Cattle prices lift on back of rainfall across south eastern Australia

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

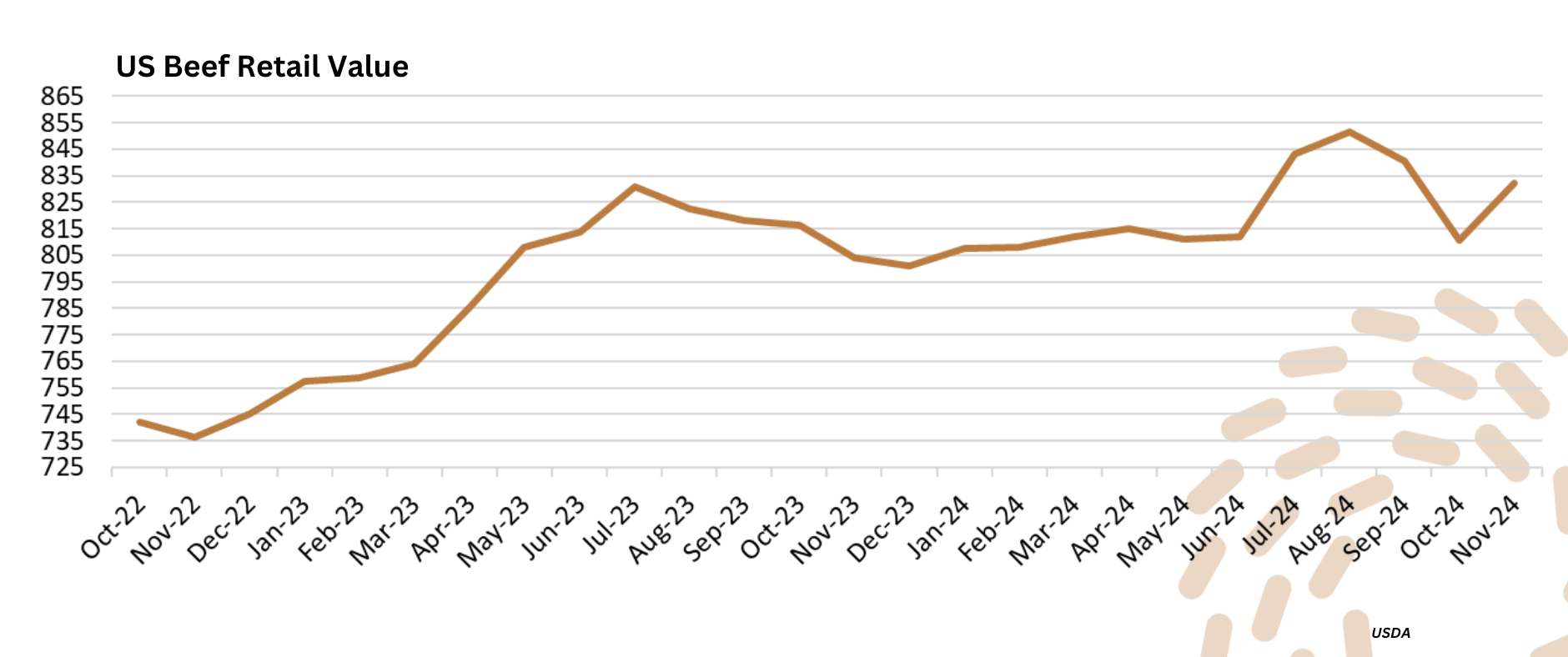

After easing in to 811c in October, the US Beef Retail value according to USDA has risen back to 832c in November. This average price has not been below 800c since April 2023, and 851.5c in August 2024 is the highest it's ever been since records started in January 1970. I was in the US recently, it was interesting to see the price of beef at various supermarkets.

T-Bone steak = $19.99/lb USD = $68.78/kg AUD

Grass fed organic flank steak $21.99/lb USD = $74.64/kg AUD

Grass fed organic New York strip steak (porterhouse) $28.99/lb USD = $98.42kg AUD

Meanwhile, Australian lamb imports into the US continue at a record pace throughout 2024, using USDA figures of lamb imports (carcass-weight equivalent); October-2024 shows that 8,000 tones of lamb were imported from Australia into the US. Of the top 10 highest ever monthly lamb imports into the US, four have occurred in 2024 (June, July, August and October 2024). Again while in the US recently, I found prices of:

Lamb mince pattie $9.90/lb USD = $38.86/kg AUD

Lamb loin chop $17.99/lb = $60.98/AUD

Lamb cutlet $30.99/lb = $105.05/kg AUD

Over the past four weeks the Australian Bureau of Meteorology showed widespread rain and falls of 20mm up to 200mm across much of Tasmania, Victoria, NSW, Queensland and the Northern Territory. Couple this with hot weather and many crops coming off well, and it has given the livestock market a boost heading into the Christmas and New Year period. The MLA Eastern State Young Cattle Indicator has risen from 636c on the November 30, currently (December 12) sitting at 685c. This is the highest daily point since the April 23, 2023. On the sheep front the MLA National Heavy Lamb Indicator was 913c on December 11, its highest value since the October 17, 2021. The MLA Trade Lamb Indicator is currently sitting at 875c, its highest value since February 2, 2022. A wet start to Summer and strong overseas demand for Australian beef and lamb is driving restocker confidence.

The gap between the MLA heavy and restocker steer indicators has been on the rise throughout November and December, highlighting growing restocker and trading confidence. The gap on November 1 was only 22c, but has since risen to 48c the week ending December 13. After an extremely stable cattle market throughout 2024, there has been signs and signals that the restocker market could be in for further rises as producers take advantage of feed.

On the wool front this week, the AWEX Eastern Market Indicator held firm dropping 2c to sit at 1140c/kg. Since October 11, this represents only a 1c movement. This stable period began when the Chinese Government announced and implemented their stimulus package. Overseas global conflict and economic uncertainty remain significant barriers to ongoing growth for the wool market. Next week is the final week before the traditional three-week break for the wool industry, it remains to be seen whether a rise is on the cards as overseas mills look to fill any supply gaps.

Sources: MLA, USDA, AWEX and Australian Bureau of Meteorology.

Tom Rookyard is the General Manager at Ottley Livestock Finance.

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...

The Australian Bureau of Statistics (ABS) released it’s quarterly ‘Livestock Products’ data and statistics on Friday. There is plenty of data to dig...