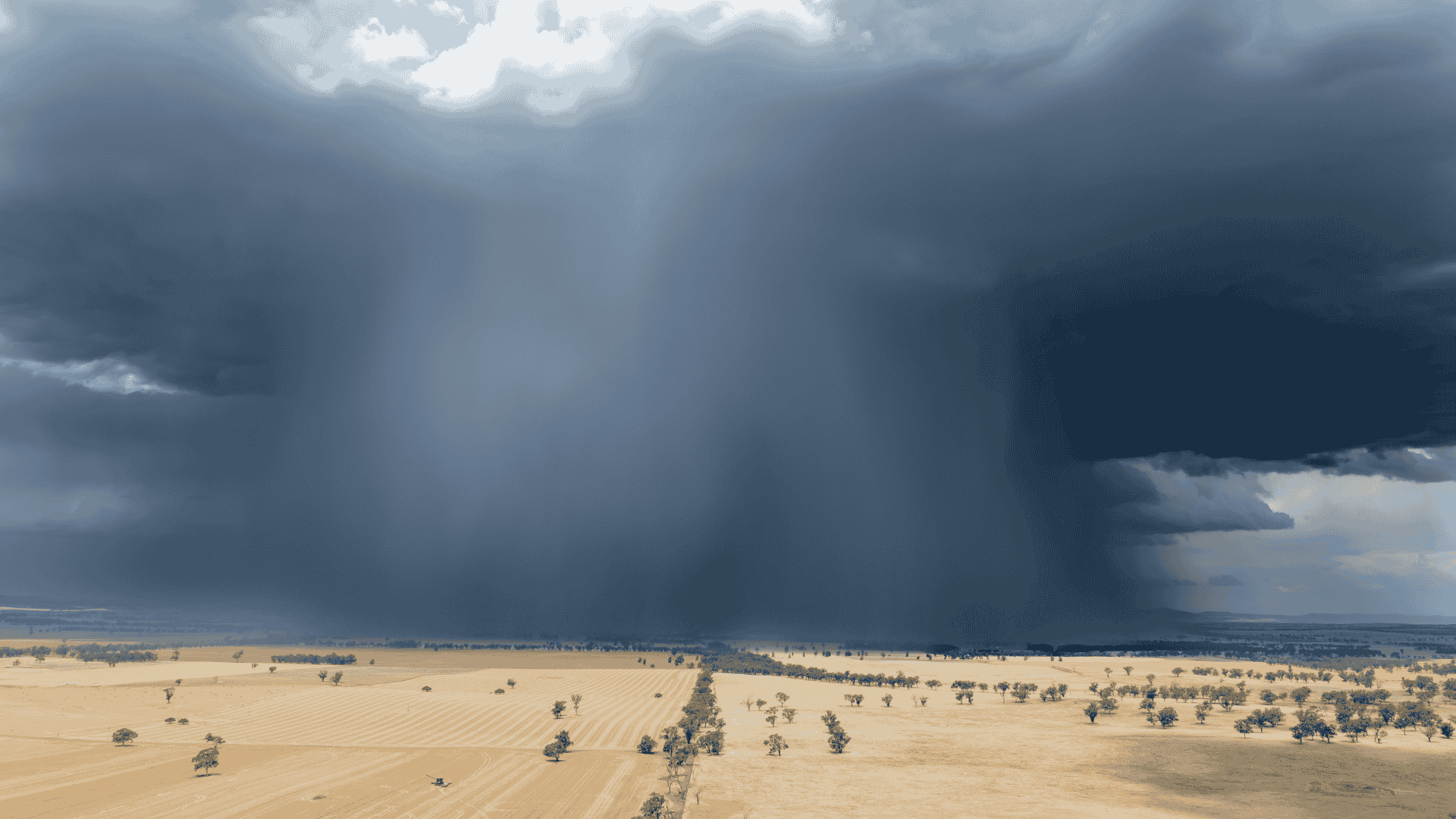

A look at the implications of El Nino on rainfall

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

Despite a generally confident outlook in the cattle market, last week’s clearance rates revealed a gap between vendor expectations and buyer sentiment. While the data clearly points to one key factor - reserve setting - there may be other things at play that vendors and agents need to consider.

While vendors ultimately choose their reserves, livestock agents play a critical role in guiding those decisions.

In last week’s commercial cattle sales there were 26 passed-in steer lots. This is a clear example of what can happen when the market looks strong, but the final bids don’t meet vendor pricing.

Initial clearance rates told one story, but follow-up sales helped recover ground. This clearly shows that vendors were prepared to go lower than the reserve provided.

A 10% lift of the reserve after sale highlights the value of follow-up work — but also underlines that many of those lots could or should have sold at auction had the reserve been better aligned with the market on the day.

Reserves need to be seen as a minimum acceptable price — not an aspirational value.

There’s a difference between what you think they are worth and what your minimum reserve is.

Everyone is always happy with more, but most people are much happier after a successful sale.

Consider the cost of holding stock for another week, missed opportunities and the market changing from week to week. Delays usually don't pay.

When I have been talking with senior agents in buying regions in the past week they all spoke about how the amount of available feed that is in front of their clients was playing a big role in lot selection.

One remarked that with a good oats crop you know approximately how many days of feed you have ahead. Clients are then taking that into account when they are purchasing.

If they have 90 to 120 days of feed available, they are looking to purchase an animal that they can get into a “high-demand” stock category like the export feeder market. This makes steers and heifers under 300kg not quite as desirable for them. The clients know that they can put on 100-150kg before the crop may cut out, so entry weight is important.

This doesn’t mean that they won’t buy light cattle and "stick them in the back paddock” for six months plus, but the incentive to do so is not as great for what is close to a guaranteed trade with an export feeder.

Agents are encouraged to shift the reserve-setting conversation with vendors from “what do you want” to “what’s the lowest you’d be comfortable taking”.

Reserves are not the highest minimum price, they are what the minimum acceptable price on the day is.

Have the conversation: What do you want? $1,200. Would you be happy with $1,100? Oh yeah, I’d take $1,100. Well, what about $1,050? Yeah, that’d still be OK. Well, that’s your reserve — not $1,200.”

Price Discovery is a new tool from AuctionsPlus which helps users determine estimated market value of their lots, when assessing recent sales.

But we must remember there’s a big difference between a market price and reserve.

The number that price discovery gives you is sold lots. it shouldn’t be your reserve. It’s not where you start it’s where you finish.

The AuctionsPlus data also shows that keeping reserves close to starting prices is a winning strategy.

The most effective way to increase your chance of making a sale is getting the livestock on the market. This gives bidders time to participate.

You need them on the market to get full market participation. Remember, it’s not where you start — it’s where you finish.

When you’re down to the 20-second timer people aren’t mucking around throwing bids on stuff that’s not even on the market. They have trucks to fill.

If you’re not on the market, you’re not in the race and buyers won’t wait around while you make up your mind.

Paul Holm is General Manager - Network for AuctionsPlus.

The mention of an El Nino has the scribes’ seeking forecasts and projections for agricultural commodities through production to price. This article...

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...

.png)