August 2023, when the Light Lamb Indicator was 23% above the restocker lamb price. During this time, despite good seasonal conditions, speculation surrounding the weather led producers to offload stock earlier and faster than expected.

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...