New locations sought for Aussie beef due to China levy

Around 800 million burgers worth of Australian beef may need to be diverted into alternative markets, as China enforces import quotas limiting the...

2 min read

Alex McLaughlin

:

Oct 28, 2024

Alex McLaughlin

:

Oct 28, 2024

Red meat industry leader David Foote believes that Australian producers must focus on the "sizzle" of their product to stand out globally.

The former Chair, and current Director, of Cattle Australia explained Australia's high operational costs, including labour and energy, meant Australians couldn't compete on price with major exporters like the US.

Instead, Mr Foote urged producers to emphasise product integrity to differentiate in an increasingly competitive global market.

Mr Foote is well placed to make the assessment, having held agribusiness-centred operational, senior and executive management roles across all mainland states of Australia over the past 45 years.

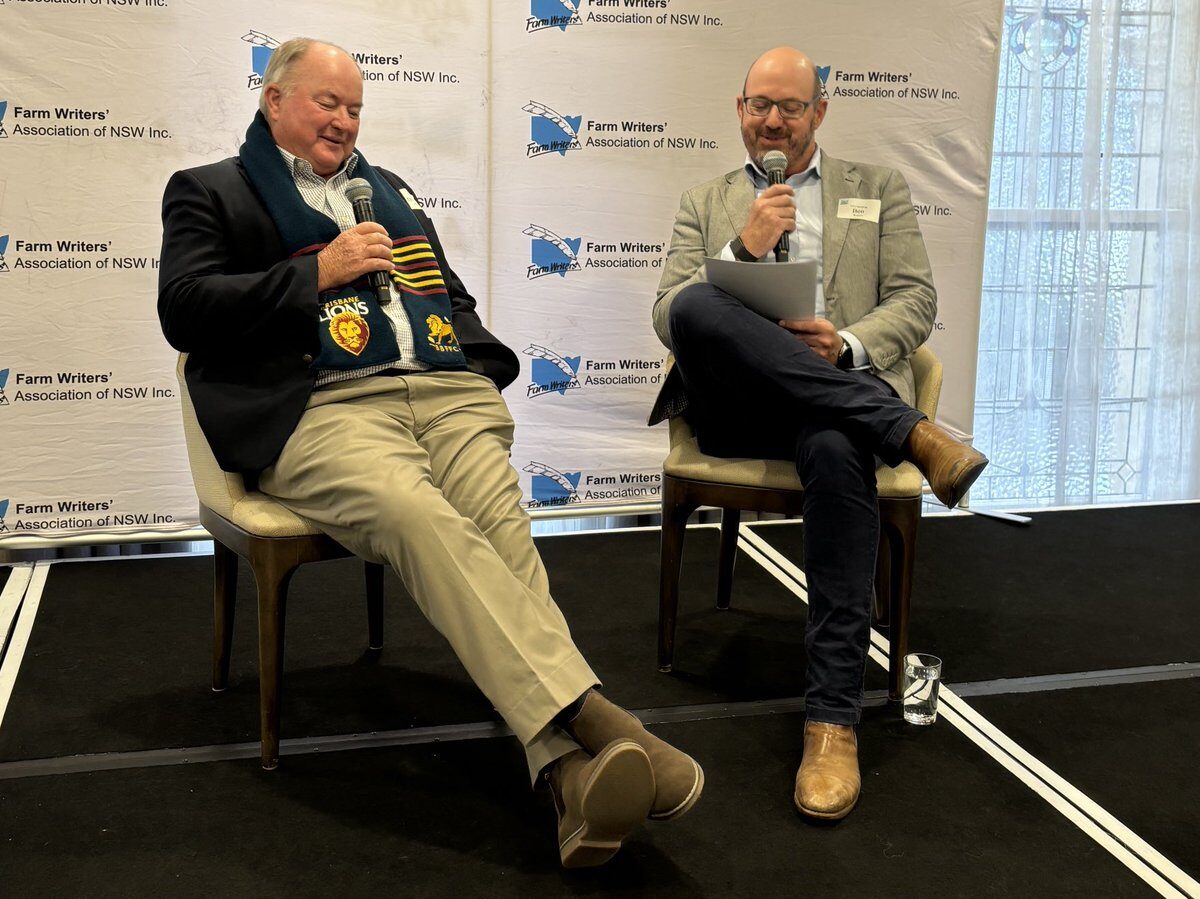

He highlighted key industry challenges, such as unpredictable weather, biosecurity threats, and the fluctuating demands of international markets on Friday at a Farm Writers' Association of NSW luncheon in Sydney.

Mr Foote elaborated on the supply chain's intricacies, noting the duality of Australia's beef market, which, while exporting 70% of its product, constitutes a mere 2% of the global market.

"We are totally at the whim of others," he cautioned.

David Foote in conversation with APlus News at Beef Week 2024.

Mr Foote pointed out the significance of US trade relations - where until the end of September Australia has exported only about 267 million kilograms of beef.

"We kept saying they won't do well without us ... however the US has 11 million cattle in feedlots. If they kept those cattle on feed for 28 days longer, that would equal the total of Australia's exports to the US.”

Mr Foote also analysed the cost structure that underpins Australia's beef production.

"Coming back to cost competitiveness outside of Brazil, we're all on about the same price," he said, mentioning that live prices for beef hovers around $4/kg in several countries.

Yet, he highlighted a critical disparity in labour costs, citing hourly rates for general labour: “Brazil, $3.62 USD, the United States $7.16 USD, and Australia $16.21 USD.”

With such cost pressures, he stressed that Australia needed to focus on quality and integrity.

"If we say the animals are the same cost, the conversion rates differ. The US has labour rates at 7.9 cents per kilowatt-hour, while Australia’s rate is 24 cents per kilowatt-hour. So we can’t compete on a like-for-like basis," Mr Foote said.

"We need to offer something special, which is our integrity."

Looking ahead, Mr Foote also expressed his optimism about the potential for increased production efficiency.

He referred to the trend of dairy cows being joined to beef bulls, which could significantly alter the landscape: "23% of the cattle on feed in the US have dairy genetics in them. This is potentially a new $1 million growing cattle market that is going to come into the Australian scene over the next two to three years,” Mr Foote said.

However, he also warned of possible challenges ahead. "If we get to 30 million cattle, when we start to push for cattle, 11 million turn off, we then may have capacity challenges," Mr Foote cautioned, indicating that the industry must prepare for the ramifications of scaling production.

Reflecting on the turbulent period faced by the Australian red meat industry from the end of 2023, he highlighted the consequences of long-range forecasts that led many producers to de-stock rapidly, only to witness a surge in demand once conditions improved.

“I never, ever run my farm business or the company I’m in based on a weather forecast, and I really do not know why last year, the farm sector chose to agree that it was going to be dry before it was dry, and they behaved that way,” he said.

.png)

Around 800 million burgers worth of Australian beef may need to be diverted into alternative markets, as China enforces import quotas limiting the...

It was 3.30pm, the hottest part of January 9, when an out of control bushfire, powered by its own microclimate, came roaring out of the state forest...

At Mawarra Genetics, Peter and Deanne Sykes are focused on stepping back from short-term noise and focusing on what actually drives long-term,...