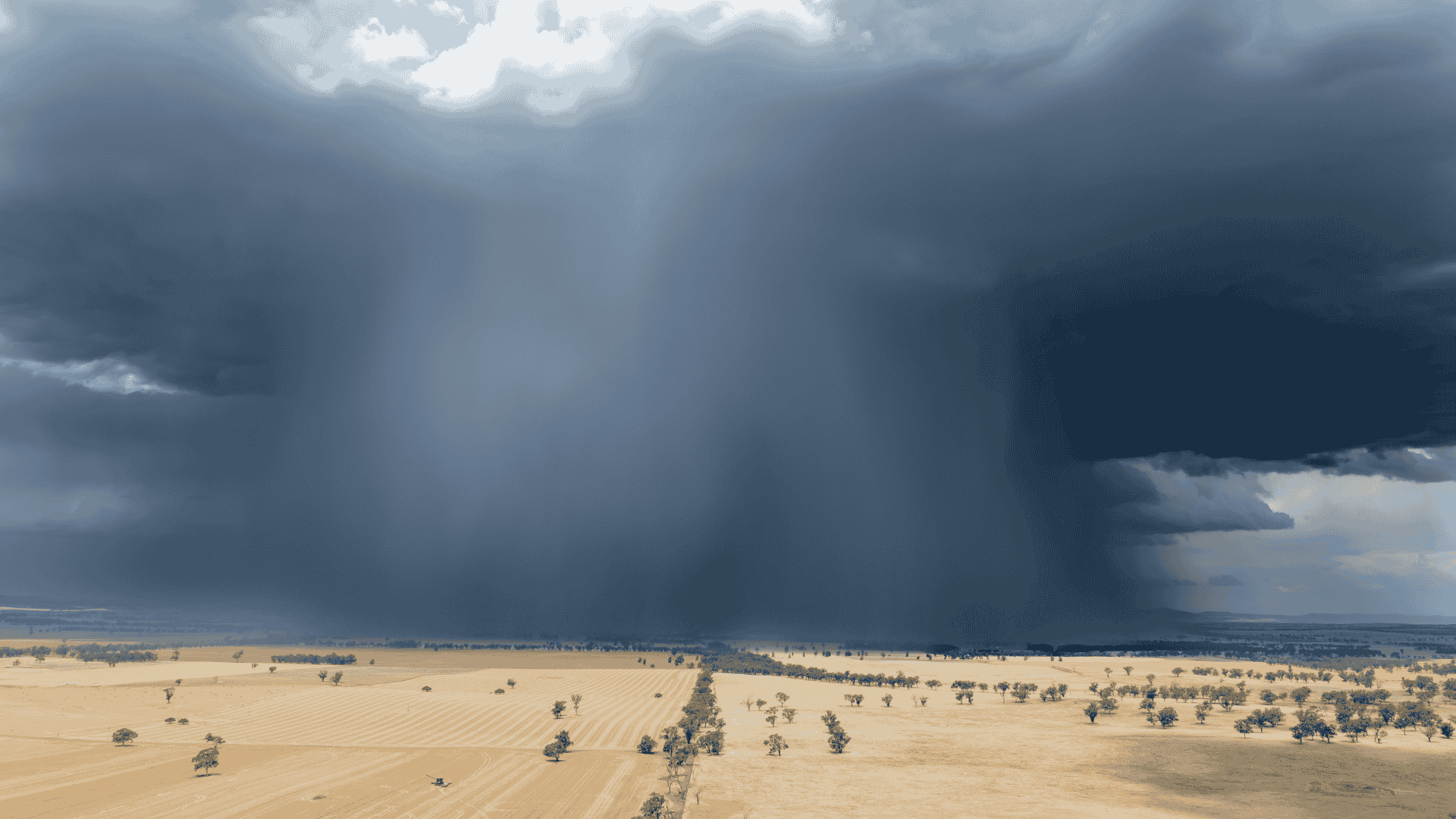

A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

3 min read

Tom Rookyard : Mar 7, 2025

The Indian Ocean Dipole (IOD) has continued to warm heading into Autumn, rising to +0.05 for the week of February 24, through to March 2, 2025. This is off the back of increasing warming periods in November 2024, December 2024 and January 2025.

