Australia ag commodity prices and the Australian dollar

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Australia enters 2026 with both the beef and sheepmeat sectors positioned at significant turning points shaped by evolving supply cycles, global economic forces and shifts in competitive dynamics across major export markets.

Although the two industries operate within distinct production systems and trade environments, they share several underlying themes that will define market behaviour in the coming year. Herd and flock rebuilding, shifts in global demand arising from trade policy developments, and the changing competitive landscape in both premium and commodity protein markets form the core considerations for producers, processors and exporters. Together these elements point to a year of adjustment rather than disruption, with conditions in place for firmer pricing if seasonal and macroeconomic indicators move in favourable directions.

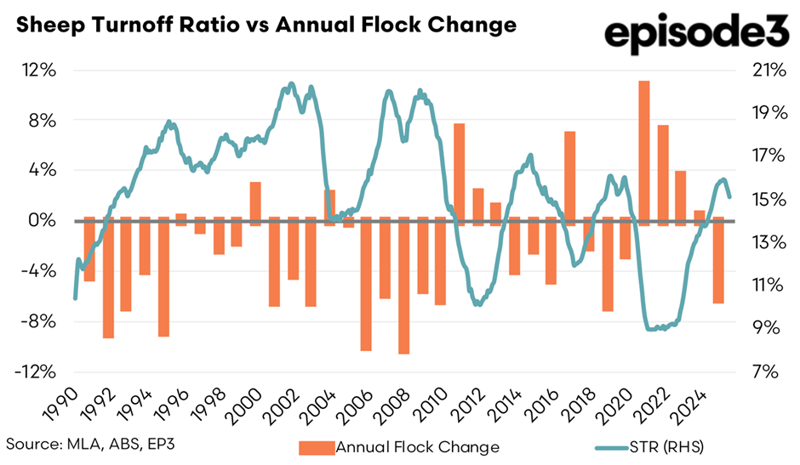

The first major development affecting both sectors is the likely transition into a rebuild phase after several years of liquidation. In the sheepmeat sector, the Sheep Turnoff Rate has steadily eased toward the 14% threshold that historically signals a shift from contraction to expansion. Prolonged liquidation from 2021 to 2024 enlarged supplies and weighed on prices, yet rainfall across southern Australia during late 2025 has begun to improve producer sentiment. A fair to good autumn break in 2026 would accelerate this shift by encouraging retention of ewes and ewe lambs. The consequences of a flock rebuild are predictable. Slaughter volumes tighten and supply becomes constrained as producers rebuild breeding numbers. While price effects are rarely immediate, the directional change places upward pressure on lamb and mutton markets once the rebuild is underway. The industry has not experienced a meaningful expansion phase since the early years of the decade, and 2026 appears likely to mark the beginning of this new cycle.

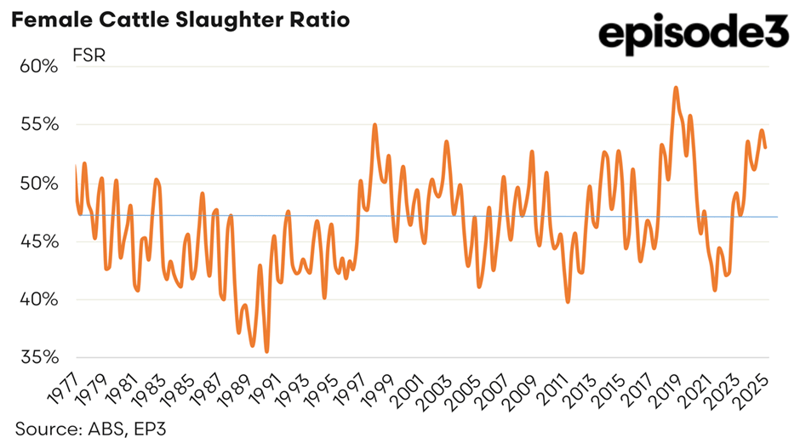

Similar dynamics are unfolding in the beef sector. Indicators such as the Female Slaughter Ratio suggest the cattle industry has reached a turning point of its own. Australia has endured a mild herd contraction phase, yet improved seasonal conditions and rising producer optimism now point toward a rebuild beginning in early 2026. As with sheep, the tightening of supply is gradual but structurally supportive of prices once producers retain more females and ease slaughter. The most recent quarterly FSR measure shows that the upward trend appears to have peaked and is now heading back towards the threshold for rebuild with an FSR under 47%.

