Cattle prices lift on back of rainfall across south eastern Australia

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

On April 2, so called Liberation Day, Donald J Trump decided to join a game of high stakes poker, bankrolled by other people’s money (the US taxpayer), using US tariffs "pardon the pun" as his Trump card.

His key financial backers, who were prepared for some risk and a period of higher prices and a mild recession, took money off the table as the magnitude of his bet dawned on them. The bond market expressed this risk most clearly, with 10-year Treasury yields posting their biggest weekly increase in nearly 25 years. The market was clearly concerned that the size of his bet may lead to a full-blown global financial crisis.

This was the catalyst for Trump to take some risk off the table and reduce the size of his bet (impose the minimum 10% global tariff) against all other nations except China. China kept calling his larger bets, and he was forced to fold a hand against vital electronic components needed by US manufacturers. He also lost a series of big bets on US beef and grain; the loss of the beef trade alone is worth US$4 billion (a cost to the industry estimated by US Meat Export Federation at US$150-165/head).

The US beef industry is paying dearly for his bet against China. High value US beef cuts that would have been exported to China are being shoved into the meat grinder (and sold as minced meat). The spread between US domestic fresh 90CL and imported frozen 90CL (which they blend with their fatty trimmings to make hamburger patties) has narrowed from +80USc/lb +30USc/lb during the past year.

Australian beef exporters have stared down Trump’s bet and are adamant that they won’t be adjusting their offers, so the US importer, wholesaler and then retailer will need to work out how to meet Trump’s ante.

The slowdown in forward orders from Australia is because US importers are waiting for the tariff-free product (which was on the water before April 2 – there is a four-week sailing time) to clear the market before working out how to handle the cost of new business subject to Trump’s 10% tariff bet.

Eventually, the importer will have to start putting the tariff on the wholesale customer invoice, maybe as a separate line item i.e. $9/kg plus 10% Trump bet = $9.90/kg.

Then the wholesaler must work out how they are going to pass it onto the retailer. If the retailer passes it on, which they will have to do otherwise their profits go down, it eventually reaches the US consumer who sees Trump’s bet as increasing the price of their burger from $9 to $10.

The US consumer will then get an inkling of the consequences of Trump’s poker strategy. And remember it’s just a small bet this time - but his stack has already been crippled by a series of lost hands. Gradually the US consumer will be awakened to the cost of the bet of the full Trump tariff agenda. Once the US consumer starts to see the impact on their grocery bill, all bets will be off the table.

He has 90 days to revise his poker strategy. Analysts will be currently crunching the numbers and seeing the impact of Trump's tariff bet on US company profits, and they won’t like what they are seeing.

Trump must decide whether to go all-in (short-stacked) with a pair of deuces vs China holding aces that has him covered … the market will force him to fold.

Elders Business Intelligence Analyst Richard Koch combines a deep understanding of global market dynamics with regular insights from Elders staff on the ground, providing informed analysis shaped by both data and real-world observations.

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

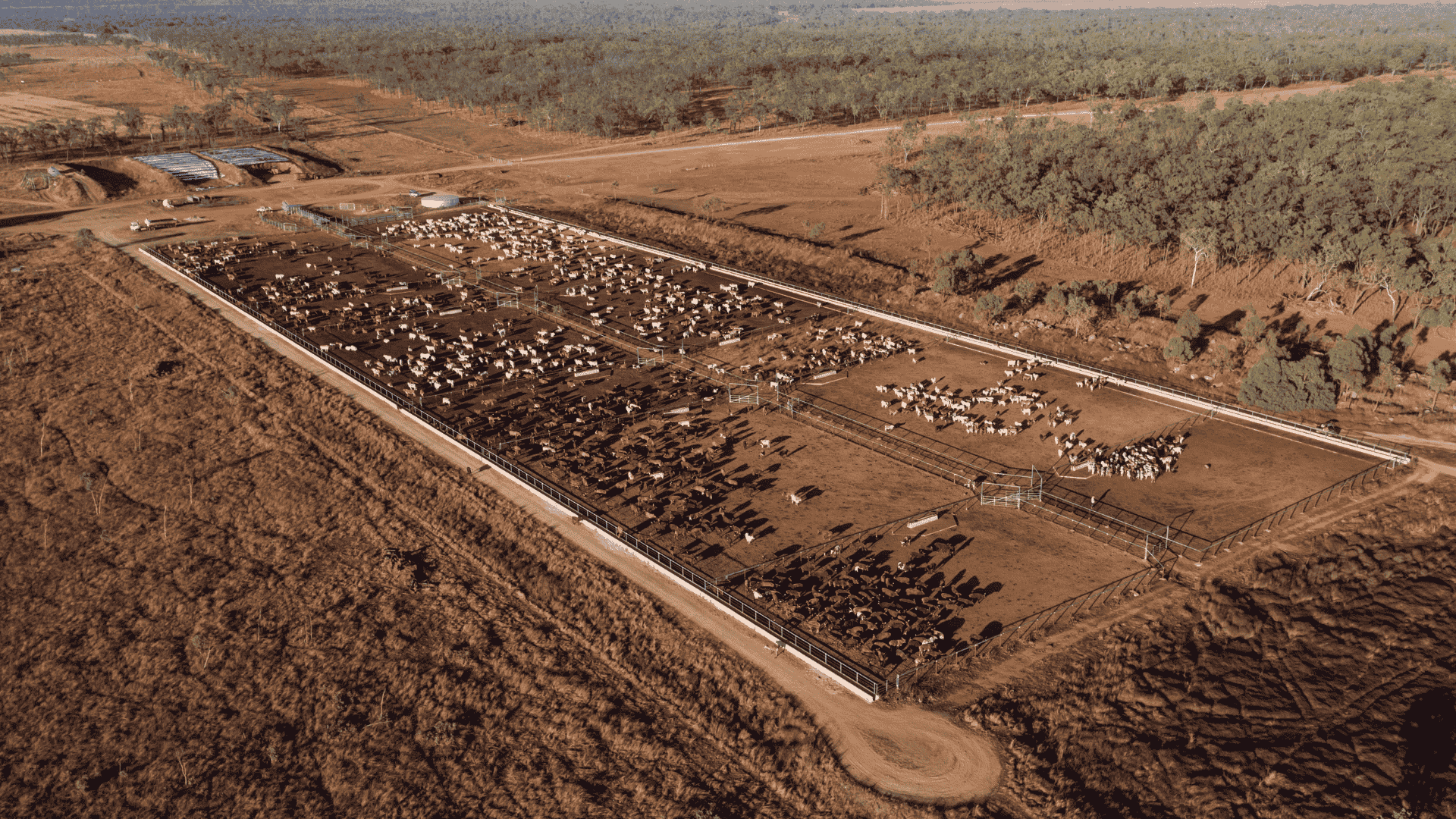

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...

The Australian Bureau of Statistics (ABS) released it’s quarterly ‘Livestock Products’ data and statistics on Friday. There is plenty of data to dig...