Cattle prices lift on back of rainfall across south eastern Australia

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

1 min read

Tim Jackson, MLA Global Supply Analyst : Nov 21, 2024

Key points:

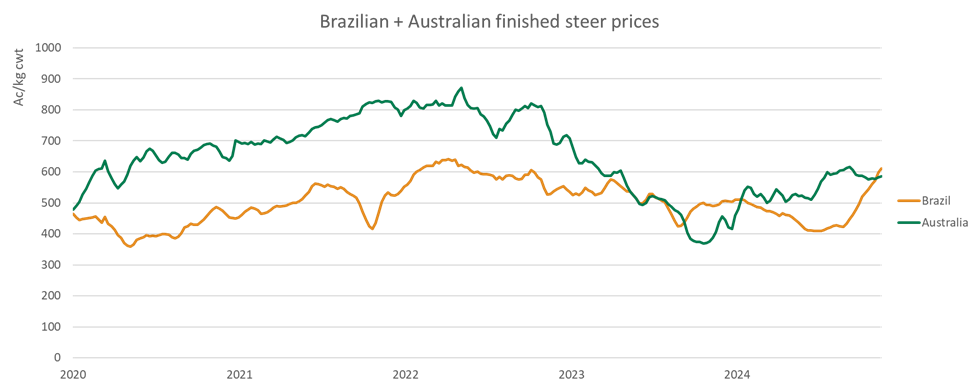

Since June 2024, the Brazilian Boi Gordo processor steer indicator has jumped 49% to 610¢/kg in carcase weight terms (cwt). This places the Boi Gordo at a slight premium to equivalent Australian cattle, which were most recently priced at 585¢/kg cwt.

Source: CEPEA, NLRS

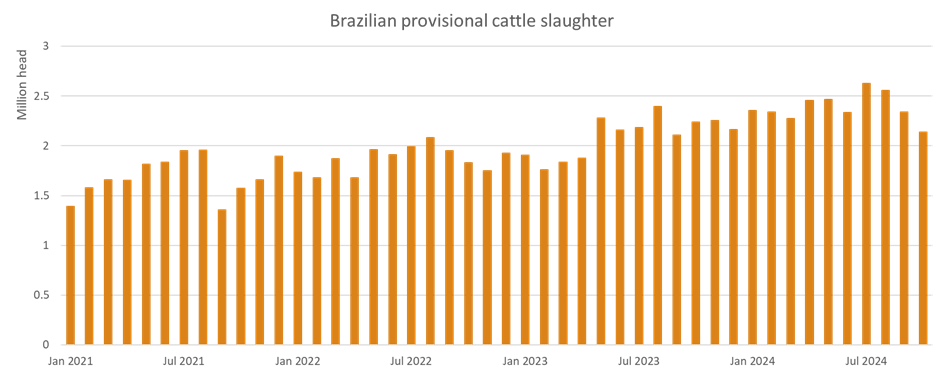

The sharp rise in Boi Gordo pricing can broadly be attributed to a slowdown in supply. After several years of drought conditions driving cattle slaughter up, supply of finished cattle has begun to tighten and slaughter has begun to slow down. When combined with relatively consistent export demand, this has driven up demand for existing slaughter-ready cattle.

Provisional figures for October show monthly slaughter at 2.13 million head, 5% below October 2024. While still very high, this is the first time slaughter has been below year-ago levels since 2021 and marks the fourth month of consistent declines in slaughter.

Source: Ministério da Agricultura e Pecuária

At the same time, Australian finished steer prices have remained remarkably consistent in 2024, trading within a relatively narrow band of 120¢ cwt since January and trading within 550–620¢ since July.

The maturation of Australia’s herd rebuild into a consistent supply of slaughter-ready cattle, when paired with growing processor capacity and rising demand in export markets, has allowed prices to remain steady over the year, in marked contrast to the price volatility seen in 2023.

Although very early, the indications of tightening in Brazil’s cattle cycle present a considerable opportunity for Australia going into 2025.

As mentioned earlier, Brazil is the world’s largest beef exporter and reductions in Brazilian slaughter would have a marked effect on global supply. Even a reduction in the rate of increase of exports would effectively tighten supply, given projected increases in demand from developing markets over the next several years.

The rise in Brazilian prices makes Brazilian beef somewhat less competitive in export markets, and acts as a signal of tightening supply. The markets where Brazil exports the most beef tend to be relatively price-sensitive, so increased costs are likely to correspond with lower exports over time.

Tighter supply would generally have a positive effect on demand for Australian beef, which Australia would be well-positioned to meet given projected record beef production in 2025.

There’s plenty happening in cattle markets at the moment, and as always, weather is sitting front and centre.

Australia's grain fed beef sector continued to break records in the December quarter - with capacity, utilisation and numbers on feed exceeding...

The Australian Bureau of Statistics (ABS) released it’s quarterly ‘Livestock Products’ data and statistics on Friday. There is plenty of data to dig...