The record run for farmland values could very well be nearing an end, with analysts tipping 2023 to be a year of slowed growth in the property market.

The record run for farmland values could very well be nearing an end, with analysts tipping 2023 to be a year of slowed growth in the property market.

A number of market headwinds, which emerged in 2022 and continued into this year, have been identified as the catalyst for the softening.

The recently-released Australian Farmland Values report, put together annually by Rural Bank, makes clear it doesn’t necessarily signal a downturn, though.

Rural Bank head of agribusiness development Andrew Smith said it seemed unlikely farmland values had reached a peak.

“The new level of interest rates, downturn in commodity prices and potential for a drier finish to 2023 points to farmland values reaching an inflection point,” he said.

“Growth is still expected in 2023, albeit at a slower rate than the previous two years.”

The report – which is the longest running analysis of the farmland market in Australia – said the impact of the headwinds was offset by tightened supply last year, meaning farmland values maintained their strong growth momentum.

“Overall, 2022 was another outstanding year for Australian agriculture,” Mr Smith said.

“This, in turn, has translated into sustained momentum for Australian farmland values, as buying power remained firm and supply tightened as landholders had fewer reasons to sell.”

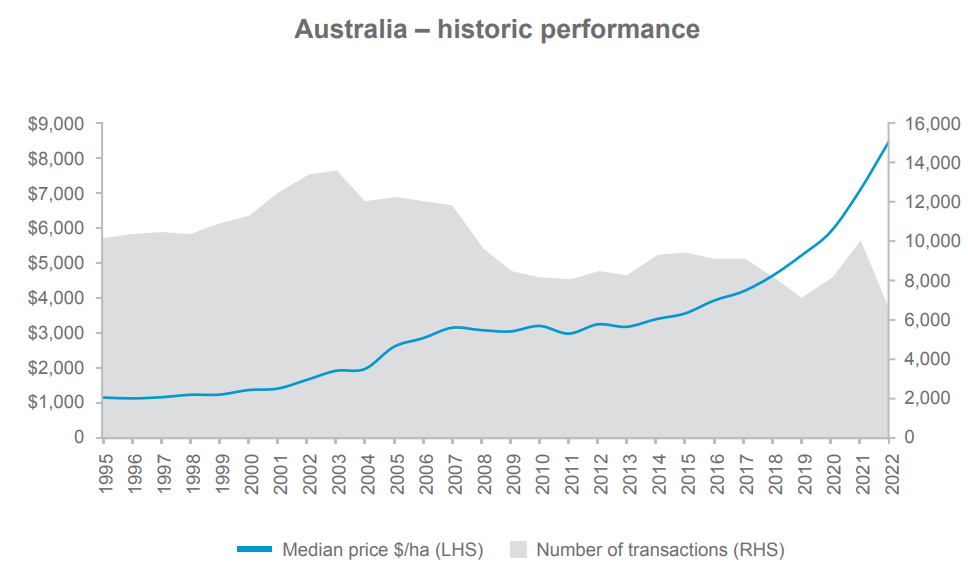

Strong demand and reduced supply of properties led to the national median price per hectare increasing by 20 per cent to $8,506/ha, keeping pace with the 20pc rise also recorded in 2021.

The rising prices through 2022 extended the recent period of growth to a ninth consecutive year, with the national median price rising by 167pc over that time.

State by state

For the first time in the past 28 years, all states and territories recorded a growth of more than 15pc.

Tasmania was a clear standout, with a rise in its median price per hectare of 54.9pc.

Victoria, South Australia and Western Australia all recorded growth of more than 20 per cent, followed by Queensland and New South Wales with increases of 15.9pc and 18.9pc, respectively.

Blowing them out of the water, though, was the Northern Territory, which recorded a price growth of 108pc.

The report said farmland values were supported by a sharp decline in transaction volume.

“Nationally, the number of farmland transactions declined by 34.3pc in 2022 to 6,588,” it said.

“This was the lowest level of transactions in the last 28 years - a sudden reversal from 2021 which was the highest transaction volume since 2007.”

Value drivers

Beyond the strong demand and increasingly tight supply, the combined impacts of commodity prices, seasonal conditions and interest rates were very much at play.

Farm incomes delivered by high commodity prices in 2021 and into the first half of 2022 helped fuel strong buying power, further buoyed by wet conditions continuing across many agricultural regions in 2022.

These factors were tempered by the high cost of inputs and the rapid rise in interest rates though, and it’s likely all of these price drivers hit a turning point during 2022.

Declining commodity prices have the potential to cause prospective buyers to reassess their purchasing intentions, with current interest rates having potentially already taken some buyers out of the market.

Couple this with the dry start to the year and dry signals for the coming months, and it’s likely to lead to an element of caution.

Outlook for 2023

Despite the key drivers of farmland values hitting a turning point, the report said they are set to remain in favour of demand exceeding supply in 2023.

This will drive a 10th consecutive year of growth in the national median price per hectare.

“Supply and demand are likely to come into closer alignment as a softening of demand is expected on the back of lower agricultural commodity prices, a drier rainfall outlook and relatively high interest rates,” the report stated.

“There is still appetite and ability to continue expansion and acquisition following strong farm incomes in 2022, however some buyers are expected to return to consolidation and take some competition out of the market.

“Recent high farmland values, lower commodity prices and a drier seasonal outlook may also prompt some additional supply on the market as these conditions will, for some, indicate a prime opportunity to exit the industry.”

Results

Results-3.png)