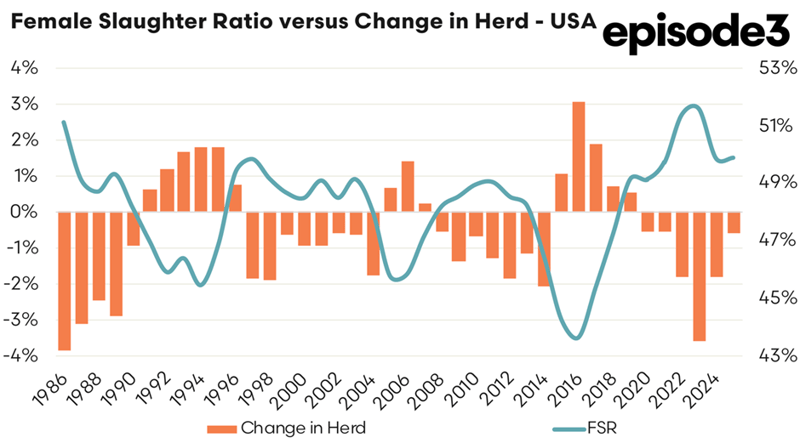

The United States is following a similar trajectory, but at a different stage. After six years of herd liquidation driven by drought, rising feed costs and weaker margins, signals suggest that the herd decline is nearing exhaustion. The US FSR has already shown a well-entrenched downward trajectory and is now heading towards a herd rebuild phase.

If the US moves into a rebuild at the same time as Australia, the global cattle supply base will shrink and create a multi-year period of constrained availability. This would reduce American competitiveness in key export markets such as Japan, South Korea and China, allowing Australian beef to consolidate its position in both grass-fed and premium grain-fed categories.

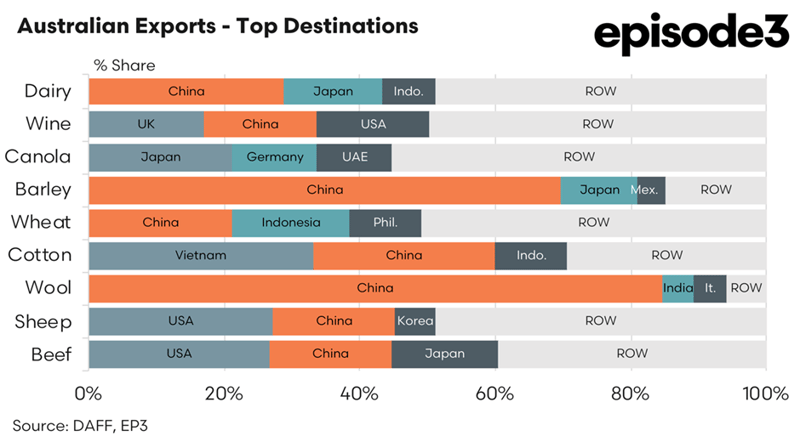

Alongside the internal supply shifts in both industries sits a second major force: the evolving geopolitical landscape surrounding trade, particularly involving China, the United States and other major protein suppliers. For beef, the prospect of a new trade agreement between the US and China looms large. The last major deal, the Phase One agreement of the previous Trump administration, reshaped import preferences in a manner highly favourable to the US and indirectly negative for several Australian commodities. The current environment differs meaningfully. The US has taken a more confrontational approach to many trading partners in recent years, prompting several countries including Canada, the EU and the UK to explicitly seek to diversify away from dependence on US markets. China is acutely aware of this shift and may prefer a more balanced approach than the highly US-centred arrangement of 2020. Any new agreement that stimulates Chinese economic activity or consumer confidence would benefit Australian agriculture more broadly. China remains central to demand for wool, wine, dairy, red meat and a host of other agricultural exports, and stronger Chinese consumption would lend support across these categories.