The IOD offers an insight into Australian weather conditions - positive IOD is associated with lower rainfall in the central and southern Australia, while a negative IOD is associated with increased rainfall the eastern Indian Ocean is warmer. It leads to increased rainfall across parts of Australia. To note, a rise between the months of October and April is not unusual. Couple the warm weather with strong volumes on offer and it has led to the softening of most markets in February. Our thoughts are with the people dealing with Cyclone Alfred.

READ MORE: Cyclone Alfred will spread rain far and wide… but not into the south

With the price of beef in the US at record levels, a review of other proteins offers an insight into what consumers are willing to pay. Australian lamb in America still remains a premium product, however it hasn't been on the record breaking pace that beef has over the past 12 months.

Reviewing Australian imported lamb racks over the past 10 years shows that 2022 and 2023 saw prices rise to the peak of 1370c USD/pounds, (979c/kg AUD) but retracting in 2024. 2025 has seen lamb prices climbing back over the 1300c mark, which is not surprising as a byproduct of record beef prices. For Australian lamb producers, competitive prices of imported lamb are pleasing, as the battle of share on US plates appears to be key in order to grow new markets and opportunities.

Despite a warm end to Summer and large volumes on offer, the trade lamb market is remaining resilient. Across the past five weeks 58,000 crossbred trade lambs have been offered online on AuctionsPlus. The market has remained extremely robust seeing a 97% clearance rate, coupled with an average price that has risen $18/head - from $123 on February 5, through to $141 on March 5.

What's more, a key telling detail is that the minimum price paid for crossbred lambs on AuctionsPlus has sat at $70/head for the past three weeks. Buyers are looking for opportunity.

From a lamb producer's perspective, this shows the underlying strength of the market; primarily driven by strong exports, lamb contracts have sat around the $8 mark, driving trading opportunities. Lamb slaughter volumes of 500,000 per week in February show the volume that processors are getting through; these numbers sit around historical highs.

Expectations are for overseas' demand to remain for the lamb market as buyers look for alternate proteins and also general lamb consumption grows. However, the US tariffs remain an elephant in the room as to what could play out.

The Australian Wool market saw one of its largest rises in recent months with the AWEX Eastern Market Indicator rising 30c to close off Thursday, March 6 sitting at 1.225c. This sits at the highest point the EMI has hit in over 12 months. A low volume of wool on offer (32,000 bales across the week) coupled with a relatively low Australian dollar have been contributing factors. Encouragingly the market rose across all microns particularly on the finer end seeing 19u micron and finer rising 50c-60c, the above resulted in a clearance rate of 97%, showing growers and brokers are welcoming of the rise. Looking forward, volumes return to 38,000 nationally.

Donald Trump has confirmed his 25% tariffs are likely to go ahead, stating there is "no room left" for a deal with either Canada or Mexico that would avert the tariffs by curbing fentanyl flows into the US. He also confirmed increase tariffs on all Chinese imports to 20% (up from 10%). Trump was quoted this week saying, "The tariffs, you know, they’re all set. They go into effect tomorrow." Meaning 37% of the US beef imports are about to get more expensive. My view and thoughts are that the market will react in several ways because there is no single country waiting to supply this deficit.

The low US beef stocks will see prices accepted but any increase will be passed directly onto the US retail consumer.

The Canadians and Mexicans will look to trade elsewhere resulting in further global beef competition - i.e. Japan and Korea.

Over the next few weeks local Australian cattle prices could soften as people “wait and see” the outcomes of the above.

Indirect impact as general business slows down in China (who have already seen slow economy movement from a property bubble bust). From Australia's perspective, we export steel and iron to China, so this leads to a sluggish economies across the globe. What’s next is anyone's guess.

READ MORE: Will he or won't he? Trump address sheds new light on beef and lamb tariffs for Australia

SOURCE: AuctionsPlus, MLA, USDA, ABC, BoM, AWEX

SOURCE: AuctionsPlus, MLA, USDA, ABC, BoM, AWEX

Tom Rookyard is the founder of Cactus Commentary.

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...