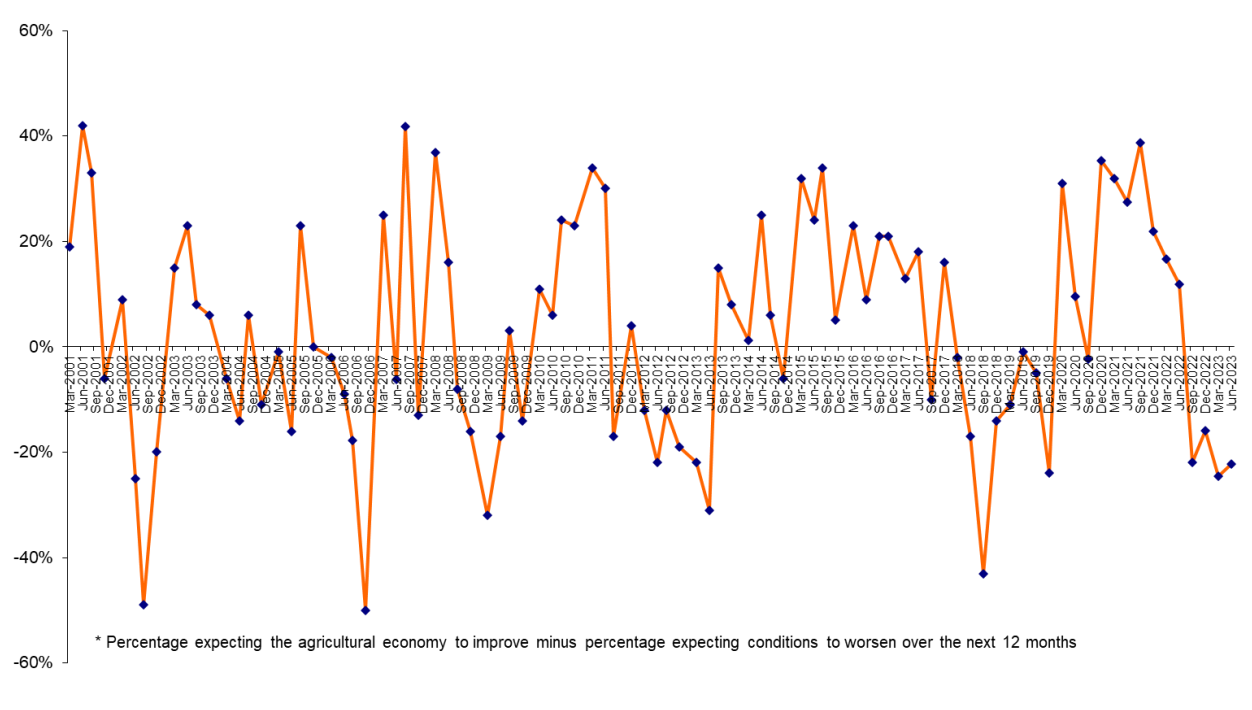

Beef producers are becoming more optimistic that conditions are unlikely to get much worse, but sheep producers continue to have a gloomy outlook.

Beef producers are becoming more optimistic that conditions are unlikely to get much worse, but sheep producers continue to have a gloomy outlook.

According to the latest confidence survey by Rabobank, the outlook in the beef industry is still negative, but lifted slightly from minus 29% in quarter one, to minus 21% this quarter.

While prices have continued to decline at recent AuctionsPlus sales, Rabobank found that concerns about prices have begun to ease, with 64% of respondents recorded as pessimistic compared to 70% in the previous quarter.

Rising input costs also eased as a reason for worsening conditions (24%, down from 30%), but overall, Australian beef producers were more concerned about government interventions/policies, rising interest rates and drought.

Sheep confidence sags

Confidence took a hit in the sheep industry, where 40% of producers expect the agricultural economy to worsen, up from 35% in quarter one of 2023.

While they were less concerned about falling commodity prices, there was increased concern around rising input costs and overseas markets and economies.

While lamb exports and mutton exports hit historic highs in May, lamb slaughter numbers reached their highest level for over two years, putting downward pressure on prices, according to AuctionsPlus' recent MarketPulse report. How export markets hold up is likely weighing on producers' minds.

Grains industry confidence also falling

Falling commodity prices, rising input costs and rising interest rates are also worrying grain producers.

Drought appears to be the greatest contributor to the negative outlook, with 42% of grain growers nominating this as a reason for worsening conditions, compared with 18% in the previous quarter after a dry start to the planting in many grain growing regions.

Overall, confidence within the grains industry, fell to minus 25% from minus 19%.

Looking at other sectors, Rabobank found:

-

Dairy producers were more upbeat than last quarter, with their confidence in the agricultural sector lifting

from minus 22% to minus 15%

-

Cotton growers had a more bullish outlook this quarter thanks in part to recharged water storages, which pushed confidence from minus 59% in the previous survey to minus 20% this quarter

-

Sugar was the only sector where confidence moved back into the black, increasing from minus 28% last quarter to 22% in the most recent survey in response to very high sugar prices

Overall, it has contributed to a marginal improvement in producer confidence, lifting nationally from minus 25% in the first quarter to now sit at minus 22%.

Rabobank group executive for Country Banking Australia, Marcel van Doremaele, said the survey paints a picture of how farming conditions across the nation drive a range of confidence levels.

“While nationally confidence increased marginally, it’s riding on the back of a much larger surge of positivity in Queensland, where confidence lifted from minus 30% to minus 13%,” Mr van Doremaele said.

“We can’t credit this just to winning the State of Origin opener – seasonal conditions and commodity prices are the real drivers of the optimistic outlook in Queensland.

“These factors also improved confidence in Victoria, although not as notably as in the sunshine state."

Investing on farm

Despite marginally higher confidence across the entire agriculture sector, producers remain cautious about investing in their farm businesses.

Fewer respondents expect to increase their on-farm investment over the next 12 months (21% this quarter, compared with 25% in the previous survey), including a reduced intention to increase livestock numbers (34%, down from 41%).

“Farmers across the country are realigning their investment intentions and focusing spending on projects that will deliver essential productivity gains, including labour-saving infrastructure and technologies,” Mr van Doremaele said.

"There’s also an ongoing focus on investments which will strengthen their seasonal resilience.”

Appetite for property declines

This quarter saw a 7% reduction in those intending to purchase new property to expand their operation (down to 21%), with fewer farmers planning to borrow to purchase property – falling from 34% in quarter one to 17% in the latest quarter.

“While we’re still seeing strong demand for rural properties – especially well-presented, ‘blue chip’ offerings when they come on the market – overall there’s a decrease in the number of farmers who intend to purchase new farming land in the next 12 months,” Mr van Doremaele said.

“This reflects how our industry is reassessing where key factors such as markets, input costs and, of course, interest rates have landed following recent adjustments and farmers taking a hard look at what this means to their bottom line.”

Overall, there was increased pessimism about farm income.

Only 17% of farmers anticipate their income will increase, down from 20% the previous quarter, and more expect it to decrease (41%, up from 36% in quarter one).

However, the number of farmers who view their farms as viable remained similar to previous levels.

Results

Results