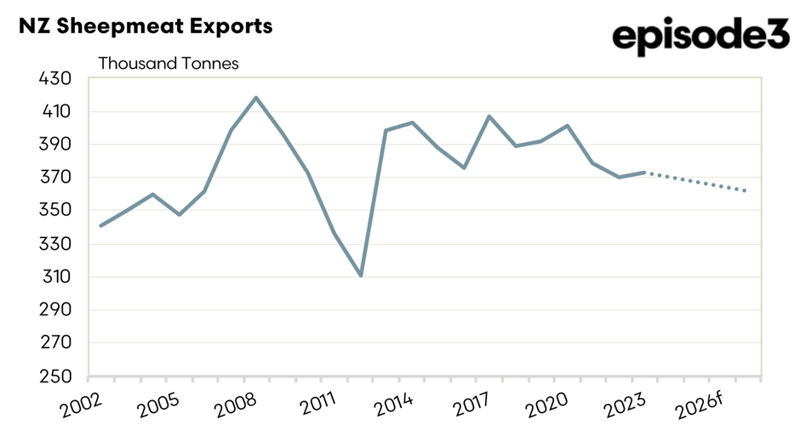

For sheepmeat, the geopolitical element takes a different but equally significant form. New Zealand’s structural decline in sheep flock numbers has intensified over recent years as farmers shift to alternative land uses or reduce flock size in response to cost pressures. This reduction has lowered export volumes and limited New Zealand’s ability to service major growth markets. As a result, Australia is increasingly positioned as the primary supplier capable of meeting expanding global lamb and mutton demand. Markets across Asia, North America and the Middle East have already shown greater reliance on Australian supply, and with New Zealand’s contraction expected to persist, 2026 will likely reinforce Australia’s dominance in many of these destinations. This creates a favourable long term outlook underpinned not merely by temporary market conditions but by structural changes in global supply.

The third major theme shaping both industries concerns wider macroeconomic risks, particularly the potential for a recession in the United States. Although the US economy has demonstrated remarkable resilience, recent indicators point to softening labour markets and renewed inflationary pressures. If inflation persists, the Federal Reserve may halt or reverse any easing cycle, raising the prospect of slower growth or recession. For lamb, this risk is particularly pronounced. The US is Australia’s largest and most valuable lamb market and consumption is heavily concentrated in foodservice settings, especially fine dining. These establishments are among the first to experience reduced patronage when consumer spending tightens. Even a mild US downturn could temper lamb demand and weigh on export returns, particularly if the timing coincides with Australia’s transition into a flock rebuild. For beef, the impact would vary by product type and market segment, yet US economic softness would still influence high value cuts and dining-driven demand channels.

Competitive dynamics in beef markets also warrant attention. Brazil’s anticipated approval to supply beef to Japan introduces a new player into one of Australia’s most important destinations. Brazil will compete aggressively at the commodity end of the market, particularly in lean trimmings for ground beef. However, the core of Australia’s trade into Japan lies in premium grain-fed beef, where quality, safety assurance and established supply chains give Australia a durable advantage. Brazil’s presence may pressurise some lower value segments, but the effect on Australia’s high end trade is expected to be limited.

Taken together, these developments create a complex yet broadly positive outlook for 2026. In both beef and sheepmeat, tightening supply conditions from rebuilding cycles should gradually support higher prices. Australia’s competitive position improves further as the New Zealand sheep industry contracts and as the US faces its own supply constraints. Trade risks remain, but the global environment suggests that any future US-China agreement is unlikely to disadvantage Australia as severely as in the past. The main caveat across both sectors is macroeconomic. A US recession would soften demand for higher value proteins, particularly lamb, and could delay the benefits of tightening supply. Yet if the US slowdown is shallow or avoided, the combination of supply contraction, reduced international competition and renewed Chinese economic momentum would place both industries on firm footing.

As 2026 begins, producers and exporters face a landscape shaped not by crisis but by transition. The themes of herd and flock rebuild, rebalanced trade relationships and evolving competitive pressures will define the operating environment. For those able to anticipate these shifts and adjust accordingly, the year ahead holds the potential for improved margins and stronger long term positioning across global protein markets.

Matt Dalgleish is a director of Episode3.net and co-host of the Agwatchers podcast.

.png)

The higher Australian dollar has prompted questions about the likely impact on local extensive agricultural commodity prices. Mecardo has covered...

Last week, StoneX released its H1 2026 Australian Cattle & Beef Market Outlook report, which covers all key production forecasts for the beef...

Greasy wool prices have increased markedly this season, in the absence of any substantial improvement in macroeconomic indicators or major apparel...